When I first gave my Bitcoin price prediction for $100,000 in 2021 back in July 2019, it seemed ludicrous.

After all, Bitcoin was trading at about $10,217 at that point, down 48% from its previous all-time high in December 2017. Many skeptics doubted Bitcoin would ever get back to $20,000, much less five times that.

After all, Bitcoin was trading at about $10,217 at that point, down 48% from its previous all-time high in December 2017. Many skeptics doubted Bitcoin would ever get back to $20,000, much less five times that.

But in December, Bitcoin breached $20,000. This year, it has zipped past the $30,000 and $40,000 milestones. This morning, it breached $50,000 before slipping back to about $49,000.

Today, that 2019 Bitcoin price forecast doesn't look so crazy.

In fact, I think it's too conservative. That's why I'm revising my Bitcoin price prediction to $100,000 by Labor Day - just a little over six months from now.

I think it's very likely not just because of the No. 1 cryptocurrency's dramatic surge in price, but also because many of the factors powering Bitcoin continue to intensify.

Let's dig in to the details...

Why the Bitcoin Price Keeps Going Up

A big part of why I've revised my forecast lies in the thesis behind the Bitcoin price prediction I made in 2019.

That story focused on two main points: The halving of the Bitcoin block reward, which took place last May, and the "stock to flow" model of determining a commodity's value.

The halving has to do with newly mined Bitcoins. The system is designed to cut the reward for each mined block by half about every four years. Originally, the reward was 50 bitcoins; the three halving events have cut the reward to 6.25.

As just about every investor knows, price is a product of supply and demand. The supply of new Bitcoin is designed to shrink over time, with an ultimate cap of 21 million.

These concepts plug right into the stock-to-flow model. The idea is that you take the existing "stock" of a commodity and divide it by the fresh supply that's added every year (the "flow"). The higher the number, the higher the value.

The designed reduction in the supply of new Bitcoin ensures that its stock-to-flow ratio will keep rising, resulting in climbing prices.

The designed reduction in the supply of new Bitcoin ensures that its stock-to-flow ratio will keep rising, resulting in climbing prices.

A crypto enthusiast who goes by the name of "Plan B" used the stock-to-flow model to create a remarkable Bitcoin price chart. It showed how the Bitcoin price falls in the months leading up to a halving - and how it soars in the months after a halving.

Projected into the future, it also predicted a major rally starting in the latter part of 2020 and resulting in a Bitcoin price north of $100,000 by the end of 2021.

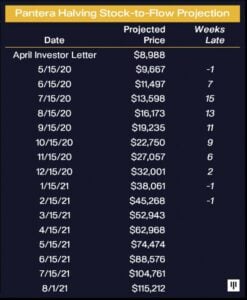

Last April, Pantera Capital, an investment firm focused exclusively on digital currencies and blockchain technology, used the stock-to-flow model to make a more precise, month-by-month Bitcoin forecast.

That chart has Bitcoin hitting $100,000 as early as mid-July. And as you can see, the Bitcoin price has tracked it pretty well, especially lately.

But Pantera isn't basing its prediction solely on the stock-to-flow model. It cites several other factors - and it all meshes well with what I've been saying for years.

Why Big Investors Are Buying Bitcoin

One of oldest arguments for Bitcoin is that it serves as hedge against steadily devaluing fiat currencies like the U.S. dollar.

The U.S. money supply is ballooning like never before, the result of stimulus policies launched in response to the 2008 financial crisis and accelerated during the COVID-19 crisis.

The M2 money supply doubled from $7.5 trillion to $15.3 trillion by the end of 2019. But since January of 2020, the money supply has jumped by another $4.2 trillion to $19.5 trillion. That's a 27.45% increase in just a little over one year. Until 2020, the M2 supply had never grown more than 15% in a year.

It also means that more than one-fifth of all of the U.S. dollars in existence were created in 2020. That's a big reason why investors have been snapping up deflationary Bitcoin.

"20x Bigger Than Bitcoin": For every $1,000 you could make with Bitcoin, this special trade could make you as much as $20,040 instead. Details...

And we can expect more of the same in 2021 with President Joe Biden's $1.9 trillion stimulus package teed up and ready to go. On top of that, President Biden has proposed a $2 trillion infrastructure plan.

Meanwhile you have central banks keeping interest rates near zero - and even below zero - adding to the inflationary pressure on fiat currencies.

Big investors like Bitcoin as a hedge against inflation as well as an asset mostly uncorrelated with stocks.

Here's how that's been translating into real-world buying...

