The media heads over at the financial news networks have been talking a lot about billionaire investor Carl Icahn and how he missed out on $4 billion from selling his Netflix (Nasdaq: NFLX) shares two years ago.

What they're not talking about is the huge bet he recently made...

You see, Icahn is betting big on auto repair shops. In fact, he's planning on acquiring thousands of them.

But whether he's right or wrong, you can still get a "cut."

Here's how...

Two Auto Parts Stocks to Consider - and Two Ways to Play Them

Carl Icahn is a billionaire investor who doesn't just buy some shares of stock in companies - he owns substantial percentages of these companies and even buys them outright.

That's what he's doing right now with private automobile parts makers. In fact, he already bought 82% of the shares in Federal-Mogul Holdings LLC (FDML), the maker of Champion spark plugs. And after upping his bid price, he bought the remaining 18% of shares in a $300 million deal. He also already owns Pep Boys and Auto Plus, which now puts all three companies under the roof of his own investment firm, Icahn Enterprises LP (Nasdaq: IEP).

And this month, Icahn bought another major auto parts player, Precision Auto Care, which has more than 250 stores in 26 states. He did this through none other than his automotive company, Icahn Automotive Group LLC, a wholly owned subsidiary of Icahn Enterprises LP. In fact, Icahn Automotive Group LLC was created to "invest in and operate businesses involved in aftermarket parts distribution and service."

Clearly, he's trying to be the dominant player in this industry - which means you've got profit opportunities.

And these are the two auto parts companies to consider making a move on:

1. AutoZone Inc. (NYSE: AZO)

2. O'Reilly Automotive Inc. (Nasdaq: ORLY)

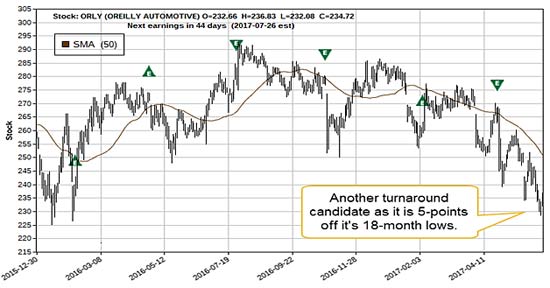

2. O'Reilly Automotive Inc. (Nasdaq: ORLY)

What's interesting to note is that Icahn's been buying substantial stakes of auto parts companies, if not buying them outright, at least as far back as last September. And because of that, these stocks will stay on investors' radars and spur more buying in the markets - which could drive prices higher.

Now there are a couple ways to play these stocks for profits...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

1. Buying Call Options

When you buy call options, you're essentially "renting" the stock instead of buying shares outright - and you get to control 100 shares for each call you buy. Calls give you the right - but not the obligation - to buy a stock (or any other optionable asset) at a certain price for a certain time in the future.

For example, say a stock bought at $103.70 goes up 2.70 points. Selling that stock $2.70 higher in price results in a 2.6% return on investment (ROI). Now, on that same 2.6% move in the stock, say you bought a $103 call option that expires in less than a month for $1.50 (or $150, since 100 contract equals 100 shares). After the $2.70 move higher in the stock, the call option goes up to a value of $3.00. If you sell it for $3.00, you make a $1.50 profit ($150 profit). When you look at the ROI, that's double your money on that call - for less than the price you'd pay for single shares of stock - and without the risk of needing that stock to reach a certain price in order to avoid losing your investment.

2. Buying Long-Term Anticipation Securities (LEAPS)

LEAPS are an even more conservative way to play these stocks because they expire much further out in time (up to three years), which gives you even more time to capitalize on upward or downward stock price movements. They're also even less expensive to buy than standard options, so you're cutting your cost even more than buying shares of the stock outright. And like standard options, the most you can lose is the amount you paid to buy them - unlike buying the stock outright.

I'd say that's a pretty good deal!

Of course, you'll want to talk to your broker about which strategy will be best for you to use.

Editor's Note: Tom's discovered a way to cash in on the top 325 stocks in the market – in only four days or less. In fact, members of his elite trading research service have already had the opportunity to bank over 898% total gains so far this year. Click here to find out how – and get in on the next opportunity.

The post How to "Get a Cut" from Carl Icahn's Big Auto Bet appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.