Gold has traditionally been a safe haven for investors concerned about market crashes.

In fact, despite recent stock sell-offs over the possibility of nuclear war with North Korea, investing in gold has been a losing strategy.

Whatever happens, that's going to continue for the next couple of weeks.

And that's not the only thing keeping gold prices from going up...

Here's everything you need to know...

Why Even North Korean Missiles Can't Boost the Price of Gold

For the past week, gold prices have been low - and that will be true for at least the next couple of weeks.

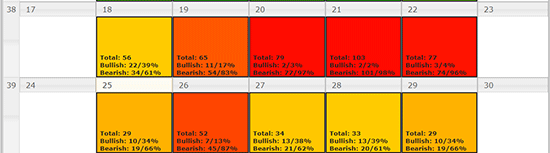

In fact, take a look at what the Money Calendar sees coming for the rest of this week:

There's a clear "bearish" outlook for the most popular stocks in the markets. That's why I'm not crazy bullish right now in general.

But when it comes to gold, things look even worse - at least for now.

Traditionally, gold prices go up when stock markets go down.

Now, recent stock sell-offs have happened mostly because of news about North Korea and its leader seemingly provoking a nuclear war.

But every time this happens, the markets take a dip and then bounce back to new all-time highs rather quickly, usually within a couple of days.

That means there's not much time for gold prices to go up.

But that's not the only hurdle gold has to clear...

How the Fed Is Keeping Gold Down

Gold also has to contend with rising interest rates.

Now, the Fed didn't raise rates at its last meeting on Sept. 20, but there's still a chance a hike could happen by year's end.

Moreover, while the Fed kept its prognosis of three rate hikes next year, it dropped its assessment for 2019 down from three hikes to two.

That affects gold over the longer term, and that's partly why gold prices haven't skyrocketed.

Another hurdle affecting gold prices is the rise in stocks we've seen over the past few months.

This has been an impressive and highly resilient bull run for the markets, and it seems investors still believe that Trump's promised tax reform is coming.

That belief is one of the main reasons stocks have continued this run.

Now, stocks have recently slowed down a bit.

But I wonder how much of a concern this slowdown is.

After all, every time someone writes about stocks being overpriced and says "this can't last" - the stock market jumps higher.

And as long as stock prices keep being propelled higher, gold prices aren't going anywhere.

Now, when stocks go down in the short term, you may be tempted to put some money to work in gold.

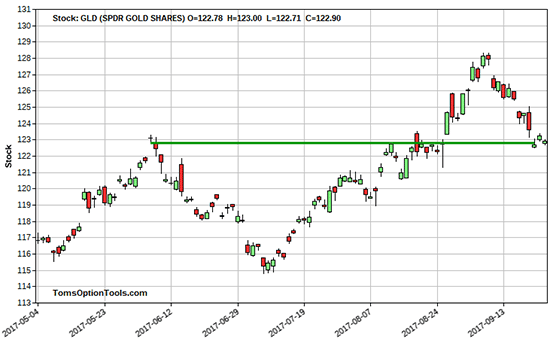

But before you do, look at the chart below...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

This is one of the main means of investing in gold without buying it outright - the SPDR Gold Shares ETF (NYSE Arca: GLD):

In this chart, you can see where GLD has dropped about 3% to 4% off its recent high.

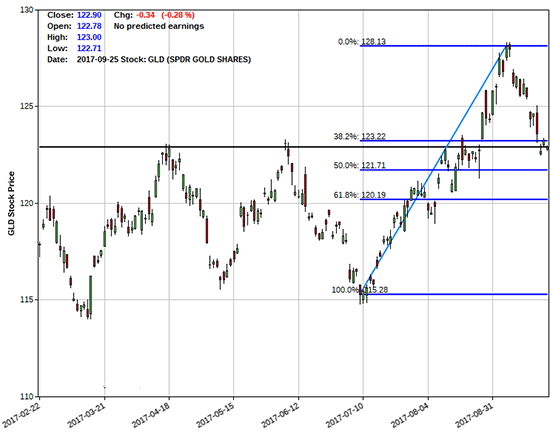

The ETF has also trailed back to a key Fibonacci retracement level of 38.2%, which is at the $123.22 price, as you can see in this chart:

Now, when that happens, you'd expect the price to bounce back up (if you want to know more about Fibonacci levels, click here).

But that hasn't happened yet.

If GLD's price does bounce back up, you'd have to wait and see how long the bounce lasts and what type of trading volume supports it.

But if GLD doesn't move back up and instead keeps falling, the next two Fibonacci retracement levels of 50% and 61.8% are at $121.71 or $120.19, respectively.

Both of those levels could then become support points that would help stop GLD's fall in price.

Now, despite all these hurdles that gold has to clear, I still wouldn't play long puts to try to make money off of GLD falling.

That's because any fall in the price of gold may be short-lived and small, and a snap back is possible should stocks really sell off.

So for now, I'm keeping my powder dry on gold and waiting for better technical opportunities to come along, whether they're bullish or bearish - and so should you.

Up Next: Rare Gold Anomaly

Money Morning Executive Editor Bill Patalon just caught something on his gold charts that he's only seen twice in the past 20 years. A $13 billion gold anomaly he calls the "Halley's Comet of investing."

It's very rare, and fleeting, and Bill sees things lining up perfectly to bring some very sizeable precious metal profits to well-positioned investors.

Click here to check out his research…

The post Four Hurdles Gold Must Clear Before You Should Even Touch It appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.