postcards from the florida republic

postcards from the florida republic

what you missed, what I’m watching, and what’s investable now

saturday, may 27, 2023

Dear Old Friend,

The last 48 hours have been difficult. As you likely know by now we've had to make some tough but needed decisions about our future. I spent two hours on-air Friday in front of 1,000 people under heavy cannon fire, explaining the renewed vision of our organization. There were many anonymous attacks thrust at me. But I went to an all-male high school (so I’ve been called way worse). Perhaps the best insult I received was someone calling me a “Macro Bear Clown.”

I asked Midjourney to define that term. It produced that image…

Wear it proudly, Mister Bear.

Yes… I am bearish about the economy but short-term bullish on the market – and I’ve dictated this mixed sentiment and the chaotic momentum changes since October 2022. That’s when we had we started policy changes by the Fed, Bank of Japan, Bank of England, European Central Bank, and People’s Bank of China.

I don’t think we’re getting back under the 3,500 level on the S&P 500 that we hit when the Fed pivoted on Mortgage-Backed Securities and Great Britain decided it was okay to eradicate the wealth of its population via inflation and bad policy.

But 3,800 is certainly on my radar when stock valuations catch up with a blatantly obvious recession in the productive economy.

Momentum has been choppy for a month – but largely bullish since January. That doesn’t change the fact that roughly eight companies are pulling this market up. The performance divide between the Nasdaq and the Dow Jones is the greatest we’ve seen since 1971 – which should concern any person with a pulse. The Nasdaq is up 24% to start the year, while the Dow Jones is flat.

So, what is happening there?

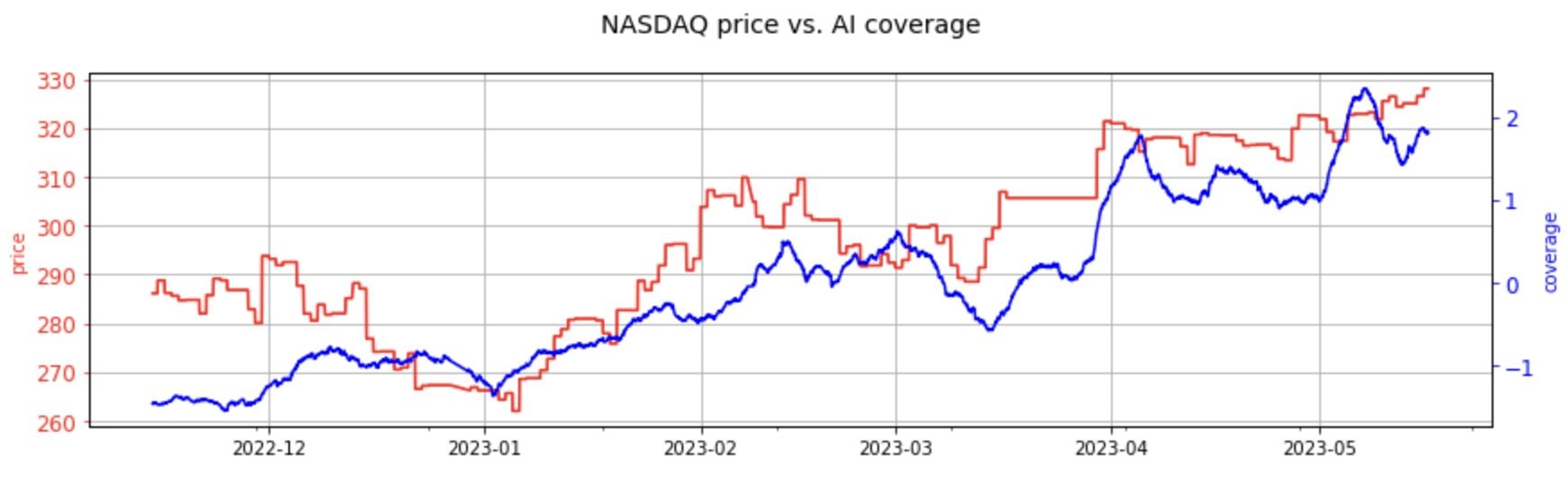

Well let’s just look at the chart of the day everyone…

AI… Bringing Price Momentum to 11

What gives, Mr. Market?

AI sentiment momentum (don’t call it a bubble…) If 2000 is any indication, these semiconductor stocks could run much higher, despite their already nosebleed valuations.

