"Don't follow the herd" is essential to any contrarian investing strategy.

Contrarian investors studiously avoid "groupthink" when it comes to searching for undervalued investments that will maximize their returns.

Contrarian investors studiously avoid "groupthink" when it comes to searching for undervalued investments that will maximize their returns.

Related: How to Profit from IPOs in 2018 - with This ETF

The latest evidence to show the power of contrarian positions comes from a new research report by Deutsche Bank AG (NYSE: DB).

The study looked at how the rebalancing of exchange-traded funds (ETFs) affected the returns of the component stocks being bought and sold.

The researchers were looking for a way to exploit the idea that "passive" investments like ETFs - in which stocks are bought and sold to match a formula rather than on a thorough analysis of company fundamentals - distort pricing.

"The proliferation of passive investments is causing distortions," Ronnie Shah, Deutsche Bank's head of U.S. quantitative equity strategy and one of the report's authors, told Bloomberg. "It's a new anomaly associated with ETF flows that active managers can take advantage of."

Because passive investing doesn't take into account the full range of information available on a stock - everything from the latest earnings report to rumors about a possible merger - it bypasses the usually efficient price discovery mechanism of the markets.

Deutsche Bank discovered a contrarian phenomenon that, when properly managed, can double profits.

Here's how it works...

Playing the ETF Price Distortion for Profits

Deutsche Bank discovered an exaggeration in pricing that works both ways.

Stocks with high ETF inflows - the ones ETFs were buying the most - have their prices distorted to the upside. Stocks with high ETF outflows have their prices distorted to the downside as large blocks of shares are sold.

Don't Miss Out: The Treasury is sitting on an $11.1 billion cash pile, and a loophole entitles Americans to a sizable portion. Some are collecting $1,795, $3,000, or $5,000 every month thanks to this powerful investment...

But Deutsche Bank discovered these distortions are temporary. Within a few months, the price discovery action of the markets returns stocks to appropriate levels.

That means buying stocks with high ETF outflows should results in short-term gains. And the research shows it works.

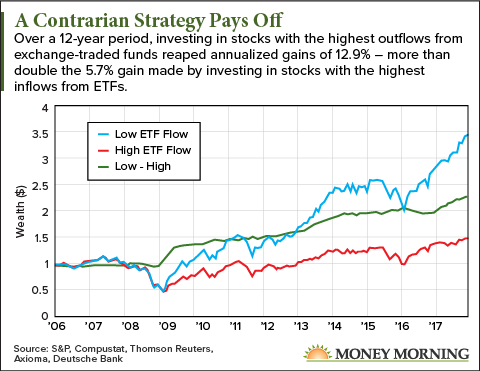

Deutsche Bank used data going back 12 years to test the theory. The hypothetical portfolio repeatedly bought stocks with high ETF outflows, turning over the holdings periodically.

The results (compared to a hypothetical portfolio that "follows the herd" - one that bought stocks with the highest ETF inflows) were dramatic.

From the Deutsche Bank report: "$1 invested in those firms with the most negative ETF flow in January 2006 grows to $3.48 at the end of December 2017, compared to $1.40 for those firms with the highest ETF flow."

Converted to annualized gains, the contrarian strategy resulted in gains of 12.9% per year compared to 5.7% for the "herd" strategy.

While putting this particular strategy into practice would be difficult for a retail investor, it's a great illustration of how effective a contrarian approach can be.

And there are plenty of other contrarian ideas you can put to use...

Meet Our In-House Expert on Contrarian Investing

Here at Money Morning, we're fortunate to have an expert in contrarian investing in our midst - Money Morning Executive Editor Bill Patalon, who writes the Private Briefing investment advice column.

Patalon co-wrote a book on the topic, "Contrarian Investing: How to Buy and Sell When Others Won't and Make Money Doing It," which was published in 1998. You can still buy it on Amazon.com.

Life-Changing Profit Potential: One tiny firm is rapidly developing the parts for a game-changing technology - and the gains from its stock, trading for less than $10, could turn every $1,000 invested into $4,719. Learn more...

