Crypto has something in common with the king of social media, Meta Platforms Inc. (NASDAQ: FB) - originally known as Facebook - and it's the very thing that turned that service from a college kids' hobby into a $518 billion global behemoth.

It's a phenomenon shared by other social media apps, the internet as a whole, and even the original telephone network.

I'm talking about Metcalfe's Law, also known as the "network effect."

It was named after Robert Metcalfe, who co-invented the Ethernet networking protocol. The law describes products or services that increase in value as more users connect to it.

The telephone is the quintessential example of the network effect.

In the late nineteenth century, having a phone in the house was little more than a novelty. After all, you could only call one of the rare few who owned a phone.

But of course, as time went on almost everyone had one, making it an extremely valuable communications tool. And it made the firm behind the system, American Telephone and Telegraph Company - that's AT&T to us - one of the top companies in the U.S.

In fact, the more you look at examples of the network effect, the more obvious it becomes that cryptocurrency is on the same trajectory.

But crypto adoption is still in the early stages of its parabolic rise; the network effect has only just begun to work its magic.

To get an idea of what lies ahead for crypto, let's take a look at what happened with Facebook, and I'll show you why the crypto boom is just beginning...

How Metcalfe's Law Predicted and Powered Facebook's Rise

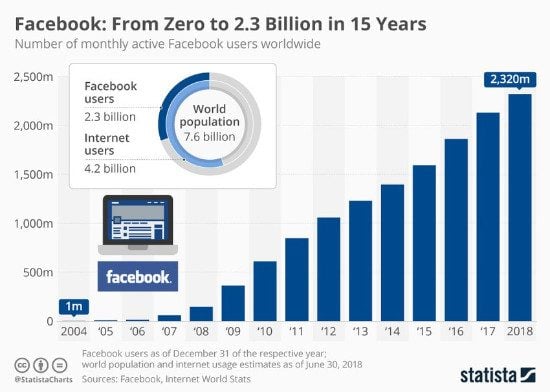

CEO Mark Zuckerberg famously launched Facebook (now known as Meta Platforms, Inc.) as a student at Harvard in 2004. Within a year it had 1 million users and was valued at about $5 million.

Growth was rapid. By 2006, Facebook had 12 million users and was valued at $1 billion. By 2010, the social network had over 600 million users and was worth $56 billion.

At the time of its IPO in May 2012, Facebook had 900 million users and was valued at more than $100 billion. Today Facebook has 2.23 billion users and a market cap of $524 billion (although last year the market cap briefly passed $1 trillion).

That's an amazing story. The gains were parabolic, and Metcalfe's Law played a big part in it. What Facebook provided was a new way for people to connect and communicate. And you could communicate with your Facebook friends all at once.

One of the key elements of a network effect is that more users make the service or product more appealing. The more friends you have on Facebook, the more useful it becomes. This drives growth as more people seek to join in the fun.

The network effect helped push the FB stock price from $38 at the 2012 IPO to an all-time high of about $382 last September. That's a gain of more than 900%.

Here's the thing, though: Bitcoin has already done way better than that. And the potential gains Metcalfe's Law suggests have a very long runway...

Surging Adoption Has Fueled Bitcoin's Gains

Bitcoin isn't a communications system, but having more users does make it more valuable. When Satoshi Nakamoto launched the Bitcoin network in 2009, he could only transact with a handful of collaborators, such as Hal Finney. (In those earliest of days, Finney was on the receiving end of the first-ever Bitcoin transaction - 10 BTC from Nakamoto.)

Clearly a digital currency network needs users just as much as a communications network. The difference is that the increase in value is reflected in the price of the digital currency itself.

So when Bitcoin had just a few hundred users, it was worth only pennies.

But in 2011, interest accelerated. Soon there were thousands of users. And the BTC price started rising. By February of that year, it reached $1. A few months later it shot past $20 as more users rushed to join the network.

By late 2013 the number of users had climbed past 1 million. And the price of Bitcoin shot up accordingly, this time past $1,000.

Late in 2017, the number of users rose past 10 million. That pushed the price of Bitcoin to nearly $20,000.

Early last year the number of global Bitcoin users surged beyond 100 million, reaching 176 million by year's end. That brought a new all-time high of $68,789.63 on Nov. 10.

Of course, Bitcoin is down more than 50% from that high. But crypto's volatility means you have to always keep an eye on the long term. And over the long term, Metcalfe's Law suggests a much higher price for Bitcoin.

Consider this: Exchange Crypto.com estimated the number of global Bitcoin users at 176 million as of December of last year - just 2.23% of the world's population.

Put another way, more than 97% of the world's population does not use Bitcoin... yet. That represents an enormous amount of potential.

This Analysis Sees Bitcoin at $1 Million by 2028

For some actual Bitcoin price predictions, we turn to Timothy Peterson, Global Macro Manager at Cane Island Alternative Advisors. Peterson wrote a paper in 2017 analyzing how Metcalfe's Law has affected the Bitcoin price and periodically speaks of it on Twitter.

Petersen has used Metcalfe's Law to predict a Bitcoin price of $100,000 by January 2024. That's not all that much higher than its all-time high of $68,000. But Petersen also has predicted the price of Bitcoin will hit an eye-popping $1 million by March 2028.

A rise to $1 million would be a gain of more than 3,200% from the current price, or more than 32x.

This is great news for Bitcoin in particular, but this bodes well for crypto in general, as Bitcoin has historically led the direction of the market.

As for the numbers, Crypto.com estimated that, as of December 2021, 300 million people owned any kind of cryptocurrency. That's just 3.8% of the world population. Again, the potential gains here are huge.

And adoption is already starting to go parabolic. In January of last year, only 106 million people owned any crypto. That means the number of crypto users nearly tripled in a year.

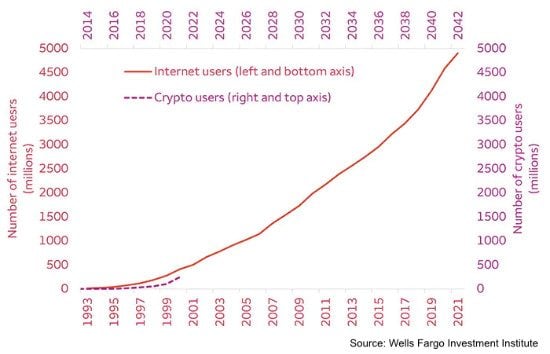

In fact, the global rate of crypto adoption is tracking closely with the rate of internet adoption 30 years ago. And we all know what an investor's bonanza that turned out to be.

This chart is from a February Wells Fargo Investment Institute report which set out to answer the question, "Is it too late to invest in cryptocurrency?" It compares crypto adoption to the rate of Internet adoption - another technology that was driven by the network effect.

"Cryptocurrency adoption rates look to be following the path of other earlier advanced technologies, particularly the Internet," the report says. "If this trend continues, cryptocurrencies could soon exit the early adoption phase and enter an inflection point of hyper-adoption, similar to other technologies."

Now look hard at where the line representing crypto is.

Too late to invest? On the contrary, it's still very early.

We specialize in finding the best crypto profit plays that everyone else is overlooking. The Bitcoin boom is going to take other tokens along for the ride, and there are many little-known, smaller coins that you can get for pennies on the dollar compared to Bitcoin, but nonetheless have the potential to beat BTC and the stock market many times over in proportional returns.

You can go here to learn how to access their complete model portfolio. Our panel of experts, including yours truly, has hand selected these recommendations for sheer profit potential. We're particularly excited about two small coins that could each soar more than 5,000% in the next five years. Take a look...

Follow Money Morning on Facebook and Twitter.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.