I simply note: if AI is supposed to be the great economic engine that so many advocates imply, then every stock in the S&P 500 should be rising in tandem. But they are not, so we know – from a very simple scan of historical analysis – that we are engaged in a sentiment move higher. The primary difference right now is that algorithms and passive investments are the culprit, not people selling their farms to pile into tulips or Beanie Babies.

Dance Macro Clown Bear, Dance!

Inflation remains hot – yet consumer sentiment is improving.

What comes next? The Fed likely needs to raise interest rates – yet again – in June. And they likely need to keep raising.

I’m still holding the line on 6% for the Fed funds rate, which would have gotten me banned from CNBC about two months ago.

Money is still looking for a place to go. And thanks to sentiment momentum – semiconductors and names linked to artificial intelligence are rallying because… everyone keeps talking about it. It’s a feedback loop – and algorithmic systems like the ChatGPT portfolio are bidding up these names and trading them in the short-term. That’s going to be the future of this market – it’s entirely irrational, but machines are not rational. They don’t know we’re heading into a recession. They don’t know that interest rates are moving higher. They are programmed on technical analysis. So, the market moves higher.

Add on the fact that passive investments (ETFs) control about 60% of equity assets and quant funds are now 20%, and you have conditions where the market is detached from the economy because machines are chasing money locked into the passive fund world.

DANCE, BEAR! DANCE!

Treasury Secretary Janet Yellen lied to everyone, which isn’t surprising given that she is now a politician.

The U.S. isn’t running out of money on June 1. We now have her saying that the U.S. has enough money until June 5, which begs the question of when will the media make her show her work?

It’s ridiculous at this point, and she’s eroding her credibility (I’m giving her the benefit of the doubt, but there are plenty of people with stronger, negative opinions on her role.)

While short-term interest rates explode, there’s more concerning news. The Fed and the United States are losing control of inflation, something I’ve warned about for – is it 18 months now? The Personal Consumption Expenditures Price Index (PCEPI), increased by a compounding rate 4.2% from April 2022 to April 2023. That’s UP from March. This should not surprise anyone.

While politicians are blaming “corporate greed,” the reality is that in the post-COVID policy machine (never let a crisis go to waste), we simply printed too much money. We increased our money supply by 35%. Please read that number again. We increased the number of dollars in the world by 35%. THIRTY… FIVE… PERCENT.

Milton Friedman explained that inflation is ALWAYS a monetary policy phenomenon… you can’t jack up prices if there isn’t a supply of currency to pay the cost (eventually, demand dries up). And the Fed, which controls the price of time in interest, left interest rates at zero with no reserve requirements from banks. They created reckless spending conditions, while Congress dropped money from the sky too… and picked winners and losers…

We had a 35% increase in currency units… we’ve only seen about 17% inflation SO FAR. Do the math: 35 minus 17, equals 18.

There is still… 18 percentage points of inflation coming.

I know that it seems overly simplistic, but there is still an incredible amount of money on the sideline waiting to be deployed into equity assets, the real economy, and more. When you increase the monetary base… when you increase government spending and run deficits, when you hike cost of living adjustments (COLA) by 8.5% while the rate of inflation is falling… you GET MORE INFLATION. This is not difficult.

The Week Ahead

I’m heading to Switzerland on Monday and am not really focused on the market. I’ll be in contact with you, but I’m not “trading” and shifting my focus to longer-term trends…

Tuesday: I don’t understand how Acrimoto (FUV) is still in business, but they’re holding an investor event. Watch the movement of the EV stocks that day due to the macro research.

Wednesday: Crowdstrike (CRWD) reports earnings. The company will offer a better understanding of risk tolerance in tech, given its current valuations. We just saw Snowflake (SNOW), with similar valuations to NVIDIA (NVDA) get nuked after its earnings report. CRWD trades at 16 times revenue… and it’s unprofitable.

Thursday: Dollar General (DG) will report earnings. After Dollar Tree’s (DLTR) brutal forecast this week, I can’t imagine that it will look better here. Margins are getting hammered in this part of the retail sector… a sign that more pain is coming.

Friday: The May jobs report emerges, and we’ll get clarity on wage growth in the U.S. This report will determine market sentiment around any rate hike in June. In addition, this we’ll look for updates on the oil market ahead of the June 4 OPEC meeting. I remain bullish on oil and gas on the long term.

Bring Your Eye Patch

Finally… I’m about to get on a pirate ship in Ft. Myers…

Current Mood: Jimmy Buffett’s Boat Drinks…

See you out there,

Garrett Baldwin

Florida Republic Capital

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.