from the desk of garrett baldwin (@floridarepcap)

Dear Old Friend,

We are off to Switzerland.

I planned this vacation after I burned out a few months ago. And now – there are new developments in my career and opportunities ahead that make me incredibly excited.

The winds died down. The smoke cleared. The storms have passed…

It’s time to get to work…

I now have an incredible opportunity to speak with you candidly about the world of investing and finance – and do so in a way that delivers real value to you. It’s a blessing… and an honor.

I’ll be writing to you from Zurich and Zug this week. I suppose I should temporarily rename this publication Postcards from the Swiss Empire – but

we know… The Florida Republic is a state of mind… transferable to all longitude and latitude coordinates.

As I announced – this letter is now daily. I have published on Substack. It is broadcasted on Twitter.

It is part of our fulfillment on MiddayMomentum.com.

And it files through MoneyMorning.com – a site I plan to rebuild with daily content.

So, if you missed my commentary about the Angry Sea God yesterday, or my experience being called a “Macro Bear Clown…” please catch up on my editorial.

Dance Macro Bear Clown, Dance

It is fitting that as my organization Money Map Press shifts its attention away from trading to long-term, investing, that I received the sophomoric

nickname Macro Bear Clown from a moderator of one of our previous partners.

I won’t be speaking on what happened (I covered that live on Friday), but I’ll state that I’m extremely disappointed in the decisions of a few people that I’d grown to know, love, and consider friends. Oh well.

As I’ve said, I’m bearish on the U.S. economy because I have eyes, a functioning frontal lobe, and enough academic training in economics to ruin all future conversations at family events.

(You’re a professional “Debby Downer” a therapist might say.)

But that is temporary. I welcome a recession. I welcome the cleansing and healing of the financial system. I welcome a retreat in valuations, giving entrepreneurs an opportunity to benefit from cheaper costs of capital. Bear markets and recessions are where entrepreneurs show real grit, shed off the anti-competitive nature of the system that has been hurting them, and build sustainable businesses that enrich investors.

I’m not a Macroeconomic Bear Clown.

I’m actually a Microeconomic Bull Ringleader.

Microeconomics is my real strong suit – but I haven’t had the opportunity to flex these muscles in print for a long time. And that’s because I was placed in a position to really – only – focus on trading – and the never-ending swings of momentum in the financial markets that hit Defcon 5 in the last six months.

I want to talk about businesses.

I want to dig in, put money to work, and own slices of companies. I want to talk about cash flow, management, and – in a more interesting way – explain the importance of Customer Theory, financial incentives, and how businesses and consumers dig our way out of the grave that has been constructed for us by central planners, self-appointed experts, and bullshit artists.

The Big Idea – the macro is only half the story.

How do you make money? How do you invest? How to you hedge? What opportunities exist from a specific trend? That is found in microeconomics – and it requires a VERY bullish conviction.

We’re going to have to put down the macro-bear clown.

But before we do… let’s look at a few important charts.

