The price of silver made a valiant effort to rally twice last week, but to no avail. Rather than head toward gold and silver as safe havens, investors favored the U.S. dollar.

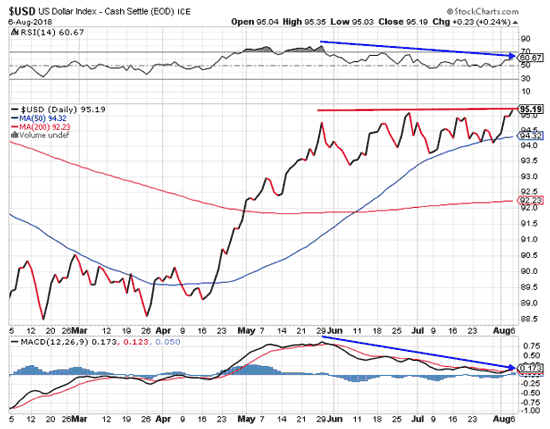

The U.S. Dollar Index (DXY) made another run towards 95.5, punishing silver prices and a host of other commodities along the way.

The main driver seemed to be investor concern over trade wars. That has pushed the dollar higher against the Chinese yuan, the euro, and currencies of several commodity-exporting and emerging-market nations.

But U.S. President Donald Trump is known for using aggressive negotiating tactics, squeezing his opponents, and then retreating somewhat as an act of compromise. In this type of scenario, trade wars could end in a flash, removing the attraction of the dollar and allowing commodities to soar.

That would do wonders for the price of silver and silver miners, helping them soar as the dollar weakens.

How to Profit off This $11.1 Billion Money Pool: By following a few simple steps, one IRS directive could help set you up to receive checks of up to $1,795 every single month thanks to a genius investment. Learn more...

So keep an eye on the trade wars, as they could provide a long-needed catalyst for silver prices.

Before we get to my outlook for silver prices in 2018, here's how the metal is trending this week...

Here's How the Price of Silver Is Trending Now

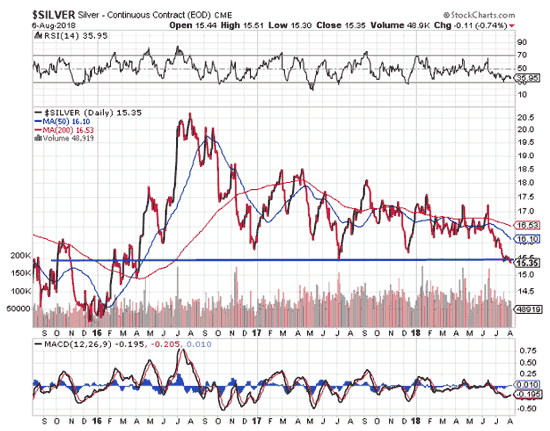

Silver began last Tuesday, July 31, laden with weakness, oddly enough selling off with the DXY early in the day. But even as the dollar bounced, pulling the dollar index up to 94.5, silver jumped as well, reaching $15.54.

Silver began last Tuesday, July 31, laden with weakness, oddly enough selling off with the DXY early in the day. But even as the dollar bounced, pulling the dollar index up to 94.5, silver jumped as well, reaching $15.54.

But the next few days would prove challenging as the dollar index steadily climbed. By Friday morning, it had reached 95 on news the United States was threatening to up tariffs from 10% to 25% on $200 billion worth of Chinese goods. As China promised to retaliate, the DXY rose past 95 and silver reversed, rallying to $15.50 by 11 a.m., and then settling to $15.38 by the close.

Here's the DXY action for the past week:

On Monday, earnings optimism drew capital toward stocks and bid up the dollar.

The DXY toyed with 95.5 once again near 7:30 a.m., then retreated and consolidated around 95.35 the rest of the day. Dollar strength punished silver, which dropped back to $15.25. A small rally to $15.31 ensued but had no legs, leaving silver to close back at $15.25.

Now here's what's next for the price of silver in 2018...

Where the Price of Silver Is Headed Now

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

This latest bout of dollar strength has managed to push silver back and retest its low of July last year.

The DXY is once again testing overhead resistance just above 95. But for now, momentum according to the relative strength index and moving average convergence divergence continue trending downward. This could be a make-or-break moment for the dollar. If it reverses here, it could weaken significantly.

Silver could well find support at current levels. If not, $15 then $14.50 would be the next lower targets.

I think sentiment is bad enough that right now, there's practically no one left who wants to sell. And I'm not alone.

Andrew Hecht, publisher of the Hecht Commodity Report, believes silver is giving technical signals of consolidating. He also indicates that over the last two years, silver has struggled in July but came back with strength in August and September.

We could see a repeat again this year, which may mean higher silver prices in short order. But we're not there yet, and we can't discount the risk of more downside first.

If silver does reverse and head higher, I'd look for silver to regain $15.60 initially, with further strength pulling the metal higher to $16.20.

This IRS Directive Could Mean Billions Are Now in Play

Everyday folks from across the country are taking advantage of an obscure IRS directive to collect what we call "Federal Rent Checks."

And by implementing a simple investment strategy, you can collect them each and every month. At this moment, Americans are adding their names to the distribution list - and you can too.

To see how you could receive $1,795 or more every month, go here now.