Peak gold represents a watershed event for the yellow metal.

Gold miners and gold investors alike have anticipated this moment for years.

In short, peak gold is the year in which gold miners extract as much of the yellow metal out of the ground as they ever will.

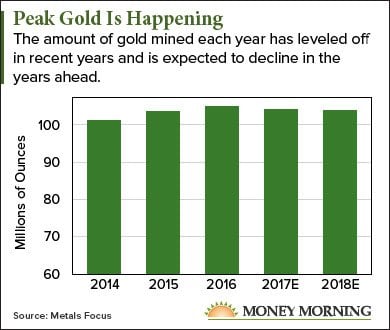

Since 2015, production from gold mines has been flattening, according to data from Metals Focus. If the estimates for 2017 prove correct, peak gold happened in 2016. Metals Focus foresees a further decline this year.

"We're pretty close to [peak gold] if we're not at it," World Gold Council Chair Randall Oliphant told Bloomberg last September at the Denver Gold Forum.

Peak gold will fundamentally change the gold market by permanently restricting supply. And that in turn will serve as a major catalyst to gold prices and gold mining stocks for... well, forever.

And right now the signs are pointing beyond a short-term stagnation of supply to a full-blown decline...

How We Reached the Point of Peak Gold

Gold miners are always searching for new deposits to replace their depleted mines.

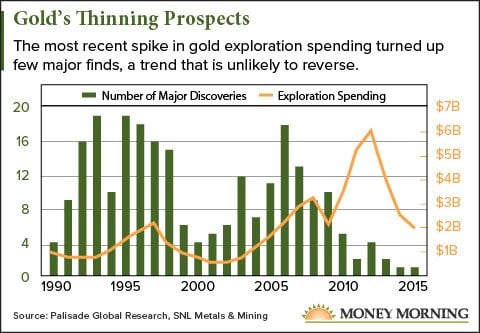

Spending on such exploration tends to rise when gold prices are high, and miners can afford it, and fall when gold prices decline. It takes 10 to 12 years from the time gold is found to when a gold mine goes into production.

But a gold mine is productive for 10 to 30 years. Until recently, the exploration cycle had succeeded in finding sufficient gold to keep production rising.

Right now, gold miners should be reaping the benefit of a spike in exploration spending from 2006 to 2008.

Learn How to Turn $500 into $1 Million: This Sunday school teacher's "retirement career" made him a millionaire. This book will teach you how you can do it too. Claim your FREE copy...

But they're not. The gold discovered in that period was barely enough to keep production flat. And the situation is guaranteed to get much worse in the decade ahead.

While gold miners spent about twice as much on exploration in 2010 to 2012, new gold discoveries plummeted. And over the past year, spending on exploration fell again.

It's becoming increasingly clear that most of the world's "easy" gold has already been mined...

Gold Mining Production Is Hitting a Wall

"We just haven't been finding the new gold deposits, there hasn't been an interest in bringing on as many mines as we have in the past, and a lot of companies have declining production profiles," Oliphant said.

And it's not just the number of discoveries that's fallen. Gold finds in recent years have been much smaller.

"If you look back to the 70s, 80s and 90s, in every of those decades the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless five to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits," Pierre Lassonde, chair of gold royalty and income stream company Franco-Nevada Corp. (NYSE: FNV), told German financial newspaper Finanz und Wirtschaft last October.

In addition to the global production numbers, several of the world's leading gold producers are experiencing or expecting significant declines.

Gold mining production in China, the world's top gold miner, fell 9.8% in the first half of 2017 (the most recent data available), according to the GFMS World Gold Survey. The report also forecast that Chinese gold production would continue to drop for the foreseeable future.

Meanwhile, MinEx Consulting predicted last year that gold mining in No. 2 producer Australia will peak in 2021, just three years from now. That report estimated a drop in Australian gold production from 11.3 million ounces in 2021 to 6.65 million ounces by 2035.

But the most telling signal that we've reached peak gold is the collapse of production in South Africa. After peaking at an astonishing 1,000 metric tons in 1970, by 2016, gold production had plunged 83%. Once by far the world's leading gold producer, South Africa is now ranked sixth.

The shrinking supply is bound to drive prices up as gold-buying demand at least remains steady in 2018 and beyond. This is the perfect storm gold investors have been waiting for.

Here's where gold prices are headed...

Our Shocking Gold Price Forecast for 2020

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

John Reade, the chief market strategist for the World Gold Council, believes gold prices will continue to rise in 2018. He sees several factors feeding demand, such as improving economic conditions in both China and India, more German buying of bars and coins, and more gold jewelry buying in the United States.

Coupled with declining supply, gold prices should continue to push higher in 2018. This morning (Tuesday), gold was trading at about $1,335, already up more than 2% on the year.

Money Morning Resource Specialist Peter Krauth thinks gold will end the year between $1,475 and $1,500.

But while gold keeps edging upward in 2018, Krauth sees much bigger gains lie ahead.

He has forecast a gold price of $5,246 an ounce by 2020 - just three short years from now. That represents a stunning gain of nearly 300% from the current price.

"The bears have been unable to quash gold," Krauth said. "That's why I'm so confident in this move to the upside. And it came right after the Federal Reserve hiked rates."

The Night Trader Has Arrived... It's taken us eight months of negotiations... and now, the moment has finally arrived. A former CEO and Wall Street insider revealed his coveted night trading strategy - a new mechanism for executing trades that set you up for potential $850... or $2,250... or $6,775 paydays - OVERNIGHT. Go here for details.

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.