Netflix Inc. (NASDAQ: NFLX), Amazon.com Inc. (NASDAQ: AMZN), Facebook Inc. (NASDAQ: FB), Alphabet Inc. (NASDAQ: GOOGL) - they're most people's go-to stocks right now. They're the biggest in the world. And they have one major thing in common...

They're expensive.

GOOGL is currently trading around $1,500 per share, and AMZN is sitting at $3,100.

For most traders, it's just not worth it to buy shares for more than $1,000 each just to see gains of 10%, 15%, or 20%.

That's why I like to make money on these highfliers with a different tactic. It's one that costs only pennies on the dollar, and it comes with a chance to double my money. That's right - the payout is much bigger, and it arrives much faster.

See, instead of buying these stocks, I rent them. And today, I'm going to show you how to do just that with one of the crown jewels of the car industry - and by crown jewel, I mean a serious profit player.

I'm talking about Tesla Inc. (NASDAQ: TSLA). TSLA shot up 42% in the past two weeks alone, to almost $1,400 a share. And with these four strategies for playing this lucrative stock, you'll get the chance to pocket some of that serious profit...

Four Ways to Profit on Tesla Stock for Pennies on the Dollar

As you know, I am a big, big fan of this car brand. In fact, I own two myself! I owe it all to that Model S, since it's the car that got my family and me safely out of Hurricane Irma's path.

After the company's IPO launch back on June 29, 2010, where shares were just $17, TSLA has recently hit all-time highs of $1,429.50.

This 10-year-old company grew 242% in 2020 and is now the largest U.S. car manufacturer, with a $254.5 billion market cap.

TSLA just blew second-quarter expectations out of the water, and the news kicked off a dramatic five-day rise. And it's set to go even further on the upside.

In the graph below, you can see the traction that TSLA has gained since its year-to-date low in mid-March to the all-time highs we're currently seeing.

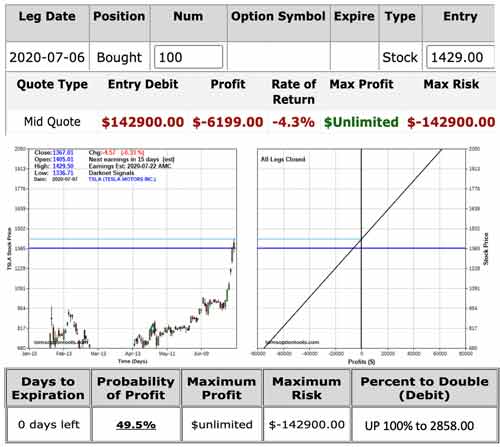

Now, let's take a look at your profit potential on TSLA shares if you bought the stock.

- Long Stock

At $1,429 a share, you'll need $142,900 to buy 100 shares of TSLA. You'd make $100 for every $1 that TSLA rises, but you would lose $100 for every $1 that the stock price goes down. Seems a little chancy, doesn't it?

Let's take a look at just how risky it is.

The risk graph above reveals unlimited profit and unlimited risk. Now, it's possible for TSLA to drop to $0, but it's not likely.

In order for you to double your money, the stock will need to rise to $2,858.

Now, let's reduce the cost, essentially renting the TSLA "house" for a fraction of the price, which could double your money much faster.

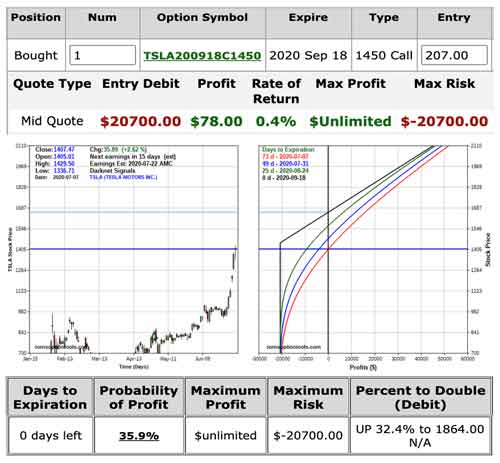

- Long Call

A call option gives you the right to buy an underlying asset for a set price (strike price) by a set time (expiration date) in the future. Call options rise in value along with the underlying asset and vice versa.

For example, you can "rent" the TSLA house by buying a TSLA Sept. 18, 2020 $1,450 call option for $207 per share controlled. At 100 shares controlled, this option would cost you $20,700 - a fraction of the $142,900 it would cost you to buy 100 shares of the stock.

This call option essentially allows you to rent TSLA until Sept. 18, 2020.

Let's take a look at the risk chart...

This trade provides an unlimited profit potential with a lot less risk than the long stock. The best part is that TSLA only needs to rise 32.4% to $1,864 for you to double your money on the call option.

And with our third opportunity, it gets even better...

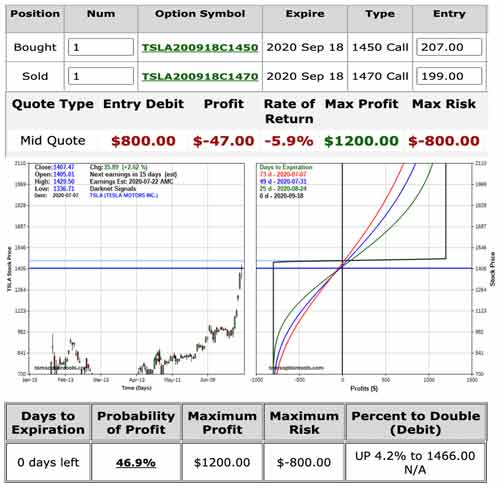

We can actually generate income with our long call, reduce risk, and greatly reduce the distance the stock needs to rise to double your money. If buying a call is like renting the stock, a long call spread is like renting and subletting the stock.

- Long Call Spread

Selling a TSLA Sept. 18, 2020 $1,470 call will bring in $199 a share, reducing our entry cost for a bullish trade on TSLA to a measly $8 per share controlled, or $800 in total.

That's right... you can essentially "rent" $142,900 of TSLA shares for only $800.

Here's how this long call spread breaks down:

- The long TSLA 18 $1450 call gives you the right to buy the stock for $1,450.

- The short TSLA 18 $1470 call gives you the obligation to sell the stock for $1,470.

The best thing that could happen is for the stock to rise about $1,470, at which point you achieve a maximum profit of $1,200; a potential 150% profit on this trade.

Let's get to the risk chart.

Now, here's the best part - although the long call spread has a cap on maximum profit of 150%, the percent to double is only 4.2% to $1,466. That's right... the stock only needs to rise by 4.2% by Sept. 18 to double your money.

Given TSLA's meteoric run up in 2020, this opportunity has the chance to pay out big... and even sooner than you might think.

- Weeklies

The above strategies are great ways to score a profit on TSLA - but the fastest way?

That's with weekly options.

Weekly options offer expirations at market every Friday. Because of their short time frame, they're much more sensitive to the underlying security's price movement - meaning they have an increased profit potential.

Especially when it comes to TSLA's unrivaled speed!

In fact, since June 8, this group of readers has had the chance to take home six sets of profits by trading weeklies - and they all took just three days or less.

The sheer speed at which these options can produce profits rivals only the speed of flooring it in a Tesla Model S - it's that fast.

And the best part? I send readers a new weekly option recommendation every single Monday.

To learn how you can receive my next one, just click here.

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.