President Trump's chief economic advisor, Gary Cohn, resigned last this week, throwing global markets into a tizzy over fears of a (now) very real trade war.

I can't say I'm surprised.

Having voiced my concerns on national media for a few months now, Cohn's departure is the last straw for skittish traders who crave stability. There doesn't seem to be anyone in the White House who can tell the president things he may not want to hear.

Like, for example...

... trade wars don't work.

... trade wars hurt those he's trying to help because prices rise.

... trade wars are a "tax" on the American people.

Don't get me wrong, though.

I'm not picking a fight with the president or anyone else, for that matter.

I don't do politics.

My job as chief investment strategist is to help you make and protect your money no matter who is in the White House and no matter which party he or she represents or even which agenda they advance. So let's get that off the table.

What the United States Is - and Isn't - Competing For

The data is very clear that protectionist policies ultimately cause more broad-spread economic and financial damage than they fend off, all in the name of saving jobs in manufacturing sectors that "sunset" decades go.

What the president appears to be missing is something we talk about all the time - our economic future is knowledge-driven, not trade-led... or even production-created. Our nation is not, for example, competing with low-cost manufacturing in countries like China.

We are, however, competing with highly skilled labor and U.S. production capacity, knowledge, and intellectual property that's been "offshored."

Automation, robotics, the cloud, artificial intelligence... all were pioneered by American firms that now have operations spanning the globe and foreign partners capable of picking up the proverbial ball if needed. It's not for nothing that roughly 46% or more of S&P 500 sales come from outside our borders.

That's what's really at stake - our partners are learning to innovate faster than the West can maintain the knowledge that now drives them. And, they've got fewer logjams in the way.

Take China, for example. It's long been one of the president's favorite targets, yet the nation's companies are stepping onto the global stage far faster than most Westerners can comprehend. Alibaba Group Holding Ltd. (NYSE: BABA), for example, threatens Amazon.com Inc. (Nasdaq: AMZN) in key markets around the world. Baidu Inc. (Nasdaq: BIDU) is gearing up for a fight with Alphabet Inc. (Nasdaq: GOOGL).

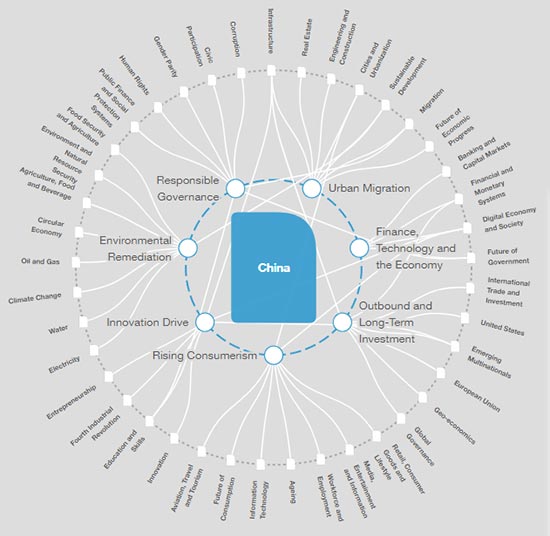

Most people see this as a threat, but it's actually one of the world's most concentrated investment opportunities, and the investing landscape looks like this:

Source: World Economic Forum

The rub here is that protected companies lose the incentive to compete over time when they should be empowered by the rapidly growing competition that got them there in the first place.

I've personally seen, for example, the shift in languages and demographics that drives the Far East. When I first arrived in Japan, the single most important language to study if you wanted to get ahead in the 1980s was English. Now, it's Chinese.

When I arrived in China, most foreigners - particularly blond-haired, blue-eyed ones like myself - were assumed to be Russian. Now, they're assumed to be Americans (which really irritates the Russians, incidentally).

Monthly Checks Up to Three Times Higher than Social Security? Click Here for Details and to Learn How to Stake Your Claim.

In Vienna, there used to be a few Chinese fast food joints... now, there's an entire China "town" filled with legions of Chinese business professionals. And, not surprisingly, the $9 billion China's invested in Eastern Europe as part of the country's trillion-dollar One Belt One Road Initiative is clearing the road for direct Chinese foreign investment in Western Europe.

My point is that our future isn't about a few tourists or sports clubs any more. Instead, it's about real economic change that protectionism won't, ironically, protect.

For the most part, we've got this covered with the big, multinational world-class companies that we talk about regularly. They're the ones making "must-have" products and services that are tapped into the six Unstoppable Trends we follow, especially when it comes to technology and financials. So, I'm not worried about that aspect of things.

Instead, I'm thinking about how to play the situation for still bigger profits using currencies - now that a real trade war appears imminent...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

How to Play a Trade War for Maximum Profit Potential

As the old adage suggests, "a little goes a long way" if you add small currency positions to your investing arsenal.

The Japanese yen, for example, has recently strengthened significantly against the U.S. dollar as trade war talk accelerates. But, the Bank of Japan has every incentive to want a weaker yen because Japanese earnings depend on that; nearly 40% of the revenue for TOPIX-listed companies comes from outside Japan, for example.

So, contrary to what a lot of currency traders think about it appreciating in a trade war, I believe that the Bank of Japan will make a surprise announcement that takes it the other way by not curtailing stimulus as planned later this year.

The best way to play that is a choice like the ProShares UltraShort Yen (NYSE Arca: YCS) - an ETF designed to increase twofold in value compared to the value of a decreasing yen. Normally, I'm not a fan of leveraged ETFs because of something called "tracking error," but this is one of very few exceptions in my book because of the yen's implied stability as a global "safe-haven" currency.

At the same time, I believe the U.S. dollar will weaken over time because the tariffs will create additional trade and budget shortfalls that overwhelm the short-term strength that traders are counting on now and that President Trump thinks his tariffs will create.

The best way to play that is to dollar-cost average into a dollar "short" fund like the PowerShares DB US Dollar Bearish ETF (NYSE Arca: UDN).

In closing, the situation is obviously a long way from over.

Trade wars take a while to get started and, unfortunately, tend to have far longer, more expensive consequences than people are prepared to accept. The Smoot-Hawley Tariff Act of 1930, for example, created tariffs on more than 20,000 imported products and made it damn near impossible to exit the Great Depression for an entire decade.

This time around... who knows??!!

Which is why, as always, we want to prepare ahead of time so that you and your money are not caught by surprise like millions of unsuspecting investors surely will be.

I'll be with you every step of the way.

A $10,000,000 Bet: Keith's betting nearly $10 million that he can show you how to make 350% average gains every week for a year. Learn how to get started right away – you can’t afford to miss next week’s potential moneymaking recommendations. Click here now…

The post How to Play a Full-Blown Trade War... With Currencies appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.