Last June I made an observation that the Dow Jones Industrial Average would hit 60,000 at a time when it was trading at only 21,171.57 - a seemingly incomprehensible 183.4% increase.

Yet here we are.

The Dow closed at 26,392.79 last Thursday, a new record high in a string of an unprecedented 10 records recorded in 2018 already.

And 60,000 still seems incomprehensible to most investors.

Is it?

Not if you do the math.

Hitting 60,000 by 2027 - 10 years on - is not only feasible, but highly likely. In fact, getting there from here requires a compound return of just 9.56% over the next nine years.

All the ingredients are there:

- Low interest rates rising at a snail's pace

- Strong, synchronized growth for the first time since 2010

- Even stronger corporate earnings, especially in the world's primary markets

All three are capital attractors.

That's important because the S&P 500's dividends are 100.12% higher than 1999, and earnings are accelerating at a much faster pace.

The notion that markets are expensive just doesn't hold up. In fact, investors today are getting far more for their money than they did back then.

The other thing to consider is that stocks like those we follow are actually undervalued because they have the ability to grow into current prices - the "P" in PE. Some of our Unstoppable Trends - technology, defense (war, terrorism, and ugliness), and medicine, for example - all have pricing power and margin control. Widget makers don't.

There's also plenty of money still on the sidelines. I know that's hard to believe, but the rally we've enjoyed since the March 2009 lows has been driven largely by institutions, not individuals. Main Street has yet to get in on the action but is increasingly compelled to do so.

BlackRock Inc. (NYSE: BLK), a global investment management corporation with $5.7 trillion under management, estimated back in 2016 that there may be $50 trillion in cash piled up because people are scared of the current economic and political climate. My own calculations place the figure at roughly $45 trillion these days - but that's splitting hairs.

Moving just 1% of all that money into global markets would result in huge demand for every asset class. You don't exactly just mosey on over to your local brokerage with $500 billion and expect to get a deal... so prices go up as stocks, bonds, oil, and damn near everything else absorbs the demand.

This Guy Put Up $9.75 Million: His deceptively simple theory? Regular investors could pull down enough wins to turn a small stake into $813,800 in a year with this. Learn more…

That kind of money is like the tide coming in. No matter how the markets gyrate in the short term, the path of least resistance is higher over time.

Instinctively, I know that's a hard concept for many investors to understand, let alone have faith in. But, emotions aside, history is very clear on the matter. The Dow went from 68.13 at the turn of the century in 1900 to close out at 11,357.51 on the first trading day of 2000 - a staggering 16,570.35% gain of 11,289.38 points.

The world's central bankers will see to it by creating money out of thin air to preserve liquidity. In that sense there's no limit to how much money they do or do not have. Nor are there boundaries when it comes to spending limits.

I run into a lot of investors who think this isn't possible because there isn't an account or accounts holding all that cash.

And they're right, there's not... just accounting.

Take the Fed, for instance.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Like other central banks around the world with their own debt, Team Yellen has to buy and sell billions of dollars in U.S. Treasuries each day from the big banks and trading houses - yet they don't have to pay a dime when they do.

Instead, what happens is the Fed issues a credit to the seller on their Federal Reserve Statement which, for all intents and purposes, is like your bank account statement. At that point, the seller can either use that money or keep it "on deposit."

Most "use" it to buy other bonds and financial instruments on the open markets because doing so is at the very core of what makes them profitable. At this point those very same credits issued by the Fed get transmogrified and - voila - become "cash money."

The sellers, in turn, start making loans, issuing insurance, buying stocks, bonds, and other assets. Then - badaboom - all that money that came from thin air is on the move.

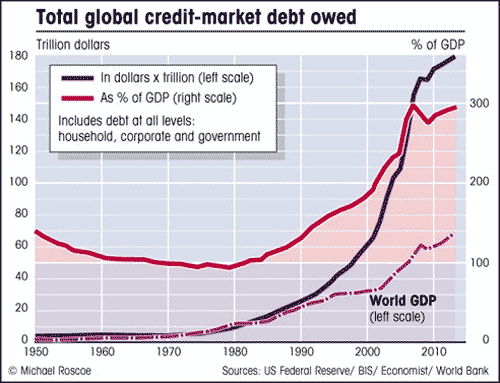

Every dollar created in global credit markets that's forced by the Fed into the world's financial systems potentially moves prices higher.

And the tax cuts that have just come into being will ensure that every last dollar gets recycled into buybacks, capital investment, wage hikes, dividends, and more.

What's more, as long as what I am describing remains true, valuations no longer matter like they once did. Conventional analysis won't work as it has in the past.

Any investor who refuses to acknowledge the argument I've just laid out will get left so far behind that their head will spin around like one of those dolls in an old "Exorcist" flick.

You can argue till the cows come home - like many people do - about whether stocks are expensive.

You can debate whether or not this much debt is good until hell freezes over.

You may or may not be right.

We may agree or we may not.

My suggestion is to put your emotions aside, get on board, and be profitable.

I completely understand if you're skeptical. I get thousands of emails every week from investors who share your very valid concerns.

The way I see it, you've got two options:

- You can stop reading right now, walk away from your computer, and ignore everything I've just shared with you. Do so knowing that the odds are firmly stacked against you.

How do I know?

Because politicians around the world want to be reelected, and the economists who advise them cannot admit they've been wrong for decades. Playing the growth card by using currency created out of thin air is the only option they've got left.

- Never forget that profits are tied to growth no matter how it is created... and paid for.

P.S. There's no time to waste. The best way to play this is by buying the world's best companies because those are the ones best positioned to profit - fast. If you'd like to learn how, click here. Members of my High Velocity Profits service have already claimed four triple-digit winners this year... and more than 63 in the past 12 months by "buying the best."

The post Dow 60K: Still On Track (Even Though Most People Still Don't Believe It) appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.