If you're like millions of investors, you'd give anything to have a crystal ball, especially when it comes to a stock like Amazon.com Inc. (Nasdaq: AMZN). Obviously, I can't give you one... but I can come close.

Today we're going to talk about two things:

- An important bit of information most investors overlook

- How to turn what you learn into a high-probability trade

Amazon reported earnings Thursday after the bell. Ahead of that, options activity implied a monster move of 7% to 9% on the numbers. Normal earnings volatility, to put this in context, is around 5%.

In plain English, that means the stock could jump by $129.40 to $1,567.22 per share versus a more "normal" $1,437.82 per share (what it closed at on Tuesday). That means the stock would be within spitting distance of a $750 billion valuation.

To be fair, options volatility works in both directions. The move I'm talking about could take prices lower just as easily as it could take prices higher. But I don't think that'll happen.

I believe that the direction will be higher based on Amazon's trajectory and its history - specifically, the company's last earnings report on Oct. 26, 2017, which caused a 13.21% move higher in a single day.

There are any number of reasons:

- Revenue is growing at a compound annual growth rate of 23.12% over the last five years

- The fact that cash and equivalents are growing at a compound annual growth rate of 22.13% over the same period

- The company will make a number of revenue-enhancing moves within the next 12 to 24 months, including entries into both healthcare and banking that I first told you were likely a year ago

Editor's Note: Shortly after Keith submitted this article, Amazon did in fact announce a joint undertaking with JPMorgan Chase & Co. (NYSE: JPM) and Berkshire Hathaway Inc. (NYSE: BRK.A) aimed specifically at improving healthcare services and lowering costs. That means it's time to prepare for the second part of Keith's prediction in this area - that conventional health insurance companies get slammed as the "Amazon-effect" rolls into personalized care. He'll have more in his next column.

We'll come back to that in a moment.

First, I want to explain why unusual options activity is important and what to look for. That way you can use today's Total Wealth as a springboard for more "crystal ball" trades on any stock you fancy.

Most investors believe options are like spicy sauce on your taco... a means of introducing a little more "zip." However, they're missing something critical.

This Simple Pattern Can Help You Make Millions: At 313% average weekly gains (including partial closeouts), this strategy is leaving Wall Street Elite in the dust. Space is limited, so you'll have to act fast for your chance at triple-digit gains…

Options are also like a "poker tell" in today's markets. As such, they're frequently a harbinger of big market moves ahead in the underlying securities.

What I like about them is there's no guesswork. Unlike stock, which exists in perpetuity as long as the company that issued it does, options come into existence only when traders make a specific choice - that a company's stock is going to move higher or lower.

Like an involuntary twitch or a hand to the side of the head at the poker table, unusual options activity tells you that there's big money on the move. Insiders, hedge funds, institutions, and corporate raiders all use 'em to pre-position their money ahead of major moves that can result in huge profits.

In some cases - like this one - that's earnings, but it could also be everything from a change in business strategy to new contracts to impending news that will have a material impact on a company's stock price. Mergers and acquisitions like those we talked about last week are also good examples.

Carl Icahn, for instance, used options to establish monster positions in both Herbalife Ltd. (NYSE: HLF) and Netflix Inc. (Nasdaq: NFLX). Bill Ackman used options to build a large position in Target Corp. (NYSE: TGT). Even Warren Buffett used warrants, a form of option, to take a $5 billion position in Goldman Sachs Group Inc. (NYSE: GS) during the depths of the financial crisis.

Options are one of the few areas in today's financial markets where you can play on exactly the same terms as the "big money." For example, you can control 100 shares of an ultra-expensive stock like Amazon for as little as $55.55 a share. Imagine the kind of returns that could create versus just a single share at $1,437.82, which is where Amazon closed on Tuesday.

The other thing to think about is that options can actually reduce your risk, especially in a situation like this one. Just like the insurance on your house or your car, options can boost your profits for a fraction of the cost while minimizing the amount of money you have at risk - something straight stock trades don't offer.