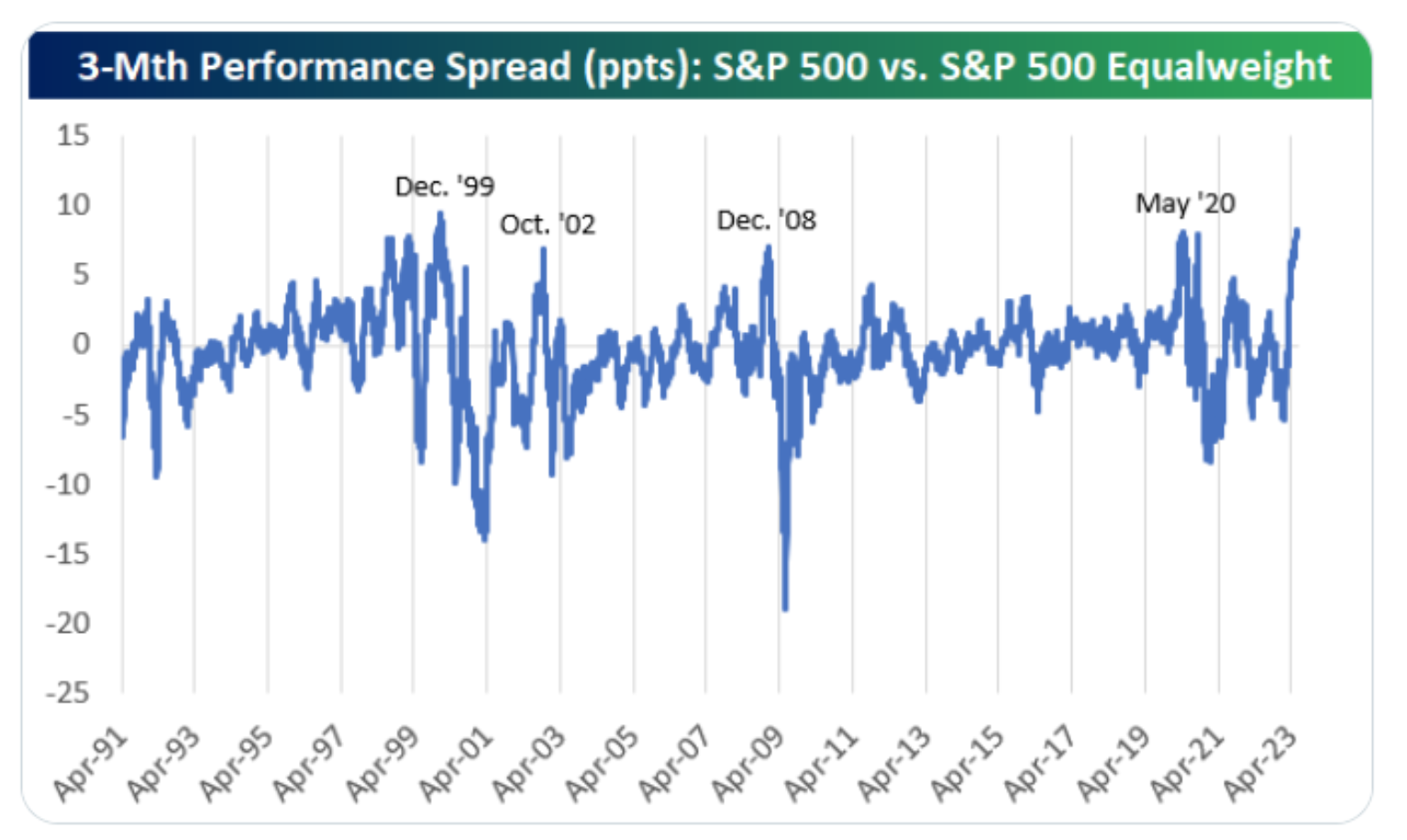

Reversion to the Mean

Just saying… what goes up will come down. It will likely happen when the shorts cover and there’s no path of resistance.

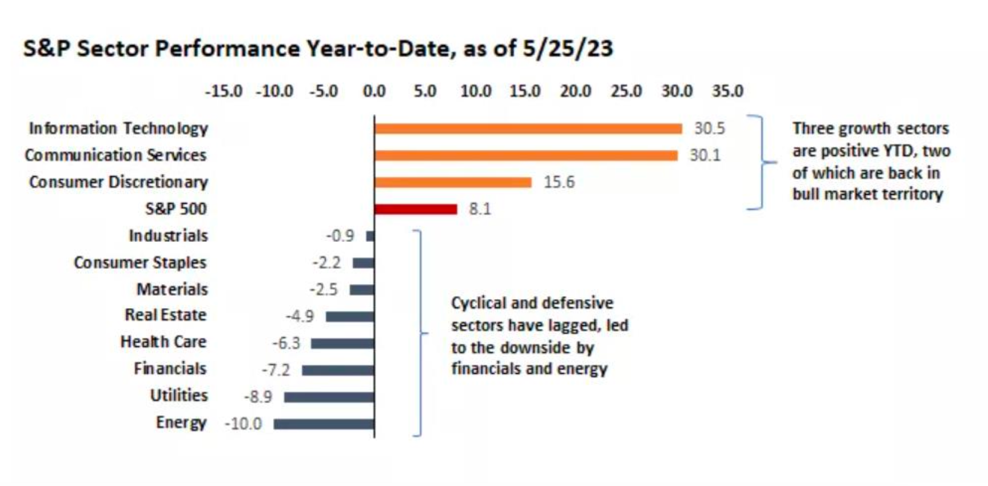

The market is being held up by strong momentum and seven stocks.

