There's no shortage of tempting, speculative plays on all the market noise raging right now - the Trump trade, the tariff trade, the midterm trade, and my personal favorite, the earnings season trade.

But there's one bright, shiny object that stands above all others right now. It's pure catnip for traders like me, who love action and volatility.

You might even call it addictive.

I'm talking about pot stocks, of course. Canada is barely two weeks away from legalizing weed nationwide, and we all know several U.S. states are already there.

Companies are rushing to fill the expected demand.

There are lots of smaller, speculative companies that have proven irresistible to option traders looking to cash in, big and fast, like the California Gold Rush. Traders have lived and died on those.

But plenty of these firms, like Cronos Group Inc. (NASDAQ: CRON), Canopy Growth Corp. (NYSE: CGC), and others stand a real shot at become the blue chips in this sector. Remember - we want to tap the volatility in the sector while limiting downside.

So these "big boys" are the companies we'll be targeting with our speculative capital today.

Let's join in the fun...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

When "Best in Breed" Meets the Best in Weed

Let's look at four of the more popular names in the ETFMG Alternative Harvest ETF (NYSEArca: MJ), the go-to ETF for pot stocks.

This table gives you the market cap (or net assets for MJ), the closing price on 9/27, the stock's high and low for the year, and the historical volatility - a statistical measure of a stock's annualized price fluctuation. For reference, Tesla's historical volatility is around 65%. Also note that none of these companies are U.S.-based.

| Stock/ETF | Mkt. Cap | 9/27 Price | 2018 Hi-Low | Hist. Vol. |

| ETFMG Alternative Harvest ETF (MJ) | 457M | 38.72 | 45.40-25.10 | 57% |

| Canopy Growth Corp. (CGC) | 11.5B | 49.42 | 56.60-16.74 | 94% |

| Cronos Group Inc. (CRON) | 2.0B | 10.94 | 15.30-4.75 | 115% |

| GW Pharmaceuticals Plc. (GWPH) | 4.9B | 174.50 | 179.65-105.12 | 55% |

| Tilray Inc. (TLRY) | 12.9B | 131.30 | 300.00-20.1 | 262% |

Canada-based Canopy Growth Corp. (NASDAQ: CRON) was founded in 2014 to serve the medical marijuana market in Canada. Despite its high volatility relative to the broader market, the recent price action has been relatively tame after it more than doubled in just three weeks starting in mid-August.

In fact, the stock traded flat in September, staying close to its rising 20-day moving average. Option liquidity is very good and bid/ask spreads are tight. Short interest is low, so don't look for any short covering.

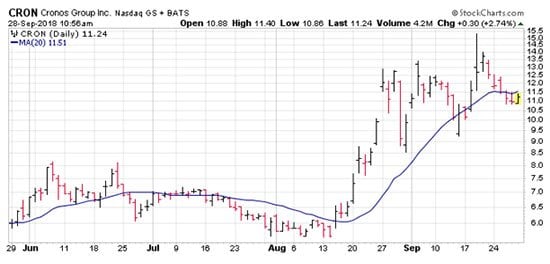

Founded in 2013 in Toronto, Cronos invests in companies that serve the Canadian medical marijuana market, which will expand through legalization on Oct. 17.

CRON shares nearly tripled in value in about a month, which caused its volatility to spike above 190%. But it has since calmed down as it hangs around its 20-day moving average. Short interest is negligible, and option liquidity is solid for a low-priced stock.

Next up is GW Pharmaceuticals Plc. ADR (NASDAQ: GWPH), the only one of the group from across the pond, based in the United Kingdom. Founded in 1998, GW has developed, and continues to develop, groundbreaking new prescription medicines derived from cannabis, designed to treat diseases like epilepsy and schizophrenia.

Volatility - sweet, sweet volatility - has been elevated of late due to a 30% pop in the past two weeks that culminated in an all-time high on Thursday.

As a buy-and-hold stock, it's a buy.

From a trader's perspective, what I really like about GW is that it has a foot in both the marijuana and biotech markets. That gives it a more diversified "look" that should keep downside volatility in check.

On top of that, short interest on GW has been increasing since January, pushing the short-interest ratio to right around the 10 mark.

Of course, I love stocks making new highs and garnering target increases that have high short interest, since the shorts will have to cover their bets at some point by buying the stock.

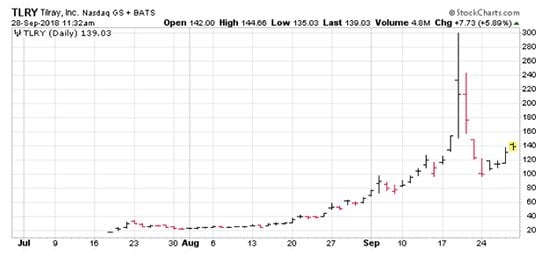

Finally, we have the speculator's dream, Tillray Inc. (NASDAQ: TLRY).

If you like gut-wrenching moves, this one's for you. Based on Vancouver Island in British Columbia, the company is a straightforward medical marijuana provider to something like 14 countries.

This company can't stay out of the news right now - for all great reasons - and it's driving some unbelievable moves.

Despite debuting in July, the stock has made an impression. Last week, for example, the stock doubled in one day and resulted in trading being halted five times in less than an hour.

Option volume on TLRY is heavy and bid/ask spreads are nice and tight.

So how do you trade these stocks? If you want a wild ride, climb aboard Tillray - just make sure you don't bet the farm (or the kids' college fund) on it. It's a choice stock for parking some speculative capital in, though.

A more traditional "buy, hold, and juice your gains" play? That's GW to a "T." With a unique line of pharmaceutical therapies (and excellent prospects for a short squeeze), the stock has a bullish future.

Note that GWPH options are not as liquid as those of the other stocks, and bid/ask spreads tend to be wider. Nevertheless, look at the near-the-money GWPH May 17, 2019 $180 call (GWPH190517C00180000) to leverage the expected upside. I like the longer expirations because option prices tend to be cheaper.

Finally, the safest play - on a budget, no less - would be a covered call on Cronos Group Inc. (NASDAQ: CRON). You can buy 100 shares for around $1,100 and sell the CRON Nov. 16, 2018 $12 call (CRON181116C00012000) for around $1.50, meaning your net cost is $950.

If Cronus goes to $12 before expiration and your shares are called away, you make a cool 25%. And if the stock drops, the call will expire worthless and you can sell another one to lower your cost basis.

This Trader Is Betting It All He Can Show You How to Turn $5,000 into AT LEAST $174,500

Chris Johnson is on pace to see 3,390% total winning gains this year.

And now, he's guaranteeing his recommendations will give you the chance to do the same.

If not, he's working for free.

So mark your calendar for one year from today...

Set a reminder on your phone...

And click here to learn how to join right now.

Follow Money Morning on Facebook, Twitter, and LinkedIn.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.