Traders salivate over earnings season as stock prices move dramatically in the hours following reports.

By placing the right trade before an earnings call, traders can pocket triple-digit gains overnight.

But recent evidence shows us that stock prices move the most dramatically when the company misses earnings, and you can use that to your profitable advantage...

How to Turn an Earnings Miss into Triple-Digit Gains

A positive earnings report - especially one that beats expectations - often pushes the company's share price higher. Similarly, an unexpectedly negative report often results in a sell-off.

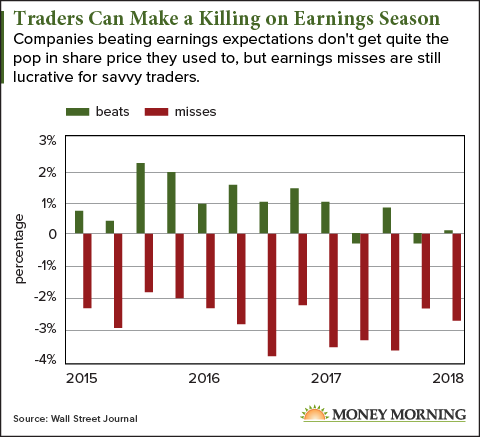

However, we've found that the sell-offs from misses are much more dramatic than the share-price gains from beats.

Just look at Netflix Inc. (Nasdaq: NFLX).

Netflix's earnings report on July 16 showed the company wasn't adding nearly as many subscribers as analysts expected. In fact, the company was off by more than 1 million subscribers.

As a result, the NFLX stock price plummeted 13.34% overnight.

But look at BlackRock Inc. (NYSE: BLK). The company beat earnings Monday, July 16, and saw share prices climb a measly 0.81% on the day.

Stunning Video Footage: Watch this guy become $4,238 richer in under a minute - then follow his simple instructions to learn how you could pocket a potential $2,918 in just one move. Click here...

That kind of plunge is exactly what we should expect. Take a look at how earnings misses have led to much more dramatic share-price moves than earnings beats since 2015...

As you can see, a company missing earnings estimates is seeing its share price move an average of 2% to 3%, more than double that of the companies beating earnings.

We can use this data to our advantage by building a trade around companies most likely to miss earnings.

And we need to look no further than the financial sector...

As Money Morning Quantitative Specialist Chris Johnson points out, the large banking sector is dragging down the S&P 500 this year.

That means these big banks will need to impress investors and analysts during this round of earnings reports to have a chance of getting back on track.

As Chris explains, "we usually see the big names beat estimates, so the pressure to impress is even greater."

But here's where things get interesting.

The financial sector is already having a terrible earnings season...

As of July 16, 25% of financial firms missed earnings expectations, while only 7% of all S&P 500 companies have missed them. Sectors like industrials or consumer discretionary saw no firms miss expectations.

Plus, the S&P 500 Financials Sector SPDR ETF (NYSE Arca: XLF) has the second-lowest percentage of companies trading above their 50-day moving averages.

Chris says it's simply inexplicable that traders aren't eating this up: "Now, you'd think that short interest in big banks would be on a run higher given this dreadful performance, but you'd be dead wrong."

This is great news for us.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Little short-interest on a weak sector means we can get into put options for cheaper prices, and it means short covering can't burn us by driving share prices up if any of these bank stocks gain some momentum.

Last week, Chris recommended buying put options on XLF itself. Specifically, Chris recommended the $27 puts with a Sept. 21 expiration date. The options are at $0.53 right now, so a contract will run you roughly $53.

If XLF drops to $26 from today's price of $27.53 over the next month, you'd double your money. If XLF drops to $25 by Sept. 21, you'd see gains of nearly 150%.

And if you want to go for a riskier (but potentially more rewarding) trade, we can break out a bank stock within XLF with an upcoming earnings report.

KeyCorp (NYSE: KEY) reports earnings Thursday, July 19, before the bell.

If KeyCorp disappoints in its earnings reports and its shares drop 3% (which is about average) we can make a quick 100% gain. You can buy $20 puts with an Aug. 3 expiration for $41 a contract. If the share price tumbles to $19.30 after its earnings report - just a bit more than a 3% drop - you'd be able to collect a 110% return.

Now, there's no guarantee financials will keep falling, or that KEY will miss earnings and plunge, but we can use what we know about earnings misses to build potentially lucrative trades.

And Chris has plenty more ways to make a killing by using his research...

This Trader Is Betting It All He Can Show You How to Turn $5,000 into AT LEAST $174,500

Chris Johnson is on pace to see 3,390% total winning gains this year.

And now he's guaranteeing his recommendations will give you the chance to do the same.

If not, he's working for free.

So mark your calendar for one year from today...

Set a reminder on your phone...