With this in mind, let's shift gears and talk about how you find unusual options activity and what very specific tells you'll want to look for. That way you can learn how to do this on any stock even though we're talking about Amazon at the moment.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

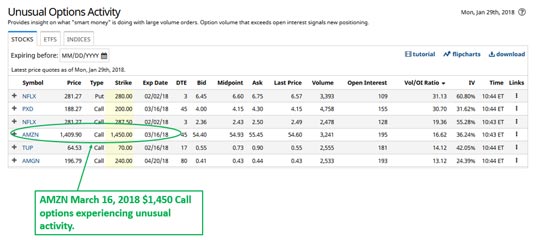

The first thing you want to do when screening for unusual options activity is look for unusual volume - meaning how many options are being traded versus the average daily volume. Trading volume of 1,000 call options on Facebook Inc. (Nasdaq: FB) or Apple Inc. (Nasdaq: AAPL) isn't unusual, but trading that amount on a much smaller stock like Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) or Xunlei Ltd. (Nasdaq: XNET) would be. The key here is anything three to five times normal transaction volume is suspicious.

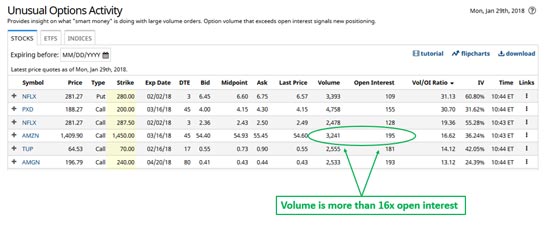

I also like to look for huge jumps in open interest. "Open interest" is the number of options contracts "open" - meaning that need to be closed and taken off the books. What you're looking for is newly established positions, and you can find those by identifying instances where total volume is greater than open interest.

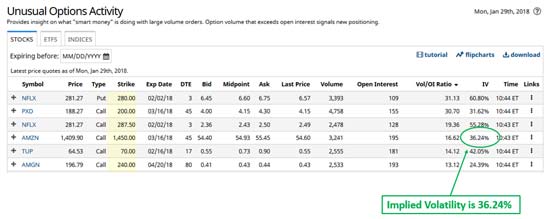

And, finally, you want to take a look at implied volatility. That's a statistical measure reflecting the price of options. Big orders that cause big jumps in statistical volatility are key because that tells you traders are willing to pay more money to get in the trade than they would be in a situation where the volatility didn't jump - even though the order causing it was larger than normal.

So now what?

So now what?

You've got all the information you need to trade a stock - unusual volume, a corresponding jump in open interest, and increased volatility - ahead of earnings.

If you own the stock... I suggest tightening up your trailing stops. That way you can benefit from a quick upside move that allows you to maximize profits while at the same time protecting against downside risk.

If you're options savvy... consider buying the AMZN March 16, 2018, $1,450 call (AMZN180316C01450000) options. That way you line up your money with large traders and institutions who appear to be thinking the same thing. (If you're a bit more skeptical and want an even more limited risk trade, consider selling an AMZN March 16, 2018 $1,480/$1,470 put spread.)

It's trading at $4.83 as I write this, and a move of only $24.72 (or just 1.69%) by expiration would allow a savvy investor to keep 100% of the premium in a move that's also extremely limited risk.

As always, there are two caveats:

- Options are speculative trades, which means you want to risk only money you can afford to lose.

- Trades like this are intended to compliment your core investments, not replace 'em.

Speaking of which, I've recommended AMZN stock in our sister publication, the Money Map Report and it's already returned more than 83.70%, which means it's closing in on another 100% winner that you can convert to a "free trade" using another of my favorite Total Wealth Tactics.

If you aren't familiar with the "free trade," now's a good time to study up. Rising interest rates are going to create some terrific trading opportunities to lock in profits and rotate the money you free up into even more windfall gains ahead.

I'll be with you every step of the way.

$15,690 a Week, $67,990 a Month, $815,880 a Year… This Is Your Last Chance

Keith Fitz-Gerald's "velocity" trading strategy is posting record-smashing gains, racking up an unbelievable 27 cash paydays… just in the past three months!

But we're rapidly approaching the hard limit on the number of people Keith will allow to subscribe through this rare invitation… and your chance to gain access to this research is almost gone.

We're being forced to shut the door to this opportunity this Sunday at midnight.

The post Amazon: How to Trade Unusual Options Activity appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.