What Makes a $100,000 Bitcoin Price Prediction in 6 Months Realistic

Earlier, I talked about the tightening supply of Bitcoin; now let's look at the surging demand.

Institutional investors have also played a big role in the current Bitcoin rally. In 2018, I predicted these deep-pocketed investors would start pumping money into Bitcoin as soon as there was sufficient infrastructure.

Last year, as that infrastructure came online, we started to see that flow of institutional money into Bitcoin.

The assets under management (AUM) of the Grayscale Bitcoin Trust (OTC: GBTC), which caters to big investors, zoomed from $1.88 billion in January 2020 to $17.48 billion by the end of December. In just the past six weeks, GBTC's AUM has almost doubled to $30 billion.

More infrastructure is on the way this year. Bank of New York Mellon Corp. (NYSE: BK) just announced the formation of a new unit to help clients hold, transfer, and issue digital assets. BNY Mellon is the world's largest custodian bank.

Deutsche Bank AG (NYSE: DB), Germany's largest bank, is also said to be working on a cryptocurrency custody platform for clients.

Over the course of last year, we saw more well-known and respected Wall Street types endorse Bitcoin - Paul Tudor Jones, Bill Miller, Stanley Druckenmiller. That encouraged more big investors to add Bitcoin to their portfolios.

As the year wears on, FOMO (fear of missing out) will kick in.

Extra: The five BEST stocks to buy in 2021 and dozens of popular stocks to avoid at all costs. Watch now...

Steve Russell, a fund manager with UK investment firm Ruffer, invested a portion of his company's £3.5 billion ($4.8 billion) total return fund into Bitcoin for just that reason.

"What we didn't want to have to do, was turn around to our investors and say, 'we're selling some gold to buy Bitcoin, because it's an alternative to gold and we're paying $100,000 for Bitcoin because we've waited to see what happened,'" Russell told Business Insider.

More recently, we've seen CEOs swapping cash for Bitcoin on their balance sheets. MicroStrategy Inc. (NASDAQ: MSTR) led the charge. The company started buying Bitcoin in August and ended the year with 71,079 BTC worth more than $2 billion.

Earlier this month, of course, Tesla Inc. (NASDAQ: TSLA) joined the party as it plowed $1.5 billion into Bitcoin. Tesla CEO Elon Musk nudged Bitcoin even higher with a few timely tweets.

This opens the door to more companies following suit. S&P Global estimates U.S. corporations alone have $2.5 trillion in cash on their balance sheets.

More capital is coming from retail investors as well. JMP Securities estimates retail investors opened 10 million new brokerage accounts in 2020. We saw their power to move markets with GameStop Corp. (NYSE: GME).

And they've already started moving into cryptocurrency, as the dramatic rise of Dogecoin has shown (I expect they'll soon realize the error of investing in a joke coin and migrate to more robust cryptos like Bitcoin).

How to Play This Bitcoin Rally

Add it all up, and you have a situation where could double your money in just six months. This is why long-time Bitcoin enthusiasts "HODL" - they know in the long term, Bitcoin still has a long way to go.

If you're new to Bitcoin, think about opening a position. Though investing in cryptocurrency may seem daunting, everything you need to know is in the Money Morning guide on how to buy Bitcoin.

As for strategy, I always advise people to invest only what they can afford to lose. As a rule of thumb, I suggest allocating between 2% and 5% of your portfolio to Bitcoin, depending on your risk tolerance. Despite the huge potential, investing in any crypto is also very high risk. It's still a very new and very volatile asset class.

If you start a position in Bitcoin and it does indeed go up to $100,000, as I expect, the best strategy would then be to take some of your money off the table. If you sell enough to get back your original stake while letting the rest ride, you'll be playing with "house money."

One reason to do this is to shield your investment from a likely Bitcoin crash. Historically, Bitcoin has crashed hard after each major rally. That's why you'll want to take some money out after you've made a large profit.

That way you can weather a crash and wait patiently for the next rally, which will start in late 2024 if Bitcoin stays true to the stock-to-flow model. That cycle will take Bitcoin to much higher levels - most likely somewhere between $500,000 and $1 million.

Put These Tiny Cryptos on Your Radar NOW

A surge of interest from institutional investors is setting the stage for a rally in a slew of small digital coins.

But understand this: These under-the-radar players are much more affordable than Bitcoin.

Some are so hot, even a small stake could transform into a humble fortune in 2021.

One is trading for just $5 - and could deliver a 328% profit in just a few years.

Our resident Silicon Valley insider is recommending three tiny coins as today's BEST crypto buys - to get his take on all three, click here.

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter and Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.