To call the markets "volatile" right now would be an understatement.

They're more like the "Batman" roller coaster at Six Flags - a 50-mile-per-hour free-fly ride that's been known to make riders black out due to its sheer speed on inverted loops.

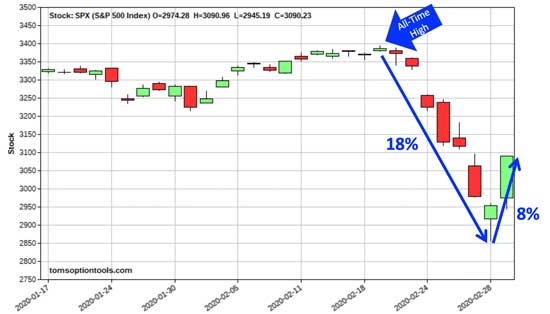

After reaching an all-time high of 3,393.52 on Feb. 19, investors blinked - and boom, the S&P 500 was down a whopping 18% in just seven trading days.

But then, the ride took a quick swing back up with an 8% bounce on March 2:

Following that, Wednesday, March 4, saw a 4% jump after Joe Biden's Super Tuesday win - only to have the major indexes open 2% lower the next day.

Feels like the fast ups and downs of a roller coaster, right? The kind that makes your stomach squirm. And the ride is far from over...

On March 3, the U.S. Federal Reserve slashed interest rates by 50 basis points, its largest cut since the 2008 financial crisis. The simple fact that the Fed feels the need to cut rates at all means that there's only more volatility to come.

But while most investors suffer from the market's whiplash, those "in the know" are enjoying the ride, snagging fast profits right under their noses.

In fact, some of my readers just had the chance to score a 50% profit in three days.

All it takes is perfect timing and fast-moving trades - and I'm here today to show you exactly how you can achieve both...[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Use Weeklies to Bank Fast Cash off the Market's Extreme Volatility

In the midst of all of this volatility, my Weekly Cash Clock readers recently closed out a three-day trade on the SPDR S&P 500 ETF (NYSE: SPY) for a 50% profit.

But they didn't do it by riding the market's headlines - they did it by nailing down the exact right time to enter a trade.

Timing is key in this market. And one of the best ways to pinpoint the right time to enter a trade is by using something called channel collisions.

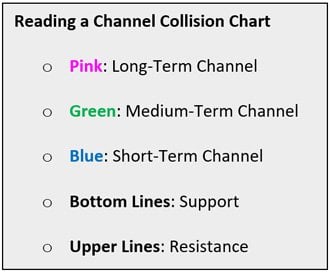

By identifying long-, medium-, and short-term trading channels, you can easily spot when a stock is ready to turn and make a quick move.

The chart below on the SPY identifies long-term (pink), medium-term (green), and short-term (blue) channels. The bottom lines of the channels are support. The upper lines are resistance.

Notice how the support lines of all three channels collided on Feb. 27, 2020, suggesting a bounce - and signaling a bullish move.

During this volatile market movement, most investors were in a panic, taking their money out of the market as fast as possible. But my Weekly Cash Clock readers followed the bullish signal from this chart and took a trade on the SPY.

On Feb. 27, 2020, we created a Green Loophole Trade, also known as a call debit spread, by purchasing a March 6, 2020 $303 call while simultaneously selling a March 6, 2020 $305 call.

On Feb. 27, 2020, we created a Green Loophole Trade, also known as a call debit spread, by purchasing a March 6, 2020 $303 call while simultaneously selling a March 6, 2020 $305 call.

Now, when volatility is high, it pushes options prices through the roof. Simply purchasing the $303 call would have run you $8.83, or $883 for one contract - which is much higher than our $500 limit.

But by simultaneously selling the $305 call, we made a credit of $7.85, or $785 for one contract.

If we add that to the $883 debit, then readers only spent $0.98, or $98 to open the trade.

The SPY did as expected and bounced 8% on March 2, allowing readers to close their trade out for $1.48 - snagging a three-trading-day profit of more than 50% while others were licking their wounds!

Now, profiting 50% when the market rose only 8% doesn't just require any old option. To be more precise, it requires weekly options.

We know that options minimize risk and maximize returns. Longer-term (30-60 day) options will typically increase returns tenfold - but shorter-term options, like the ones my readers trade, produce even greater returns.

Think of weekly options as a Formula 1 race car and longer-term options as a tractor-trailer. In a race, the Formula 1 race car would smoke the tractor-trailer. But with a much smaller gas tank, the race car would not be able to travel as far as the tractor-trailer.

In a short race, the Formula 1 race car is the clear choice. The same thing applies to options. If you're only going to be in for a few days, weekly options will greatly outperform longer-term options. The problem is that they run out of gas (time value) faster, so timing the entry must be impeccable to profit.

While the market continues on this roller coaster of volatility, weekly options just like this one could be your best bet.

In fact, this year alone, my Weekly Cash Clock Members have taken seven sets of profits, six of which were for 50% gains or more.

To learn how you can become a Weekly Cash Clock Member and receive a new trade recommendation every week, click here.

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.