Bitcoin - a digital currency with no government backing - soared in price from $1,000 to $19,343 in 2017. That's an amazing 1,834.3% gain.

Because Bitcoin isn't backed by any government, some investors view it as a hedge against political instability and stock market corrections.

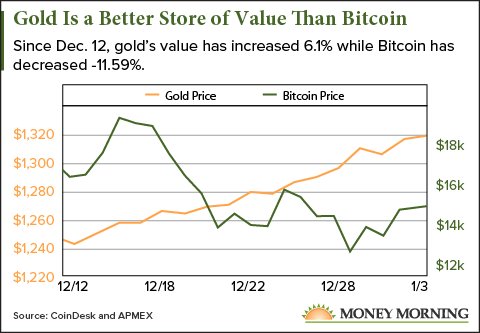

That is, until it dropped to $12,629 by Dec. 30...

Suddenly, Bitcoin lost 34.71% of its value in 14 days as the stock market continued to rally.

Over the same period, the price of gold climbed from $1,242 to $1,310, for a 5.5% gain.

Which leads us to the question we keep receiving...

The answer is both, depending on your financial goals and risk tolerance.

Investors willing to accept high risk and volatility for the chance at massive gains can buy Bitcoin.

Urgent: Executive Editor Bill Patalon just saw something on his precious metals charts he's only seen twice in 20 years. He calls it the "Halley's Comet of investing" - and it could lead to windfall profits. Read more...

Since falling to $12,629 on Dec. 30, the digital currency has climbed back up to $15,187 in just four days, for a 20.25% gain.

But as a hedge against uncertainty and political instability, Bitcoin should only be bought if you believe the U.S. government will collapse and the U.S. dollar will no longer be the world's reserve currency.

(If you're interested in buying Bitcoin, be sure to check out our complete how-to guide here.)

If you're hedging for any other reason, gold is a better investment.

But gold isn't just a hedge, it's also on pace to return investors huge profits in 2018. We'll show you our bullish new price target for 2018, as well as our shocking 2020 prediction, in just a bit.

First, here are three reasons why gold prices will soar this year...

Reason to Buy Gold No. 1: Rising Inflation

Rising inflation will drive the gold price higher in 2018.

The current 2.2% inflation rate is its second-highest level in the last five years. That number is expected to move even higher as the stock market keeps reaching record highs.

Inflation is the rate at which the price of general goods and services rises and the purchasing power of the U.S. dollar decreases.

That's why the U.S. Federal Reserve manages inflation by raising interest rates. This has kept inflation from getting out of control as the stock market rises.

But there's been a growing sense of uncertainty among investors as the stock market keeps hitting records. Rising inflation often convinces people the economy is growing unstable, which can cause investors to exit the stock market.

Since assets like gold are considered safe havens during times of economic uncertainty, gold prices will rise as people protect themselves.

And that's only the first reason we're raising our gold price forecast...

Reason to Buy Gold No. 2: Fewer Short Bets

Reduced short selling in the gold market also indicates the price of gold will rise over the next three years.

Over the last year, the number of short positions on gold stocks has fallen. One indicator of short interest is the Gold BUGS Short Index (NYSE: HUISH). This index tracks short selling on mining firms that specifically refuse to cut gold production based on gold price movements. In the last 12 months, HUISH has dropped 9.27%, indicating short interest in the broad gold sector is falling. This shows a shift in sentiment from bearish to bullish for gold.

Canadian gold mining company NovaGold Resources Inc. (NYSE: NG) shows an even starker change in sentiment. In the last six months, the volume of short bets on the stock declined 32.75%, from 19.05 million shares to 12.81 million.

But wait till you see this shocking trend that predicts when gold prices will rise - and our gold price target for 2020...[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Reason to Buy Gold No. 3: Rising Interest Rates

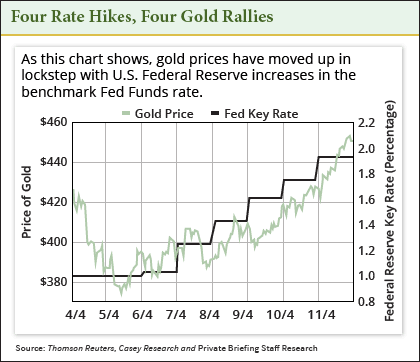

Since 1986, Fed interest rate increases have been followed by strong gold gains.

Before the rate increases, you'll see gold prices skid. But then, after the actual rate increase, they'll rally. This is supported by 30 years of data.

And this trend is happening again right now. The Fed's September 2017 meeting showed an interest rate hike wouldn't be likely until December 2017. And gold prices peaked last year at $1,348.80 on Sept. 8, before falling to $1,240.

When the Fed raised interest rates for the third time in 2017 on Dec. 12, the price of gold shot up from $1,240 to $1,309 by Dec. 29, for a 5.56% gain in 17 days.

Gold prices are currently trading at $1,318.50.

It's expected that rates will continue rising in 2018 when Jerome Powell starts as chair of the Fed. If gold prices behave like they have for the past 30 years, then they should continue rallying in step with further rate increases.

Now that we've run through the three reasons why gold prices will increase in 2018, here's our shocking gold price target for 2020...

Our Gold Price Target for 2020

Money Morning Resource Specialist Peter Krauth's newest gold price forecast has the precious metal soaring to $5,246 an ounce by 2020.

"The bears have been unable to quash gold," Krauth said. "That's why I'm so confident in this move to the upside. And it came right after the Fed hiked rates."

If history is any indication, gold prices could rise a tremendous 297% over the next three years from its current price of $1,318.50.

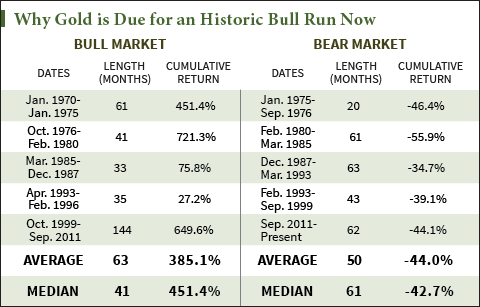

And gold prices are already taking off in this bull market. After hitting a five-year low of $1,056 in November 2015, gold has staged a 24.86% comeback.

Since 1970, every gold bull market has offered astounding returns. The median return and duration of each bull market over the last 47 years has been 451.4% and 41 months, respectively.

Up Next: Rare Gold Anomaly

Money Morning Executive Editor Bill Patalon just caught something on his gold charts that he's only seen twice in the past 20 years. A $13 billion gold anomaly he calls the "Halley's Comet of investing."

It's very rare, and fleeting, and Bill sees things lining up perfectly to bring some very sizeable precious metal profits to well-positioned investors.

Click here to check out his research...

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.