For investors, each new year is the perfect time to rebalance their portfolios.

For investors, each new year is the perfect time to rebalance their portfolios.

No matter what kind of investor you are, the "set it and forget it" approach doesn't work. At a minimum, you'll want to rebalance your portfolio once a year.

In fact, a regularly rebalanced portfolio could give you an advantage of 438% over the average investor.

Money Morning Chief Investment Strategy Keith Fitz-Gerald ran an experiment to find out how a well-managed portfolio would perform against the S&P 500.

He picked 11 investments and allocated them according to his 50-40-10 model (we'll get into that in a moment). Then he saw how it would perform over 20 years when reallocated at the beginning of every year.

During the time period he chose - 2000 to 2019 - there were market crashes, a financial collapse, international calamities, and wars.

During the time period he chose - 2000 to 2019 - there were market crashes, a financial collapse, international calamities, and wars.

But the well-managed, annually rebalanced portfolio returned 551.2%, compared to just 113.3% for the S&P 500.

That means $50,000 would turn into $325,600 in that time. The broad market would have only left you with $106,650 in that time span.

The lesson is clear: If you want to make the most of your investments - even long-term investments - rebalancing your portfolio is critical.

Among other things, that's going to mean selling your winners and buying your losers.

That may seem counterintuitive, but today we'll explain why it's a crucial strategy.

Plus, we'll give you three stock picks that have lost value recently but are poised for a big comeback in 2020. These are the types of investments to pinpoint when you're rebalancing.

Before that, though, let's make sure you've got a profitable portfolio model to begin with...

The 50-40-10 Model: Your Ticket to Life-Changing Profits

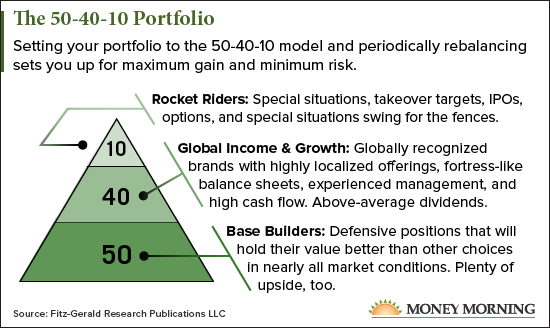

The 50-40-10 model is based on the principle of risk parity. That means investments are allocated based on risk level, rather than by asset class.

Here's what it looks like:

As the name suggests, there are three basic categories:

Base Builders: These are your foundational, defensive positions. This could include cash, bonds, precious metals, or conservative mutual funds. The point is that these assets should hold up fairly well even if the financial markets are tanking. And because this covers 50% of your portfolio, you have a strong foundation to rely on in good times and bad.

Don't fall into the trap of thinking of these base builders as low- or no-return, though. They might not have the same growth potential as the other categories. But there's no reason why you can't get some upside from investments like gold, or - for example - the Vanguard Wellington Fund (NASDAQ: VWELX), one of Keith Fitz-Gerald's favorite core holdings.

Global Income & Growth: This is where many of the recognizable names in your portfolio go: names like Apple Inc. (NASDAQ: AAPL), Johnson & Johnson (NYSE: JNJ), or Alibaba Group Holding Ltd. (NYSE: BABA).

There might be some lesser-known names in there as well. But the point is that these are large companies with a demonstrated track record of growth and resilience. They might slip during a market downturn, but they've proven that they can bounce back and deliver big profits in the long term. This is 40% of your portfolio, and it's where some of your most reliable profits will come from.

Rocket Stocks: This is where you get to have some fun. Rocket stocks can include penny stocks, new public offerings, options, or any number of exciting investment opportunities you might find.

You still need to exercise caution whenever you make any investment. But the beauty of the rocket stocks section of your portfolio is that it only takes up 10%. Any given investment will take up less than 2% - or even less than 1% - of your total portfolio. So you can afford to pick a loser or two.

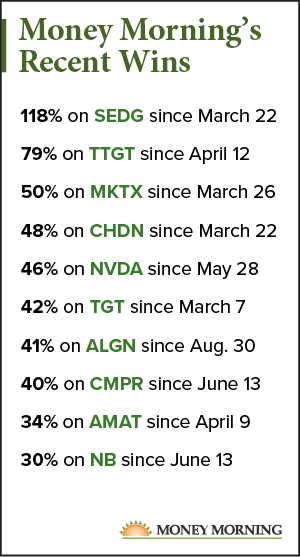

But when you pick a winner, these picks can multiply many times over in short order.

The balance of the 50-40-10 model gives you the best of both worlds. You get stability in troubled waters. And you get the opportunity to make huge gains when markets are riding high.

But again, this isn't a set-it-and-forget-it or a buy-and-hold model.

It's a buy-and-manage model.

To maximize profits, you have to be looking for new opportunities along the way. And you have to be willing to pull the trigger without letting emotion take over.

That means sometimes you have to sell your winners and buy your losers... even when your emotions are telling you to do the opposite.

Rebalancing Your Portfolio, Step One: Sell Your Winners

Even if you set the perfect 50-40-10 portfolio at the beginning of the year, it's not going to be perfect at the end of the year.

The $2,000 you had in a high-performing tech stock might now be $3,000, or even $4,000 if you really chose well.

A few of your speculative picks might have shrunk from $1,000 to $700 or so.

And maybe one of them skyrocketed to $5,000.

Even your foundational base builders will have grown and shifted over the course of the year.

Instead of 50-40-10, you might be closer to 40-40-20 or 50-45-5.

If you've had success with your current portfolio, you might be tempted to leave everything alone.

But especially if you've done well, it's time to enter the new year with the same strategy that got you here.

And that means rebalancing to bring everything back in alignment.

