The cannabis revolution is here, and there’s still time for investors to get in on this lucrative market. Cannabis stocks are gaining traction thanks to a wave of legalization across North America and new discoveries about its medicinal properties. Here’s your complete guide on the best cannabis stocks to invest in for 2020.

Why Investing in Cannabis Stocks Is for Everyone

You've probably heard different terms used to describe cannabis.

Hemp comes from cannabis plants with less than or equal to 0.3% of tetrahydrocannabinol or THC, which can induce psychoactive or euphoric effects. Marijuana comes from cannabis plants, with more than 0.3% THC.

Marijuana was categorized as a Schedule I drug under the Controlled Substances Act of 1970. However, popular opinion has shifted regarding the legalization of cannabis, including marijuana, in recent years.

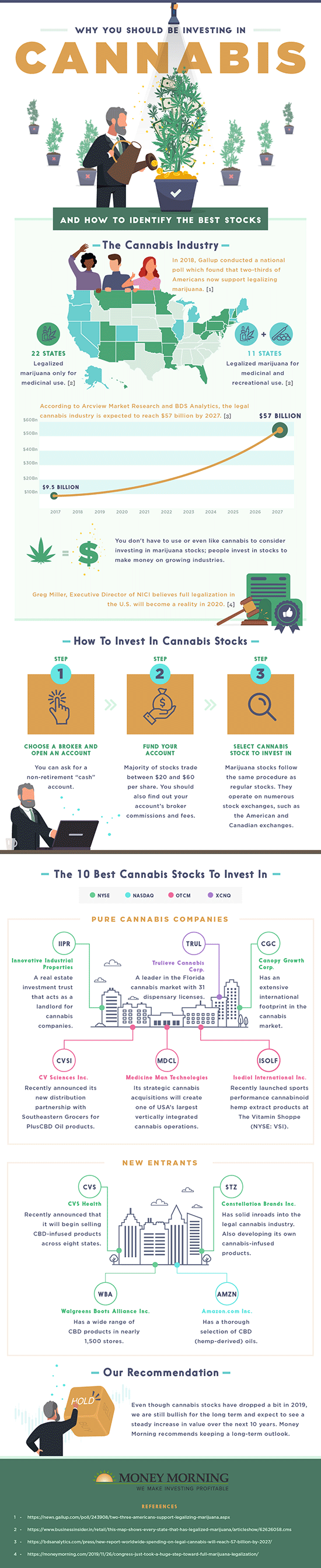

In 2018, Gallup conducted a national poll that found that two-thirds of Americans now support legalizing marijuana. Part of this shift is thanks to new research that has shown that cannabinoids, which are derived from the cannabis plant, are now being used to treat epilepsy, anxiety, pain, and even opioid addiction.

It’s no wonder why investors are seeking cannabis stocks to invest in. 2019 proved to be an indicator that federal prohibition on cannabis is likely to end as a record number of states considered legislation to legalize marijuana.

Currently, in the United States, 11 states have already legalized cannabis, while 33 others have legalized marijuana for medicinal use. On top of that, Canada fully legalized cannabis just last year.

It is only a matter of time before cannabis is completely legalized, and the cannabis industry explodes. Of course, you don’t have to use or even like cannabis to consider investing in marijuana stocks. People invest in cannabis stocks for the same reasons they invest in steel makers or streaming media companies. They want to make money on growing industries.

A Closer Look at the Cannabis Industry

History shows that one of the best ways to grow your wealth is to invest in the stock market. Between 2007 and 2016, stocks returned an average of 8.65% per year, compared to 5.03% in 10-year Treasury note, 7.88% in gold, 0.74% for risk-free Treasury bills, and 1.73% in five-year bank CDs.

But marijuana stocks offer much higher upside.

THREE STOCKS: Any one of these cannabis companies could potentially deliver a 1,000% windfall. Click here to learn more...

In 2018, cannabis sales in the United States totaled approximately $50 billion. New Frontier Data, a leading cannabis data analysis firm, reported that $10.4 billion is from the legal market. Therefore, about $39.6 billion of that revenue came from areas where cannabis is illegal.

In other words, almost $40 billion worth of revenue is sitting on the sidelines, waiting for states to legalize cannabis. With proper legislation, markets should also add sales for new users.

Additional sub-sectors of marijuana will also erupt. For example, cannabis cultivators, marijuana product manufacturers, as well as cannabis packaging companies, all have a business interest in the cannabis sector.Product manufacturers will also profit as the demand for marijuana-infused beer, body lotions, and even pet products continues to grow.

According to Arcview Market Research and BDS Analytics, the legal cannabis industry is expected to reach $57 billion by 2027. In fact, Arcview’s CEO, Troy Dayton, believes that the U.S. will legalize marijuana sometime after the 2020 presidential election.

Before the cannabis sector bursts, now is the time to pick the cannabis stocks to invest in for 2020.

How to Invest in Cannabis Stocks

Investing in cannabis stocks is just like investing in any other stock. It takes some work to find the right stock, but the process is simple.

It’s important to remember that this is investing, not day trading. In other words, you won’t need to compete against institutions and professional traders. You also won’t need to be glued to your computer, watching the market’s every move.

