General Electric Co. (NYSE: GE), a once-proud American icon, has fallen on hard times. The much ballyhooed investor day flopped, at least according to financial markets, which punished the stock on Monday and again Tuesday.

Many investors are wondering if they should buy.

No.

Not unless you have money to burn and you like playing games where the odds are heavily stacked against you.

GE's breakup value is only $11 a share, according to my back-of-the-envelope calculations - and even then just barely. That means the stock could drop another $7.28 per share and that the once-proud conglomerate will lose another $95.24 billion in market capitalization.

The company should be on deathwatch.

Contrary to what Wall Street would love to have you believe, GE is NOT a turnaround play.

- Shares are down 5% after CEO John Flannery's plan for a "more focused" company failed to excite... well... anybody.

- GE's dividend got a 50% haircut that's the worst (and largest) of any U.S. company outside of the financial crisis.

- GE's shares are trading at levels below where they traded 20 years ago and have lagged the S&P 500 by more than 50% this year alone.

CNBC's Jim Cramer even went so far as to call investing in GE "one of the biggest mistakes of my career," saying rarely has he "felt this stupid."

I agree.

Fortunately, you and I have never made the same mistake.

In fact, I've been telling you for years to avoid GE because it wasn't tapped into our Unstoppable Trends and didn't make the cut with a single "must-have" product.

I think there's a good possibility that GE gets booted from the Dow Jones and that the company loses its blue-chip status after 110 years as a Dow component. It's trading at a low price that's getting lower by the minute and has a comparatively small weighting in the overall index already, which means that now would be a good time to kick it to the curb.

"More Focused" and Less Profitable

Here's the thing.

Management has tried to create a "more focused" company for years. The story never changes - over promise and under deliver.

Urgent: An $80 billion cover up? Feds use obscure loophole to threaten retirees… Read more…

In fact, we heard the same thing from former CEO Jeffrey Immelt for a long time. His "one company" focus was supposed to be the flagship of his business strategy once he took over from Welch in 2001 and promptly sold off the company's plastics, appliances, and media businesses. Then came the valuable financial services and real estate segments.

In 2016, Immelt called this strategic pivot one of the worst mistakes he ever made. I think it'll go down as one of the single-worst-executed management plans of all time and that business students will study what happened for years as an example of what not to do.

Now, it's current CEO John Flannery who has to clean up the mess he inherited... if he can.

To be blunt, it seems to me Flannery is playing buzzword bingo in a desperate attempt to keep investors interested so they don't have a fire sale on GE stock.

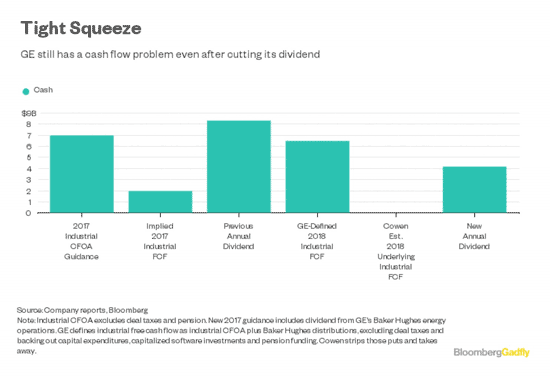

The company still has unbelievably severe problems to contend with, not the least of which is terrible cash flow that hobbles any reboot in the works. For example, the reduced dividend will still cost the company about $4 billion a year at a time when actual free cash flow is approaching zero if you factor in capital expenditures and pension expenses.

Again, I get that this is an American icon we're talking about, but don't let that cloud your thinking.

GE is a company operating in a market that has left it behind, that hates its products, and that has very little in the way of positive expectations. Its stock has gotten pummeled during one of the greatest bull market runs in history!

Breaking GE up is the only way out of this mess, and even then, probably not profitably.

GE will continue to shrink in terms of relevance because it makes things in a market that values code and technology. Fund managers and traders will buy more Amazon.com Inc. (Nasdaq: AMZN), Apple Inc. (Nasdaq: AAPL), and Alibaba Group Holding Ltd. (NYSE: BABA), for example, as it grows and continues to shed GE shares as that relationship worsens.

Dividend investors are likely to rethink holding GE stock now that the dividend has been slashed. Many are going to liquidate their holdings and move on. That means any bounce is likely to be short-lived because the cash that would have kept them on board is no longer incentive enough.

The same is true for institutional investors and pension funds that held on for too long, hoping that the stock would "come back" even as they counted on increasingly large and unrealistic dividends. They can't sell overnight, which tells me there is likely to be selling pressure on GE for months to come.

And, finally, GE's own numbers are terrible.

Management predicts an earnings decline in 2018 at a time when the average S&P 500 stock has 10.9% growth on the books.

Try as I might, I cannot envision any scenario where this ends well.

However, I can imagine three ways to profit from GE's troubles...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Three Profit Takeaways

- If you're a trader and you want to speculate on GE's recovery, you're going to have to be nimble and quick. Millions of institutional traders are thinking the same thing. I suggest waiting until the stock hits $11 to $12 then playing along with at-the-money call options. This gives you an unlimited risk-to-reward ratio, keeps the capital required to minimal levels, and factors in the potential for big, fast gains.

- If you're an income-oriented investor and want to replace GE with another dividend-producing income play offering far more consistent cash flow, a special class of investments called 26(f) programs are your best bet. In some cases, for as little as $100, you can start collecting monthly checks for a few thousand dollars. The programs operate as 100% legal tax havens, too. Click here to learn how to enroll.

- If you're a GE stockholder and you've had enough, but still want a GE-like company with growth and income, consider Honeywell International Inc. (NYSE: HON), which offers a diversified range of aerospace products and services. The company offers built-in recession resistance and growth via some very exciting work with 3D-printed metals.

In closing, you may be wondering why I haven't suggested you short GE.

That's a logical question given my take on the company.

And here's your answer.

GE's already fallen 69.86% from its September 2000 peak, which means this is a very crowded trade. As such, the countervailing proposition is grave dancing, which means there will be a concerted attack on short positions in the months ahead by buyers keen to "prove" they're right by taking GE shares higher.

The risks are asymmetric and not worth it... unless you fancy playing a game of chance in which your opponent has a pair of loaded dice.

At the end of the day, we're about profits, and that's how you should be thinking about GE's situation.

I'll be with you every step of the way.

Editor's Note: Keith is wagering nearly $10 million that average gains of 313% PER WEEK (including partial and full closeouts) are possible whenever this pattern appears in regular stocks. Click here for more details…

The post General Electric: Barely Worth $11 per Share appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.