If your base builders have grown beyond 50% of your portfolio, you'll want to sell some of them off. If they've shrunk below 50%, you can sell some of your other investments and put the proceeds to rebuild your base.

In other words, you're selling some of your most successful investments - your "winners" - and buying some of the less successful ones - your "losers."

Apple Inc. (NASDAQ: AAPL), for example, gained more than 60% through the first 11 months of 2019. So if you own shares of it, that stock is probably going to take up an outsize portion in your portfolio at the end of the year. At that point, you'll want to sell some shares to bring it back in line with other similar investments you own.

And if your entire portfolio has done especially well, your "losers" might not actually have lost much. They've just grown at a slower pace than your big winners.

In some cases, you might decide to sell an entire stock, even after it's performed very well for you. If you see a downward trend on the horizon, now might be the time to take your money off the table and collect your winnings.

But you don't have to sell all your winners. If it's still a strong stock with a bright future, you can just trim enough shares off to book your profits and invest them elsewhere to bring your portfolio back into balance.

Until you sell those shares, the success of your investment is just unrealized gain.

The more you sell your winners over time, the more real money you're making.

That's how you get that 438% advantage with the 50-40-10 model: by actively realizing your gains rather than just letting them go for a ride.

Now for the next step: buying your losers...

Rebalancing Your Portfolio, Step Two: Buy Your Losers

If you've got a real stinker in your portfolio, you can go ahead and cut it loose.

Typically, we recommend a trailing stop of 25% on most investments, so you can take your profits or cut your losses when a stock is tanking.

But sometimes it's clear that it's time to cut and run. If you owned a dying brick-and-mortar retail stock five years ago, like Sears Holdings Corp. (OTCMKTS: SHLDQ), you were clearly facing a long-term downtrend.

SHLDQ has lost another 59% in 2019 and is now down more than 99% since late 2014.

In a case like that, when global trends are moving against you, there's no use throwing good money after bad.

On the other hand, sometimes even good investments have off years.

There are some stocks, for example, that Money Morning Executive Editor Bill Patalon recommends using an "accumulate" strategy with.

That means when the share price dips, that's a buying opportunity. Over the long term, the accumulate strategy is a great way to maximize your profits. Because you're buying at a discount.

So if you have a solid pick or two in your portfolio that have lost value due to market shortsightedness, now is the time to put some of your winnings into these "losers."

Because they won't stay "losers" for long.

With that in mind, let's take a look at some of the best "losers" for 2020: stocks that have lost value recently but have all the winning ingredients to bounce back in a big way.

Best "Comeback" Stocks for 2020

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Even great stocks are subject to the whims of the market. A disappointing earnings report, an unfavorable headline, or a PR snafu can send investors into a panic.

For a company with great long-term prospects, those downturns can be a great buying opportunity.

And if you already own shares, it's a great time to add to your position.

Here are three stocks that are primed for a comeback in 2020...

- As of late November, Innovative Industrial Properties Inc. (NYSE: IIPR) is actually up an outstanding 67% in 2019. But it's lost about 45% of its value since July. That might send some investors running for the exits. But don't be fooled. This cannabis-based REIT is significantly undervalued. Its portfolio of cannabis properties has grown from one to 41 since 2016, and the dividend has increased in each of the last four quarters. Earnings per share is set to double in 2020. Right now is a perfect time to buy shares or add to your holdings.

- Beyond Meat Inc. (NASDAQ: BYND) is also up in 2019, by about 20%. But it has fallen dramatically from its late-July peak of $235. It's now sitting around $78. Perhaps the market got ahead of itself in pushing BYND's price sky-high after its IPO. But the current price is well worth the investment. Beyond Meat keeps racking up partners, with plant-based meat products now available (or soon to be) at KFC, Subway, Blue Apron, Del Taco, and TGI Fridays, among many others. For anyone who lost money by getting in near the peak, adding shares now is an opportunity to average out the cost of the stock.

- Iron Mountain Inc. (NYSE: IRM) started the year up 16% in January. It's now down ever so slightly from the start of the year, after an 18% plunge between April and July. But this REIT that specializes in data security centers has global trends working in its favor. Cybercrime is expected to cost the world $6 billion annually by 2021, according to Cybersecurity Ventures. That's a 100% increase since 2015. So data security is becoming more important every day, and Iron Mountain is already trusted by 95% of the Fortune 1000. This stock also has a top score from our Money Morning Stock VQScore™ system.

In some cases, you might be buying more shares of stocks you already own. But the new year is also a time for new opportunities. So when you take a big-picture look at your portfolio, there's nothing wrong with parting ways with investments that no longer fit with your objectives for whatever reason.

Then you can put that money into new investments that excite you.

For starters, you can look at our top 25 VQScore stocks every week. These are stocks that have been flagged by our proprietary system as being undervalued and poised for growth.

And if you want to find some true "rocket stocks," we've got some mind-blowing opportunities to make life-changing profits. And you can get started for just $50...

Anyone Can Become an Angel Investor with as Little as $50

Angel investing used to be off-limits to the average American... but Shark Tank's Robert Herjavec said it best during this live broadcast: "The walls have finally come down. You no longer have to be rich, famous, or powerful to become an angel investor!"

Congress has now made it possible for you to take advantage of these life-changing deals.

By becoming an angel investor, you can be right there - one of the first to invest in the next Steve Jobs, the next Bill Gates, or the next Elon Musk.

And because you're there at the beginning, the upside is infinitely greater.

For so long, regular folks have been locked out... but not anymore. Click here for details...

Follow Money Morning on Facebook and Twitter.

About the Author

Stephen Mack has been writing about economics and finance since 2011. He contributed material for the best-selling books Aftershock and The Aftershock Investor. He lives in Baltimore, Maryland.