Wall Street would have you believe that the most effective way to hedge against unknown market risk is to diversify your portfolio.

The theory is pretty elegant – or at least it's supposed to be.

Spread your money around, they say, and you'll reduce your risk because "everything can't possibly go down at once."

Problem is, that's a load of self-serving hooey.

Today's markets are more correlated than they've ever been, thanks to a witches' brew of computerized trading, exchange-traded funds (ETFs), and leverage.

You've got to do something different if you want to get ahead.

Many folks find that hard to believe.

The correlation part, I mean.

Wall Street spends billions on advertising to highlight the virtues of diversification. There are countless books on the subject. Academia considers it a cornerstone of investing education. So, alas, it must be true.

Legions of investors want to believe that, but...

Not!

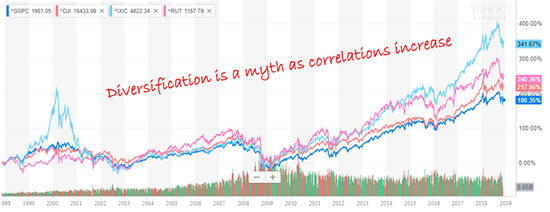

Here's a shot of the Dow, the S&P 500, the Nasdaq, and the Russell 2000, all plotted together since late 1998. Even the most hardened critic can see that the major indices are moving in near lockstep.

Especially on big down days.

Source: Yahoo! Finance

What's more, you can see that – aside from one big bump ahead of the Internet Bubble in 2000 – all of the indices get even more "alike" after 2003 and 2009, as correlations are generally increasing over time.

Still, Wall Street peddles its wares to the unassuming.

"Buy the indices," they say.

Could you Soon Be a Victim of ReHIREment? This terrifying new normal affecting 9 million Americans was completely out of their control. Read more…

"You can't beat the markets," they charge – with the implication of "So why even try?"

Yeah, and I've got a bridge to sell you.

Warren Buffett – yes, THAT Warren Buffett, who's worth an estimated $86 billion – says diversification "is protection against ignorance." Moreover, he observes that [diversification] "makes very little sense for those who know what they're doing."

I agree.

Spread yourself and your money too thin, and you will never, ever beat the markets. Worse, you WILL compromise your results.

Buffett, incidentally, is not alone any more than we are.

Other great investors go to great lengths to concentrate their investments. Names like George Soros, Jim Rogers, and Doug Kass all come to mind.

William O'Neil even went so far as to say that the winning investor's "objective should be to have one or two big winners rather than dozens of very small profits."

My favorite take, though, comes from money manager James Oelschlager, founder of $1.1+ billion investment management firm Oak Associates. He wryly observed that "no hospital wings or college dormitories have ever been named by an indexer."

Critics, of course, will scream bloody murder when they read this. "International markets are different," they'll challenge. "Diversify by sector," they'll counter.

Good luck with that.

Recent changes in the fiduciary laws make it all but impossible for financial advisors or money managers to set up a concentrated portfolio because they're legally obligated to spread your money around by "acting in your best interest."

And – you guessed it – that's officially a diversified portfolio because a concentrated portfolio runs contrary to commonly accepted wisdom.

Which brings me back to where we started.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

During an interview for Forbes in 2008, Warren Buffett was asked how he felt during the middle of 1974's vicious bear market – to which he responded, "Like an oversexed guy in a whorehouse."

I don't know that I'll repeat that sentiment, but I'm not far off.

Current selling has put any number of world-class companies "on sale."

Alphabet Inc. (Nasdaq: GOOGL), for example, has eight business units, each of which has more than 1 billion users. And the artificial intelligence (AI) they're developing to handle all this hasn't yet been priced in.

[Potential $23,441] Make the U.S. government fork over the unpaid funds it may owe you!

Amazon.com Inc. (Nasdaq: AMZN) is moving into cashless stores, healthcare, and consumer financials. Team Bezos has gone from selling books to selling whatever they want.

Merck & Co. Inc. (NYSE: MRK) has a groundbreaking and very successful immunotherapy treatment called Keytruda that's led to rapid FDA approvals and which will lead to groundbreaking new cancer treatments. And it pays a 2.77% dividend to boot.

Then, there's The Boeing Co. (NYSE: BA). People are beating the stock up because it's got "Chinese exposure" – whatever that means. Ask yourself... China or not, are people still going to fly airplanes in a low-growth world? Are countries still going to need the defense products Boeing makes? My hunch is that they will.

My favorite company by far right now, though, is NVIDIA Corp. (Nasdaq: NVDA).

The company has been beaten down mercilessly by traders who can't see the forest for the trees.

Everything from toys to serious military hardware is going to be at least partially AI-powered within the next five years, and NVIDIA makes chips that are absolutely critical to that type of technology.

People think only in terms of how AI is going to improve this process or that device, but they're missing the point. AI can be programmed to do anything.

In fact, it already is.

A recent study from Pegasystems, for example, showed that 34% of people believe they've interacted with AI in one way or another over the course of their lives. But that number is actually 84%.

I see the AI investment horizon broken into two distinct camps – one that increases productivity and one that maximizes revenue.

The former includes tech that can perform even the most intricate processes flawlessly until the cows come home. The latter includes everything from conceptual learning, to planning, to cross-domain thinking.

PriceWaterhouseCoopers estimates that AI will add $16 trillion to global GDP by 2030, but I think that's an order of magnitude low. AI has the potential to make the Industrial Revolution look like amateur hour, and the figure may be 25% more than that – or roughly $20 trillion by 2025.

Tactically speaking, there's nothing wrong with buying a few shares using a Total Wealth Tactic like Dollar-Cost Averaging to improve your profits, even as you accumulate shares. Or, consider using a LowBall Order to buy shares at the exact time and price of your choosing.

The market is totally underestimating that NVIDIA's potential and current trading conditions are very much a sum-of-the-parts story.

Don't miss the opportunity to latch on at bargain basement prices.

Even if there's more selling ahead.

Watch: Brand-New Video from the Night Trader

While the markets were in a tailspin last month, the Night Trader managed to pull off a perfect track record in closed trades – and it was all thanks to his brand-new Infrared Index.

It’s a program that allows him – and only him – to see specific trigger points after the market closes that tell him where a stock is headed over the next 24 hours.

And he’s prepared to show you exactly how it works. Click here to watch...

The post How to Hedge Against Another Big Down Day appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.