LEGAL WAVE: Barriers to marijuana could be tumbling in Mexico and Thailand, but it's here in the U.S. where legalization could spark a "Green Rush" in certain stocks. Click here to learn about three of them...

Instead, you’ll need to buy shares of stable companies with solid business prospects. When you purchase these shares, you’ll own a portion of the company. As the company does well, so do you. Additionally, if the company pays dividends each quarter, shareholders will also receive a dividend check. The more shares you own, the bigger the check.

Of course, every investment comes with some inherent risk. The value of a stock may periodically decrease. For example, if the company can’t execute plans or the entire stock market hits a rough patch, it is normal to have some price movement. However, in general, stock prices tend to move up over time, so it often pays to be patient.

1. Brokerage Account

To get started, you need to choose a broker and open an account. Some brokers are online while others have actual branches where you can talk to a person, face to face.

And if you already have a retirement account, like an IRA or a 401(k), you may already have a relationship with a broker. You can ask them to set up a non-retirement account, which is sometimes called a "cash account."

2. Fund Your Account

Now, you need to fund your account. You can add more at any time for your next investment.

To give you an idea of how much you need, stocks can range from pennies to even thousands of dollars per share. However, many stocks trade between $20 and $60 per share.

You’ll also need to see if your broker has any account minimums as well as any commissions and fees. A commission is just a small charge to compensate the broker for executing the buy or sell order. Typical discount broker commissions can be less than $10 per transaction.

STAKE YOUR CLAIM: Three pot stocks in particular could be poised for rare, wild gains of up to 1,000%. Click here to learn how you could see a $2 million "pot payday"...

Your broker will be able to tell you precisely what the fees, commissions, and minimums are for your specific account. They'll also be able to tell you how to transfer money into your account, such as by writing a check or by initiating an electronic transfer (ACH) from your bank. Just give your broker a call or send them an email – they'll be glad to help you with this process!

We've also put together a list of different brokers with their minimum dollar amount and commission prices to give you an idea.

3. Select Cannabis Stocks to Invest in

Although cannabis is not completely legal in the United States, investing in marijuana stocks follows the same procedure as regular stocks.

You can find cannabis stocks on numerous stock exchanges. For example, many cannabis stocks trade on Canadian exchanges, while American cannabis companies, such as CBD growers and companies, trade on American exchanges.

Moreover, don’t be afraid of investing in companies that are not headquartered in the United States. Chances are, you may already own shares of some, such as the Chinese Alibaba Group Holding Ltd. (NYSE: BABA) or Anheuser-Busch InBev NV (NYSE: BUD), now headquartered in Belgium.

The Best Cannabis Stocks to Invest in for 2020

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

1. Major Retail Companies and Online Stores

One way to select cannabis stocks to invest in for 2020 is to identify the major retail companies and online stores that sell products that contain CBD, a cannabis compound. A few marijuana products include CBD oils, edibles, beverages, lotions, gummies, and even salad dressings.

Consider share in companies like Amazon.com Inc. (NASDAQ: AMZN) and Walgreens Boots Alliance Inc. (NYSE: WBA) who have already begun to capitalize on cannabis oil's potential. Even CVS Health (NYSE: CVS) recently announced that it would start selling CBD products, such as creams and salves in over 800 stores across eight states.

The National Institute for Cannabis Investors is your go-to source for reliable, up-to-date information about cannabis investing. Click here to automatically subscribe to Cannabis Profits Daily, the Institute’s free newsletter, and get industry news and profit opportunities sent right to your inbox.

2. Constellation Brands Inc.

Another cannabis stock to invest in for 2020 is Constellation Brands Inc. (NYSE: STZ). Constellation is currently a major beer, wine, and spirits maker with solid inroads into the legal cannabis industry through a $4 billion investment in Canopy Growth Corp. (NYSE: CGC).

This investment into Canopy Growth Corp. is projected to be worth $66.3 billion by 2025. Constellation is also looking to develop its own cannabis-infused products and could potentially be a major vendor. This would give Constellation a significant leg up on rivals since it already has distribution networks and has already successfully navigated state-by-state regulations.

Constellation managed to deliver $2.21 earnings per share in Q1 2019, beating some estimates by 6.8%. It also posted surprise earnings in the previous quarter, beating expectations by 7.6%. It's no wonder Wall Street predicts shares will surge 40%, jumping from $193 in August 2019 to $270 a share in the next 12 months.

The Money Morning Stock VQScore™ system also flagged STZ as a breakout stock. This is a proprietary system that identifies stocks that are ready for a price jump. Constellation Brands has a perfect 4.75 VQScore, meaning its earnings per share is accelerating. We expect to see this stock to break out even further.

These 3 Stocks Are the Key to 2020's Greatest Profits

The 2018 midterm election was a turning point for the cannabis industry.

We expect nothing short of historic profits by the end of the year.

But not all pot stocks will hand you life-changing wins. In fact, often the companies making headlines are least likely to see the biggest gains.

These three stocks, on the other hand, are flying under the radar... for now. Each of them could see exponential stock price acceleration at any moment, and if you get in before that happens, you could turn a token stake into a lifetime of wealth.

I don't know of any other sector providing anywhere near this level of growth now.