I received an important question last week from Margaret who, at 81 years young, has a problem most members of the Total Wealth Family would love to have.

No, scratch that... a problem I am going to do my very best to make sure you have.

Proof There's Such a Thing as Good Problems

Margaret's got a quality problem.

She's built up enough wealth to live out her life in style and wants to leave a legacy for her children and grandchildren. But, like many older investors, she's worried about a market crash and concerned she has too much money in volatile gold and silver stocks.

There are a few things to think about here.

1) "Volatile" does not necessarily mean "down."

Many investors in similar situations - and older investors, in particular - often tell me that they can't handle the volatility associated with specific stocks and are worried about a crash... yet they plow into them anyway.

What they're missing is perspective.

As we have discussed many times, the markets have an upward bias over time, which means that older investors want to be thinking about growth when it comes to leaving a legacy even though the temptation is to think about preservation.

There's no doubt that stocks go up and down, so let's get that off the table.

The single biggest mistake any investor in Margaret's shoes can make is to confuse her risk tolerance over the next few years with that of her children over the next few decades.

Simply put, the runway, for lack of a better term, is much longer for younger people, which means the best thing you can do when it comes to leaving a legacy is choose stocks that prepare them for financial takeoff, not a hard landing.

Whereas older investors in your shoes, Margaret, often fear pullbacks, corrections, and even crashes, don't forget that every one of those things is an opportunity for younger investors because volatility makes "buying low and selling high" possible.

Over the longer term that includes their lifetime.

Admittedly, this isn't easy to do for the simple reason that we like to think we know better as we get older. Our lives are no longer measured by "firsts" - our first day in school, our first kiss, our first paycheck... even our first winning trade. Stress takes over as we age, and that forces us to reinterpret things as a series of threats... to our lives, to our relationships and, of course, to our financial security.

That's why we like to think we "know better" with each passing year.

But, do we?

2) Your children and grandchildren will live in a very different world.

Many investors are stuck in the past... or at least the present.

Psychologists call this "recency bias," which is a clinical term meaning that we have a built in cognitive bias towards events that have happened recently or which are happening now.

For example, think back 120 years. If you'd walked into a local grange and told everyone in the room that 90% of the people standing in that hall would be out of work or doing something unrelated to farming within a generation, you would have been regarded as a kook.

You also would have been correct.

Approximately 50% of the labor force in this country was involved in farming in 1870. By 1900, that stood at 38%. Today it's 2.5% or less.

I can't tell you how many investors I talk with every year who are convinced that things will continue tomorrow based on how they look in the rear-view mirror today.

Yet, tomorrow's technology will create sweeping changes, many of which we cannot contemplate any more than my father-in-law could fathom the fax machine. You should have seen his face when we showed up on Skype for the first time in Kyoto... from America!

Digitization is a great place to start and at the core of the Unstoppable Trends we follow because it may replace 50% of all known jobs today within the next 20 years. At the same time, it will create new employment we cannot imagine in areas like infotech, nanotech, and cognitive processing.

Again, you want to set your money up for that because it's going to be their money.

Starting with the six Unstoppable Trends we highlight regularly.

Starting with the six Unstoppable Trends we highlight regularly.

More billionaires have been created and will be created based on that list than any other segment or industry category in history for the simple reason that every Unstoppable Trend is backed by trillions of dollars the Fed cannot derail, Wall Street cannot hijack, and Washington cannot regulate into oblivion.

That's why I am so insistent you stick to them.

Whereas historical narratives revolved around traditional government, nation states, and even religion, these six Unstoppable Trends will define the world ahead. Further, they will eventually outrun every last bit of political, economic, and trade-based framework in place as we know it today.

Knowledge will become an asset when that happens and will be very, very valuable, which is why you want to invest in it now before everybody else latches on to what we are discussing.

Amazon.com Inc. (Nasdaq: AMZN), Alibaba Group Holding Ltd. (NYSE: BABA), and Alphabet Inc. (Nasdaq: GOOG) are all at the top of my "next generation" list.

3) Have a plan and stick to it.

Many investors make overly complicated decisions by the seat of their pants as they get older in a process that I refer to somewhat tongue in cheek as the "Christopher Columbus School of Navigation."

They have no idea where they're going. No idea where they are when they arrive. And no idea where they've been when they get back.

It's no wonder that millions fail to achieve the financial security they crave.

Being detail-oriented is great to a point. However, what you want to do as an older investor concerned with leaving a legacy is make decisions to ensure that your money makes the transition. Barring some miraculous longevity, we won't, which is why you want to work with qualified accountants, lawyers, and estate specialists if needed.

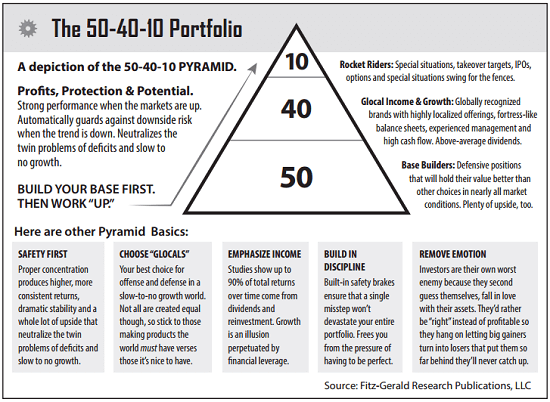

That means you want to establish a framework that will give the next generation the highest probability of building wealth, like the 50-40-10 I advocate in our sister publication, the Money Map Report and in Total Wealth.

Contrary to what a lot of people would have you believe - namely those who want to get their hands on your money - you don't have to get creative.

Just disciplined.

The 50-40-10 is especially powerful when you combine it with the Unstoppable Trends we follow, with the "must-have companies" we discuss regularly, and with the risk management that we prioritize. It's also very dynamic because the 50-40-10 approach requires you to rebalance periodically.

And that brings me to the concerns you have about having too much in "volatile gold and silver" stocks.

Studies show that having 2% to 5% in gold and silver or related metals stocks is about right for most investors. That's because even a small amount helps dampen overall portfolio volatility yet still offsets the principle risk to your bond holdings associated with inflation, geopolitical uncertainty, and economic volatility.

In closing, thanks for writing in, Margaret.

You've given me the opportunity to cover something that's very important to the entire Total Wealth Family.

I hope I've helped.

This "Secret" Helped Transform Two Teachers into Millionaires: Today Donna and Dave R. are retired millionaires who are also earning $10,000 a month in income. Much of their wealth is due to a Great Depression-era "program" most have no idea exists. Learn more…

The post How to Handle a Problem Most Investors Would Love to Have appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.