As their valuations continue to detach from reality, the greater the decline will be. Think the start of June last year… but more violent. When momentum turns red, I’ll be first out the door.

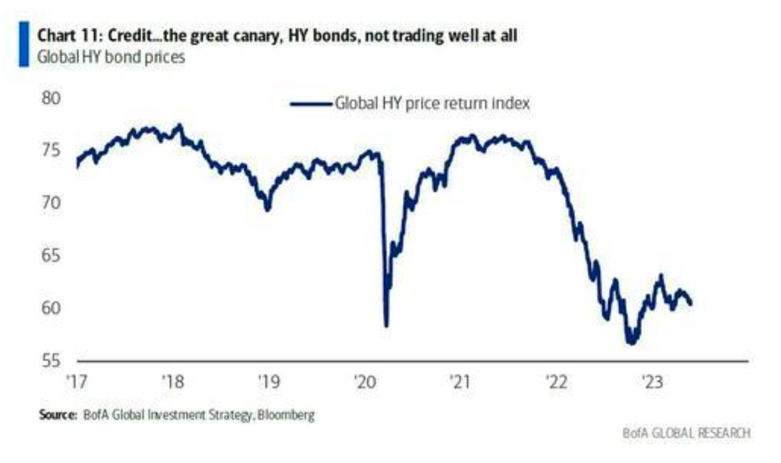

This is What Will Break

I had a good conversation with Tim Melvin on a pirate boat on Saturday. Our conclusion is that the Fed’s policy will likely take us to 6% or higher.

They’re going to break the High Yield market… and we’ll probably see a generational opportunity to buy into investment grade debt. This will be a massive opportunity.

We had a bottoming out initially in October 2022 – but remember that this was where we saw a grand pivot or accommodation from various central banks.

We had a bottoming out initially in October 2022 – but remember that this was where we saw a grand pivot or accommodation from various central banks.

But this can get much worse.

A Note from Me to Jim

I read this tonight… I thought for a second… and then I realized there is no way that Jim Cramer is writing me an email.

And he probably wouldn’t write this in the subject line.

It would probably involve some curse word.

Subject lines are critical…

“A note from me to you” sounds like it was written on the Lusitania.

A 10,000 Foot View of the Market

The NASDAQ is now at the greatest divide between its performance and the Dow Jones since 1971. When you dump off the Gold Standard, money will flow into almost anything regardless of valuation. That… in itself… is inflationary – as is the performance of this market.

But what came next? Well, three big bouts of inflation that made energy, housing, and other real assets solid long-term investments. It’s time to think contrarian… and just wait.

A 30,000 Foot View with My Daughter

My daughter was looking at “Kids” movies on the Delta entertainment system.

My daughter was looking at “Kids” movies on the Delta entertainment system.

There many heavy films available, including “My Girl.” That would traumatize her because she doesn’t know if she’s allergic to bees (my wife is).

On the other list of Kid’s films?

If you disagree, then you argue with this bench…

E.T. – the Extra Terrestrial.

Now that is a movie that I can get behind.

The bad guy in that movie… is the government.

The government is also the antagonist in… Ghostbusters.

Which is an adult option on the Delta entertainment options…

I’m going to watch Ghostbusters on the flight to Zurich (after I rewatch my favorite comedy film In Bruges for the 300th time.)

The antagonist of In Bruges? No… not Ralph Fiennes…

It’s “the very idea of Belgium.”

What’s Coming This Week?

I will arrive in Switzerland tomorrow and start eating chocolate rather early. But I will also be planning this week, which I discussed yesterday.

Some things you can expect this week…

- I’ll introduce you to my single favorite 18- to 24-month investment strategy while recapping a very important dinner party from a few years ago. This combines value and momentum… and an introduction to two titans of finance.

- I’ll be conducting two podcasts this week with my friend Neal. He is a former oil trader in Russia. We’ll discuss the current state of the energy markets, expectations ahead for geopolitics and other commodities, and talk a lot about business ethics too.

- Finally, I’ll be doing some research on the natural gas sector and exploring what Germany’s goals are heading into the second half of the year (it appears they want a pause on EU Green policies too). If that’s the case, I’ll make the argument for U.S. natural gas infrastructure, and likely focus my attention on Plains GP Holdings LP - Class A (PAGP). I’ll dig deeper into their 10-K on the plane.

See you out there,

Garrett Baldwin

Florida Republic Capital

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.