It's not like the talking heads of the media to be quiet about much - but lately, they've been hush-hush when it comes to the housing market...

Now, this is odd seeing that last year was filled with warnings regarding the housing bubble being the next to "burst."

And yet most Americans find themselves feeling rather positive about the outlook of the market, and over 64% believe that the price of real estate will continue to climb...

Here's the thing though: This optimism hasn't been around since 2005 - which was right before we experienced the infamous housing crisis.

You may find yourself wondering what's going to come next, but the truth is, no one can be 100% sure.

But that doesn't mean you can't profit off this booming "bubble."

Here's what I mean...

Housing on the Move

Housing has been on an upward climb since at least 2009 - but 2018 is displaying the strongest growth since 2005.

And real home prices have increased 28% since mid-2012, while entry-level homes are seeing double that.

Must See: This method may be the only way in history to turn a small sum of money into $100,000 without batting an eye. Read more...

But all these facts can't displace the talk of "the bubble." This idea comes from the in-depth research of home inflation. You see, when you look into the numbers, the data shows that household income is lagging behind the pace of inflation since mid-2012 - and this is a cause for concern with many analysts.

Take Zillow, for instance. The real estate website is expecting growth in the economy but they expect it to come to an end mid-2020. This is flashing the green light for those looking to get a good deal on their home. But they're expecting the biggest boom in home prices to come this year - a whopping 5.5%.

But regardless of the impending bubble, there's a profit to be made in this booming housing market.

Three Ways to Play This "Booming Bubble"

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

There are a few ways to go after profits with home prices and demand climbing higher.

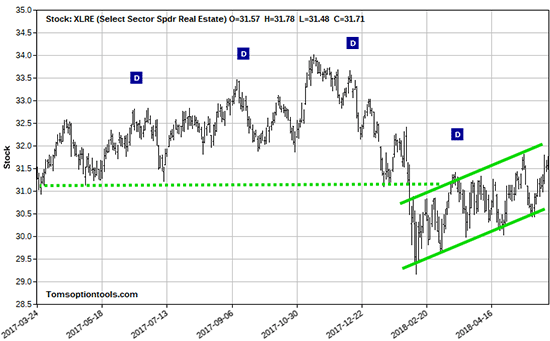

The first option would be to trade an exchange-traded fund (ETF) that correlates with the real estate industry - for instance like Real Estate Select Sector SPDR (XLRE).

XLRE tracks the investment results that correspond to the performance of publicly traded equity securities of companies in the Real Estate Select Sector Index.

The holdings of this ETF include companies from real estate management, real estate development, and real estate investment trusts (REITs), excluding mortgage REITs.

Now, you can see that XLRE was trending higher before pulling back a bit. That said, it hasn't gone into a full-scale decline. In fact, look at the trend pictured above (the solid green line).

I would go with the options with expirations 60 days out or further. As of now there isn't a ton of volume or open interest for these options, meaning the only place you will find much activity on them is at-the-money (ATM) options.

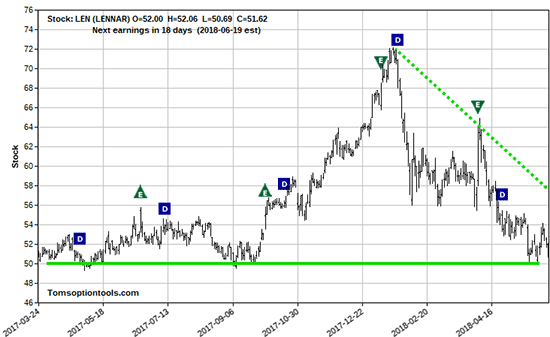

The second way to play this would be to look at an individual stock that appears to be under-appreciated and get into an option in expectation of a rebound in price.

An example of a stock like this is Lennar Corp. (NYSE: LEN) - which is a home builder that also partakes in the sale of residential land.

And on top of this, it's one of the largest home builders in the country.

Lennar also has a specific process it follows when building homes. The company takes special steps that allow it to obtain better margins than many others in the same space.

When you look at the chart above, you can see the potential in a longer-term trade.

As with the ETF, I would look into long call options with expirations at least 60 days out. I also would look into calls with a $50 strike price. If the stock starts falling below $50, before you open a trade, you consider long puts instead.

And of course, if you don't want to worry about the price target, you could consider opening a straddle.

A straddle is an options strategy you'd use to profit during earnings season and also during times of market volatility. It involves buying both an at-the-money (ATM) call and an ATM put with the same strike price and the same expiration. An option that's at-the-money simply means that the stock price and the option's strike price are the same.

Just be sure to talk to your financial advisor to decide what the best option will work for you.

But no matter what you decide, there's a major profit to be made in this booming bubble. So don't miss you - your opportunity is waiting.

And speaking of housing...

Thanks to the power of options, I'm now in the final stages of building my dream home in Nelson, New Zealand.

Now, if you haven't heard of this place, it's one of world's best-kept secrets. Life here moves at an easy pace, and traffic is scarce after the sun goes down. This is one of the many reasons why we decided to build our holiday home here.

During our last visit, we met with the builder next at the site of our new home - a sprawling cliff that overlooks the ocean.

And after looking at some blueprints, we stopped by the famous Able Tasman Park. Backpackers from around the world flock to this natural wonder - and it's obvious why. The park is in pristine condition and right off the ocean, and it makes for a beautiful view.

It's been the opportunity of a lifetime - something I'd never imagine in my wildest dreams when I was a kid.

And I want all of my readers to get that same opportunity to live out their wildest dreams.

It all starts with a sure-fire way to reel in tons of extra cash each and every week.

In fact, I've developed a way to score triple-digit gains like 100% in 1 day, 100.44% in 2 days, and 120.93% in 2 days.

It's all spelled out right here... including how you could get in position for the next quick windfall...

The post Here's How You Can Profit off the Housing Market regardless of Where it Goes appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.