Apple's latest release, the iPhone 8, is a complete failure and could spell disaster for investors... at least, that's what the talking heads on the financial news networks want you to believe. One of the pundits even said that the short-term prognosis "doesn't look good" for the stock.

Now it's true that Apple's latest release isn't selling as well as it predecessor, the iPhone 7. In fact, the demand for the iPhone 8 was so low that you could still buy phones days after pre-sales started. To give you an idea of just how bad that is, the iPhone 7 sold out minutes after pre-order selling began - setting an all-time record for Apple.

But that doesn't mean the company - or the stock - is in trouble. Quite the opposite, actually.

And the media's "doomsday" prediction is now putting you at risk to miss out on the next triple-digit profit opportunity...

The iPhone 8 Hasn't Hurt AAPL Stock - and the Early Numbers Say It Won't

Last night, Keybanc Capital Markets upgraded Apple Inc. (Nasdaq: AAPL) from sector weight to overweight. According to Senior Research Analyst at Keybanc, Andy Hargreaves, the upgrade was made for three reasons:

- The iPhone X's $999 price

- The price increases of the iPhone 8 and iPhone 8 Plus

- The change in price of their storage setup

He also said that, based on these three factors, he believes Apple's fourth-quarter earnings will drive the stock price to $187.

Now, that price target is a bit higher than my assessment... As you may recall, I showed you back in April why I believe AAPL could go as high as $180 by Dec. 31. And when you look at the overall price pattern, it's easy to see why the media's overhyping the iPhone 8's poor sales numbers:

The chart above shows that the markets liked the news of an upgrade for AAPL, as it was back to trading above its 50-day simple moving average (SMA). Now I want to see it hold above that moving average for a day or two before getting even more conviction for a higher share price to come from a technical perspective.

But, as you can clearly see from the price pattern above, AAPL is trending higher overall - far from the doomsday outlook the media pundits have been throwing around on TV.

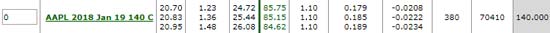

I also mentioned back in April that you could consider opening a LEAPs trade to profit on the stock, using the Jan. 19, 2018, $140 call option. Back then, the mid-price for this trade idea was $11.10. Here's what it's now priced at (this quote will likely change, depending on the time you read this):

The mid-price at which you could consider selling the calls, if you bought them back then, is $20.83. That's already an increase in value of $9.73 - or an 87% gain.

In fact, a small group of my readers have had the chance to score 233.40% total gains on AAPL this year. To find out how you can "get in" on the next triple-digit winner, click here.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

And based on my proprietary tools, research, and analysis, I still see AAPL reaching $180 by Dec. 31 - which will only drive this trade higher, depending on Apple's upcoming earnings report due after market close on Nov. 2.

The key takeaway here is to ignore the noise on the news network and focus on the numbers themselves - the technicals - and build your option trades around that anticipation. Determine how much you're willing to risk on a trade and then manage your trade from there (I wouldn't recommend risking any more than 2% of your account on any one trade). For example, if you wish to risk $500 on a trade, you can consider spending $1,000 on a trade with a 50% stop loss - of which that 50% is a $500 loss. That means you're only risking $500 per trade with that stop loss instead of risking $1,005 on that trade.

Whether or not you decide to use a stop loss is entirely up to you, of course. The bottom line is, the numbers are looking real good right now for AAPL. And even if it doesn't get all the way up to $180, I still see it climbing enough to challenge its 2017 high of around $165 - which is still another 5% bump from where it is now.

And speaking of high-profit trades...

If You Like Fast Cash, You Don’t Want to Miss This

I love fast money. That’s why I’ve been working on a new invention. It’s a way to get rapid-fire profits in your hands week after week.

I’m talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I’m the only one who knows how to find it.

I’ve used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

Tom Gentile is known as America's No. 1 trader, and for good reason. Since 2009, he's taught over 300,000 traders his option trading secrets, including how to find low-risk, high-reward opportunities. Now he's sharing that insight with you. To get started, just click here – you'll get Tom's twice-weekly Power Profit Trades delivered directly to your inbox, free of charge.

The post Apple's iPhone "Problem" Just Became Your Best Profit Opportunity - Here's Why appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.