As fears about the pandemic grow, global markets are seeing trillions of dollars disappear as the economic impact of coronavirus wreaks havoc on economies across the world.

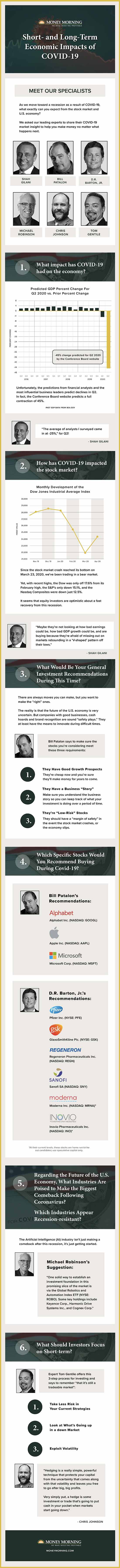

As we move toward a recession as a result of COVID-19, what exactly can you expect from the stock market and U.S. economy? Will it get worse before it gets better? Is there opportunity to be had in stock market futures or the U.S. economy in general? What can you expect as a result of COVID-19?

It seems as if we haven't yet reached the bottom of the market, so we asked our leading experts to share their COVID-19 market insights to help you make money no matter what happens next.

1. What Impact Has COVID-19 Had on the Economy?

We've already seen the economy contract in the wake of COVID-19. GDP in Q1 fell by 4.8%.

Estimates for the future of the U.S. economy and GDP in Q2 are considerably worse.

In fact, Shah Gilani said, "The average of analysts' I surveyed came in at -25%," for Q2!

And the Conference Board estimates a contraction of 45%. That means the economy is almost certainly in a recession right now.

For perspective, the Great Recession between 2007 and 2009 saw GDP slip 4.3%, making for some pretty terrifying predictions in 2020.

2. How Has COVID-19 Impacted the Stock Market?

Since the stock market crash reached its bottom on March 23, 2020, we've been trading in a bear market.

Yet, with recent highs, the Dow was only off 17.6% from its February high, the S&P's only down 15.1%, and the Nasdaq Composites were down just 12.5%. Shah Gilani says, "That's not bear market territory anymore."

Meaning we've jumped back into bull market territory, and that could be a red flag.

It seems that equity investors are optimistic about a fast recovery from this recession.

Or, as Gilani says, "Maybe they're not looking at how bad earnings could be, how bad GDP growth could be, and are buying because they're afraid of missing out on markets rebounding in a 'V-shaped' pattern off their lows."

Once stocks bounced off their March 23rd lows, fear of missing out (FOMO) buying pushed stocks higher than any economic indicator justified.

3. What Would Be Your General Investment Recommendations During This Time?

There are always moves you can make, but you want to make the "right" ones.

The reality is that the future of the U.S. economy is very uncertain. But companies with good businesses, cash hoards, and brand recognition are sound "safety plays". They at least have the means to innovate during difficult times.

Bill Patalon says to make sure stocks you're considering check these three boxes:

- Good growth prospects: Cheap now and sure they'll make money for years to come.

- Have a business "story": Should be able to understand it so you can keep track of what your investment is doing for a period of time.

- "Low risk" stocks: They should have a "margin of safety" in the event the stock market crashes or the economy slips.

4. Which Specific Stocks Would You Recommend Buying During COVID-19?

Bill Patalon's Suggestions:

D.R. Barton, Jr.'s Suggestions:

Focus on big biopharma firms working toward treatment of COVID-19, but be cautious and know the full story behind the companies.

- Pfizer Inc. (NYSE: PFE)

- GlaxoSmithKline Plc. (NYSE: GSK)

- Regeneron Pharmaceuticals Inc. (NASDAQ: REGN)

- Sanofi SA (NASDAQ: SNY)

- Moderna Inc. (NASDAQ: MRNA)*

- Inovio Pharmaceuticals Inc. (NASDAQ: INO)*

*At their current levels, these stocks are home run/strike out candidates; use speculative capital only.

5. Regarding the Future of the U.S. Economy, What Industries Are Poised to Make the Biggest Comeback Following Coronavirus? Which Industries Appear Recession-Resistant?

Michael Robinson's Suggestions:

Robotics and automation have been on the rise even before the economic impact of coronavirus was felt.

But with the drastic reduction in human workers, automation has proliferated.

Robinson says, "One solid way to establish an investment foundation in this promising slice of the market is via the Global Robotics and Automation Index ETF (NYSE: ROBO). Some key holdings include Keyence Corp., Harmonic Drive Systems Inc., and Cognex Corp."

He also suggests looking at artificial intelligence (AI), telemedicine, and videoconferencing.

6. What Should Investors Focus on Short-Term?

Expert Tom Gentile offers this three-step process for investing and says to remember "that it's still a tradeable market":

- Take less risk in your current strategies.

- Look at what's going up in a down market.

- Exploit volatility.

And always be keeping an eye on current stock market news and what's going on outside of the stock market. With new stories developing rapidly, one thing could drastically affect the market, causing a big rally or a huge sell-off.