The Coupang IPO may very well be the biggest of the year. While the Korean firm may be new to many investors, it's part of a trend you know a lot about.

Several times a week I find myself flattening out Amazon boxes for recycling. I know I'm not the only one, as I see the Amazon truck go down my street almost every day. Recycling day looks like half my neighbors just finished celebrating the holidays.

It was no surprise to me that Amazon.com Inc. (NASDAQ: AMZN) net sales increased 44% to $125.6 billion in the fourth quarter.

But this trend isn't exclusive to the United States. It's a global phenomenon. Companies like MercadoLibre Inc. (NASDAQ: MELI) in South America are seeing triple-digit growth rates. Sea Ltd. (NYSE: SE) is seeing similar results in Southeast Asia. Alibaba Group Holding Ltd. (NYSE: BABA) in China has also seen double-digit sales growth for years.

In 2020, online spending represented 21.3% of total retail sales, up 44% since the previous year. Global retail e-commerce sales for 2020 were over $4 trillion. That is a lot of money spent online.

Enter Coupang, a Korean e-commerce titan that could go public with a valuation of around $50 billion under the ticker CPNG. This would make it the largest IPO in a company based outside the United States since Alibaba over five years ago.

Here's what makes this company so exciting and whether it makes sense to try to get into the stock at the IPO.

What Is Coupang?

Founded in 2010, Coupang has built up one of the largest e-commerce companies in Korea.

The promise of 24-hour delivery through its "Rocket Delivery" service has helped it increase sales from 2019 by 90.8% to $12 billion in 2020. This revenue growth is helping operating leverage, with operating losses down almost 15% and operating margin up 4.4% during the same time period.

Coupang is growing into one of the largest and fastest-growing e-commerce opportunities in the world. Total e-commerce spend was $128 billion in 2019 and expected to grow to $206 billion by 2024. This means that by 2024, each buyer could be spending over $4,000 a year online.

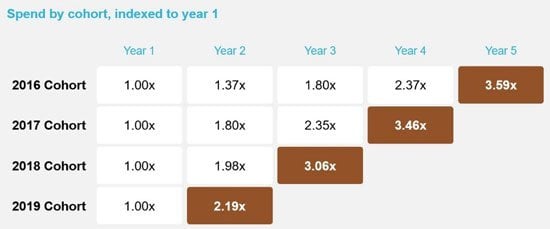

While total spend in 2024 is only an estimate, Coupang has shown strong growth in its customer engagement. This chart from its S-1 filing just shows how much more money users are spending year after year. As their customer base continues to grow, you can see how their revenue can continue to balloon.

Built as the next generation e-commerce experience, it has invested for the long term in technology and infrastructure with a focus on the customer.

With a vertically integrated delivery system it has millions of items that can be delivered within hours via dawn and same-day delivery. On top of that, it also offers next-day 365 days a year, even the day before gift-giving holidays. With 70% of the population living within seven miles of a logistics center, a total warehouse footprint of over 400 football fields, and a directly employed delivery fleet, Coupang has the ability to offer this service.

Being customer-focused, it has also created a frictionless return system where you don't even need to pack a box or print a label. You just tap a button in the best-in-class app and leave the item outside the door for pickup.

Outside of its customer focus, it also offers merchants several solutions to improve their business. This includes fulfillment and logistics services along with myStore that enables small businesses to create digital storefronts to build brands across the Internet.

In a fragmented market, Coupang is gaining market share and has been one of the biggest winners during the pandemic. It now has a 25% market share in Korea's online retail market, edging out Gmarket/eBay Korea.

This is undoubtedly an exciting company, but a lot more goes into making an IPO.

Let's take a look at whether Coupang stock is worth a buy once it's public.

Coupang Stock Is a Buy at the Right Price

With big investors like Softbank and Sequoia Capital backing the company, it has grown into one of the largest e-commerce players in the country and could continue to grow with the influx of cash going public.

While Coupang is on the right track, I would wait and see how it trades before investing.

The valuation has skyrocketed in recent years. In 2018, its last private round valued the company at $9 billion. Now the company could go public as high as $50 billion.

While the company is certainly growing very quickly, given how tech has been under pressure, the market might not accept such a high valuation for a company only operating in Korea. I would wait and see how it trades before investing.

Forty billion dollars is a good entry point for this stock. Keep an eye on how it does in its first few days of trading and look for an opportunity to enter at the right price.

The Complete List of Best (and Worst) Stocks for 2021

Wall Street insider Shah Gilani says 2021 could be a gold mine for Americans.

He's showing his subscribers exactly which stocks to buy and which to sell.

But you're getting it all for free - no sign-up or credit card required.

Prices, tickers, and company names will be coming your way fast.