Volatility reared its ugly head again last week. The S&P 500 dropped 6% over the course of the week. The Dow fared even worse, with a 9% plunge.

The market jitters came at a particularly bad time for a stock we like, pharmaceutical giant AbbVie Inc. (NYSE: ABBV). On Thursday, the company released disappointing news regarding phase 2 trials for one of its leading drug candidates.

Based on its trial results, as well as conversations with the Food and Drug Administration, AbbVie said it will not seek fast-track approval for Rova-T. The drug is intended to treat a category of small-cell lung cancer that currently has few existing treatment options.

AbbVie added Rova-T to its pipeline in 2016, when it acquired biotech startup Stemcentrx for $5.8 billion.

The size of the deal turned a lot of heads at the time. Those who criticized it are likely feeling vindication, as shares of AbbVie plunged nearly 14% in two days.

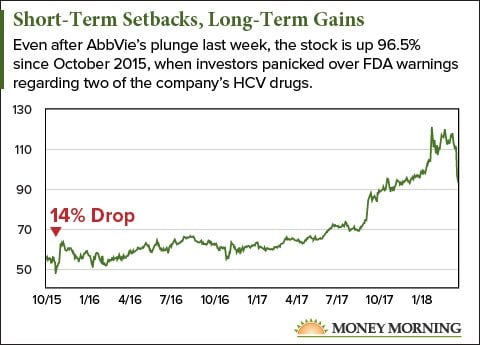

Media outlets have been quick to point out that this is the biggest decline in ABBV shares since October 2015. That's when the stock dropped 14% immediately after the FDA issued warnings that two of the company's hepatitis C drugs could cause liver damage.

That was a serious setback. It required new labeling and tempered expectations about how widely those drugs would be used.

But what most outlets won't tell you is how quickly ABBV rebounded from that 2015 drop, or that the stock is up 96% since then.

Anyone who rushed for the exits over that panic is regretting it now. And while we're not going to pretend that the news about Rova-T isn't disappointing, we think the market is once again overreacting and will regret it down the road.

Put simply, AbbVie is still a great stock to own.

AbbVie Is Built to Weather Volatility

When Money Morning Director of Technology & Venture Capital Research Michael Robinson recommended AbbVie in February, he had volatility in mind.

"When volatility hits," he wrote, "one smart move you can make is to start buying companies that richly reward their investors through dividends and stock buybacks. These are companies that are going to pay off no matter the noise in the markets."

Tech Revolution: We're on the brink of a global energy overhaul, and one tiny company has the key to it all. If you want to find out how to position yourself for the biggest, most life-changing gains, you better strike now.

Likewise, when we named ABBV one of our best stocks to buy, we said it was a good pick to ease the pain of "the occasional 5% and 10% dips in market value" that would inevitably come.

AbbVie's market cap is around $150 billion, and the company has over 50 drugs in its pipeline. The idea that disappointing results for one drug - itself only one part of a $5 billion acquisition - is going to seriously hinder AbbVie's long-term growth potential is a little tough to swallow (pardon the pun).

Nor does this mean Rova-T won't ultimately get FDA approval. The company is simply pursuing a slower course based on current data.

But there's a reason we didn't mention Rova-T in our earlier assessments. We wouldn't recommend a pharmaceutical company based on one drug in mid-stage trials.

We would recommend one if it showed multiple healthy growth factors, like these...

Why AbbVie Is Still a Buy

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

One of the biggest reasons we like AbbVie is that it's the maker of the world's top-selling drug, Humira. Biopharma publication FiercePharma projects the immunosuppressant to hold that top spot through at least 2020.

We already mentioned the 50-plus drugs in AbbVie's pipeline. That includes nine that have recently been approved for sale in the United States.

The company is also developing new immunotherapy treatments - cancer treatments that harness the body's own immune system - along with Voyager Therapeutics Inc. (Nasdaq: VYGR).

Transparency Market Research projects the immunotherapy market to triple in size, to $124.9 billion, by 2024. Entering a strategic partnership like this allows AbbVie to pool its resources and share the risk in this promising growth field.

AbbVie's earnings per share is still projected to grow 34% this year, according to FactSet. Even if that dropped to an average of 20%, investors can expect to double their money in just over three and a half years.

By then, Wall Street will have forgotten about Rova-T's phase 2 trials.

As always, when we look at stock price movements, we need to take emotion out of the equation and focus on the big picture. This isn't the first setback AbbVie has had in its extensive pipeline, and it won't be the last. But we've seen in the past that this company is built for growth, and we see no reason to change that assessment.

ABBV was a good buy at its earlier price. It's a better buy at its current price.

"I still believe in the firm's long-term potential and see this as a great buying opportunity," Michael says.

Don't forget that April 13 is the last day to get in on the new, higher dividend payment.

Once the Clock Strikes Midnight March 31, You Could Be Forfeiting Your Shot at Million

You have the chance to find out how to reach millionaire status within weeks... but you only have hours to act.

On March 31, a little-known federal mandate will be fully enforced - and could unleash a 3,982% revenue surge for one tiny company.

If you don't want to give up your shot at millions this month, you better strike now... because after this door closes, it may never open again. Continue here...

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.

About the Author

Stephen Mack has been writing about economics and finance since 2011. He contributed material for the best-selling books Aftershock and The Aftershock Investor. He lives in Baltimore, Maryland.