"Most folks believe contrarian investing means that you are always at odds with the prevailing wisdom... that's wrong," Patalon told me. "It means you are opposite the prevailing sentiment ahead of 'inflection points' - in asset classes, specific stocks, or the broad market."

In the case of the Deutsche Bank study, the inflection point comes when the market realizes the price distortion.

"By investing before that reversal in sentiment, you get into an investment before everyone else - meaning at a low price and, most likely, at a low risk level," Patalon explained. "Then, when the inflection point comes, all those other investors suddenly 'agree' with you and pour in their own capital. That liquidity does the heavy lifting, driving up the value/price of the investment you already own - making you a killing."

In his book, Patalon and co-author Anthony Gallea outlined a series of rules anyone can use to profit from this basic concept.

While the book is full of practical tips, Patalon said he has one favorite strategy anybody can use.

This is the single-best buy signal for a beaten-down stock...

Put This Contrarian Strategy to Work for You

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

"In the book, we detail a set of guidelines for identifying and buying contrarian stocks," Patalon said. "These rules tell you when to buy ... how long to hold ... and when to sell."

The signal Patalon likes applies to one common type of contrarian stock - "beaten-down" stocks.

"This stock is out of favor because it's been abandoned by the masses," he said. "It might have been bad earnings, fear of a lawsuit or regulator intervention, worries about a slowdown, or (as we've seen recently) fears of a trade war."

For stocks like these, the best indication that it's time to buy is insider buying.

Not to be confused with insider trading (which is illegal), insider buying is the purchase of a company's stock by corporate officers, board members, or "knowledgeable insiders." It's permitted as long as they follow the relevant securities laws. For instance, insider buying and selling is only allowed at certain times.

But when it happens, it's an early warning sign that a beaten-down stock is about to turn around.

"When corporate insiders go out and buy shares of their own company, they do it pretty much for only one reason -- they want to make money," Patalon said. "And when I say they do this to 'make money,' I'm not talking about a point or two. They buy because they believe their company's stock price is headed for hefty gains."

Insider selling, by contrast, can come about for a variety of reasons. They may want to diversify their holdings, or take some profits, or set aside money for taxes.

But insider buying is as black-and-white as it gets.

And no one knows better when a company is on the verge of a turnaround than the folks running the ship -- the CEO, CFO, other officers, and corporate board members.

There's another reason why Patalon likes this signal so much...

How to Make the Most Out of the Insider Buying Signal

"Think about this: Thanks to the generous compensation plans most public companies offer their execs - via restricted stock grants, stock options, or appreciation rights - most corporate officers and board members already have big personal stakes in their own firms," he said. "So, the fact that they're overtly going out of their way to add to this stake by making purchases in the 'open market' is a sign that they believe big things are coming."

Patalon added that "scads of research" from both academic and institutional studies backs up the idea that insider buying foreshadows an increase in share prices.

But to maximize gains, you need to go one step further, he said. You need to take note of the volume of insider buying.

Patalon said a joint study by the University of Houston and the Office of the Comptroller of the U.S. Currency found that the average insider purchase was about $59,000. So he doubled the figure to $120,000 to arrive at his rule-of-thumb "Buy Trigger" threshold.

He further developed that to a "good, better, best" strategy to single out the best opportunities:

- Good: A corporate officer buys $120,000 worth of his or her own stock.

- Better: Two insiders purchase $300,000 of their own shares.

- Best: Six insiders buy and aggregate $500,000 of their own shares.

"The message here, of course, is that more is better," Patalon said.

Investing ideas like these are why we refer to Bill Patalon around here as the "World's Greatest Stock Picker"...

This Man Is a Stock-Picking Genius - and You Can Learn His Secrets

As of today, this man is the world's GREATEST stock picker.

Based on every track record published today, nobody has come close to him.

And when you see exactly how he's been able to help his followers get the chance at over 217 double- and triple-digit windfalls, you'll agree - he's onto something that is very real, extremely profitable, and has NO end in sight.

Click here for more details...

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.