Right now, the financial news networks are in a “Honeymooners” phase - as in, they’re all shouting the markets are going “to the moon, Alice!”

There are virtually no voices on cable saying the markets will do anything but keep going up… and up… and up… forever.

Now, I disagree – and we'll talk about why in a minute.

But the bottom line is...

It's doubtful that this rally will continue without, at minimum, a pullback or correction of some kind. Steeper losses aren’t out of the question, either.

So, while the rally continues (on television and in the markets), let me show you the best place to put your money when – not if – this bull finally dies…

Make Triple Your Money on Bonds When the Bears Take Over

Of course, the markets have had a tremendous bullish run this year, as the "Big Three" - the Dow, Nasdaq, and S&P 500 - are trading at or near their all-time highs.

But after the U.S. Federal Reserve announced that it plans to raise interest rates again in December, U.S. stocks fell from those lofty highs. And based on over 10 years' worth of back testing millions of data points, we can expect to see more of this bearish sentiment through the end of the month.

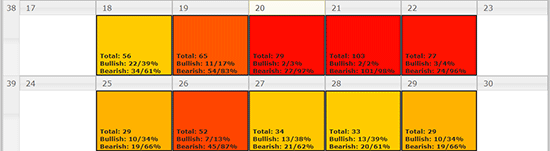

Get ready to see some red in my Money Calendar screen…

As you can see, the bears far outweigh the bulls for the rest of the month, particularly Sept. 20 through Sept. 22.

Now, this is a two-week snapshot; it doesn't speak for the markets in the long term. But if I were sitting on a bunch of cash and looking for an ideal time to deploy it in the equities market, the rest of September would not be it - I'd wait.

However, that doesn't mean you can't put your money to work in one of the other "four corners" of the market: stock, bonds, currencies, and commodities.

And with the Fed's latest announcement - and falling markets - bonds look like the safest place to do just that. In fact, if equities continue to sell off over the next week, and the Fed reinforces its plans to raise interest rates for the third time this year, then that would set off a classic “flight to quality” in bonds.

Folks who are in position before the “flight” takes off could do much better than the late crowd.

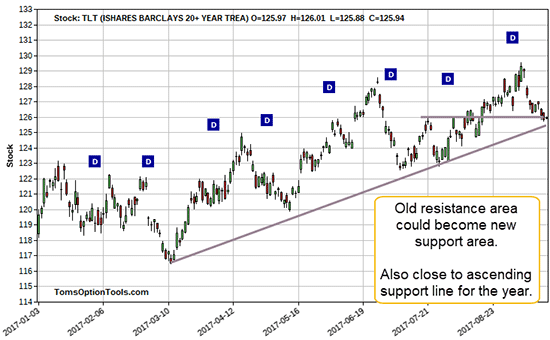

Now typically, bonds are strong when equities are weak (and vice versa). Keep in mind that they don't always have a 100% direct inverse correlation, but that is often the case. So let's take a look at the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT), which tracks an index of U.S. Treasury bonds with maturities greater than 20 years:

You can see that the overall trend for the year is to the upside, but these prices aren't even all-time highs for the TLT ETF…

So the question becomes: How high could it go?

And based on my technicals and TLT's price patterns, I could see it making a move toward its yearly high of just over $129.

But if you make these moves I’m going to show you, your returns might be significantly higher…

My Favorite Way to Slash Risk and Boost Returns on TLT

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Of course, you could buy TLT outright at $126.

But options minimize your risk and cost in the market, and they can bring outsized gains, too. So I’d make one of these two moves once you’ve talked to a certified financial professional…

- Buy calls with expirations up to three months out; or…

- Create a debit call spread, which is a strategy you can use to cut the cost of buying call options.

In fact, members of my premium research service have already had the chance to pocket 404.78% total winning gains on TLT this year using calls and call spreads.

Whichever bullish option trade idea you decide to use with TLT or any other bond instrument, it’s critical to keep in mind a stop-loss point.

There are a two smart ways to do that.

One way would be to use some value of the option, say a 50% stop-loss, so that if the option loses 50% of its value, you exit the trade.

Or you could use price as your stop-loss point. $122, or the technical support price area on the above TLT chart, makes good sense. If it closes below that support on above average volume, that event would then trigger your stop out of any option trade you may be in.

Options can move quickly, so it pays to get these stops set up ahead of time to trigger automatically.

An Incredible Win Rate: Since April 28, Shah Gilani's Zenith Trading Circle subscribers have had the opportunity to make average gains of 44% per day (including partial closeouts) on his recommendations. His win record is insane (in a good way). You've got to check this out – just click here.

Follow Tom on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.