Back in September, I showed you the No. 1 ETF to have in your portfolio right now.

Since then, it's already gained 12.7% - with my proprietary tools predicting an even bigger move higher from here.

And I'm going to show you the easiest way to cash in on this price action by Dec. 15.

Now let's get started...

How to Make Fast, Easy Cash on FAS

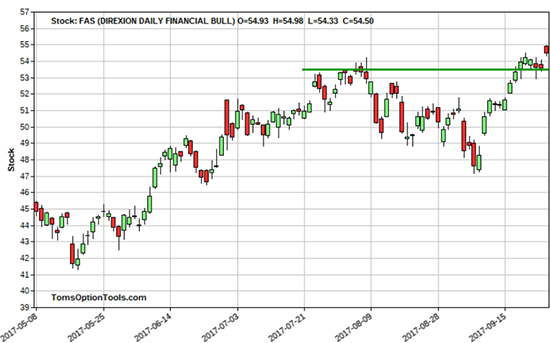

As you may recall, the Direxion Daily Financial Bull 3X ETF (NYSE Arca: FAS) broke out to its 52-week high back in September before continuing its climb higher...

At the time, FAS broke out above its $54 resistance level, testing it as a new support level, which indicated a strong possibility of it moving even higher. I also offered a technical stop you could consider - that if it closed below that $54 level, that could be considered a technical stop.

I've used this pattern to show my readers triple-digit gains in one or two days. Click here to learn more…

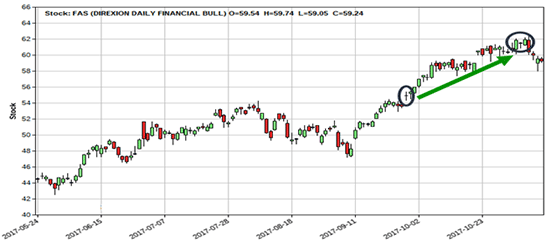

But FAS didn't retrace below that price point... it ran higher, peaking at $62 per share. That's a price gain of $7 (or a seven-point price move) based on a starting price of $55 (which is where it was trading when we first talked about back in September). Seven price points on a $55 stock is a 12.7% rate of return...

That's 12.7% on just the stock. The rate of return using a long call or a call debit spread would have been a great deal more! And if you followed the strategy I proposed and captured profits - congratulations!

If you didn't, fear not...

When it comes to options, think of them like public transportation - if you miss one bus, there's always going to be another one coming. So if you miss out on the price move of one stock and a profitable option trade, know that there will be another stock or ETF setting itself up for a price move for you to jump on.

That may be happening right now on FAS.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Even though this ETF ran from $55 to $62, it still took a couple of weeks to build a bit of a support at $58 before it made its last leg higher to that $62 price. And on an intraday basis back on Nov. 9, you can see that it traded down to $58 before trading off its low that day...

This created a longer tail on the Japanese candlestick, indicating solid buying off that low price.

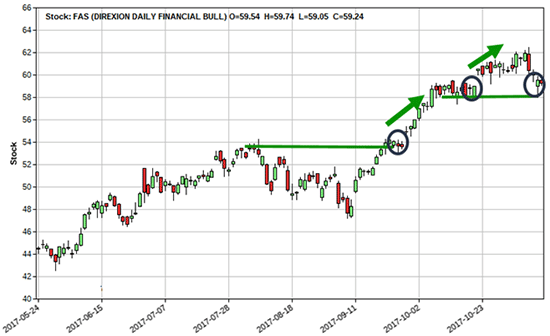

Now, as we discussed the last time around, any bullish option ideas you're considering should be monitored for a technical stop-loss point, and any closing low below the support price of $58 could be considered just that.

As for upside potential, I would anticipate a move to its prior pivot high of $62 as your first profit target. And a bullish option idea on this setup could be a call debit spread.

Now, if you were to buy a Dec. 15 $58 call for $3 and it took until expiration for the ETF to reach $62, there should at least be $4 of real or intrinsic value. If you bought the call to open at $3 and then sold it to close at $4, that is a $1 profit, or a 33% return - not bad!

But what I've circled below is a Dec. 15 $58/$61 call debit spread...

This would be buying-to-open a $58 call and selling-to-open a $61 call as one trade. That means you're completing both sets of actions at the same time on the same order ticket. Now, I'd try and work what's called the "bid/ask" spreads on either side (or both sides) of these options and try to get the position opened for no more than $1.50 per contract (or $150).

The way this option trade reaches maximum profitability if FAS gets above and stays above the strike price of the option you sold-to-open (the Dec. 15 $61 strike price) at expiration. This should result in the market exercising the right to buy FAS at $61 and your account exercising the right to buy FAS at $58.

That would result in $3 per contract (or $300) hitting your account, offset by the original debit (price you paid) of $1.50 per contract (or $150 per contract). That's an anticipated $150 profit on a $1.50 trade - a 100% rate of return.

Not too shabby!

And my elite readers are no stranger to seeing fast-moving, money-doubling gains like 100% in one day, 100.44% in two days, and 120.93% in two days. In fact, I bring them the best opportunities to score 100% in four days or less every single week, week after week. Click here to learn how you can join them.

Tom Gentile is America's No. 1 Pattern Trader, and for good reason. Since 2009, he's taught over 300,000 traders his option trading secrets, including how to find low-risk, high-reward opportunities. Now he's sharing that insight with you. To get started, just click here – you'll get Tom's twice-weekly Power Profit Trades delivered directly to your inbox, free of charge.

The post How to Cash In on the Top ETF Before December 15 appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.