Are Snap Inc. (NYSE: SNAP) and Snapchat the same company? The answer is yes. Snap Inc. is the parent company of Snapchat.

Are Snap Inc. (NYSE: SNAP) and Snapchat the same company? The answer is yes. Snap Inc. is the parent company of Snapchat.

Near the end of September 2016, CEO Evan Spiegel rebranded the company after unveiling Snapchat's first hardware product, tech sunglasses called Spectacles.

Editor's Note: Here's why Spectacles could eventually be worth billions...

According to CNN, Spiegel said they changed the name because Snapchat was just the company's first product. Now that it has more products, it needed a new name.

Unfortunately for some overeager investors, the name change has created problems...

Invest in Snap Inc. (NYSE: SNAP), Not Snap Interactive Inc.

The Snapchat IPO date could happen as early as March. But until then, retail investors can't invest in Snapchat stock.

However, that hasn't stopped people from trying...

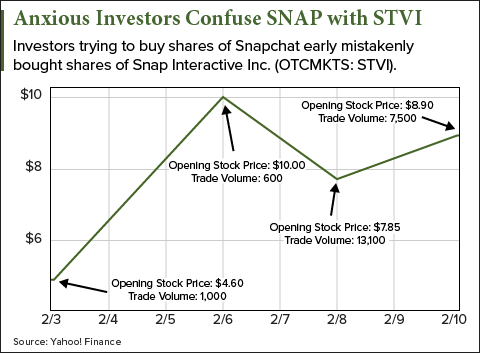

Some investors have mistaken Snap Interactive Inc. (OTCMKTS: STVI) for Snap Inc. That has helped shares of STVI skyrocket since Feb. 4.

Shares of STVI opened at $4.60 per share on Feb. 3.

By Feb. 6, the STVI stock price opened at $10 per share.

That's an increase of more than 117% in just three days.

While the share price of STVI eventually dropped to $7.85 per share by Feb. 8, investors still confused the two companies.

The stock price opened at $8.90 on Feb. 10, and 7,500 shares were traded. That was a 650% increase from the amount of shares that were traded on Feb. 6.

Now that you know the correct symbol for Snap Inc. (NYSE: SNAP), here's the most important question to ask: Should I buy Snapchat stock?

To find the answer, I interviewed Money Moring Director of Tech & Venture Capital Research Michael A. Robinson, a giant in tech investing for over 30 years.

Here's what Robinson told me...

What to Do on the Snap Inc. (NYSE: SNAP) IPO Date

Investing in IPOs, especially tech IPOs, can be risky.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

"I generally tell retail investors to avoid buying an IPO at the open because the insiders have already made all the money available at the debut," Robinson told me.

You see, it's never retail investors who make the biggest gains from IPOs...

Large institutions and big banks are able to buy shares in an IPO for cheaper than retail investors. For example, insiders were able to buy shares of tech company Twilio Inc. (NYSE: TWLO) for $15 per share before the TWLO IPO on June 23, 2016.

When retail investors were finally able to buy shares of TWLO stock, they had to pay $23.99 per share.

That means in only a matter of minutes, wealthy insiders made a return of nearly 60%.

And unfortunately, retail investors haven't profited as much. In fact, some retail investors may have lost over half of their investment...

The TWLO stock price has had volatile price swings in the last 52 weeks, trading between $23.66 per share and $70.96 per share.

If investors bought TWLO stock while it was trading at its 52-week high of $70.96 on Sept. 28, those shares have dropped over 54% from today's opening price of $32.47.

Meanwhile, those wealthy insiders have now netted profits of 116.46%.

That's why Robinson has a strategy for playing Snapchat stock to help our readers maximize their profits and minimize their losses.

"My exception to this rule is to put in a limit order that is fairly tight from the offering price. Otherwise the risk is you buy at the top and then go upside down. That's a big risk to carry with a new issue that hasn't hit the lock-up date," Robinson said.

Up Next: Top 10 2017 IPOs to Watch