All of the media heads are talking about Tesla right now and how it beat General Motors as the largest automaker in America, right after taking over Ford's number two spot.

But while they're figuring out how Elon Musk did it, I want to talk to you about something much more important - how to profit.

And I've got the perfect way for you to cash in on the new king of the auto industry...

The Stress-Free, Low-Cost Key Way to Profit from Tesla's New Milestone

I'll start by admitting that I'm a bit biased when it comes to Tesla Inc. (Nasdaq: TSLA).

I recently purchased a Tesla P90S, and my wife and I have been enjoying it ever since. Here's a shot I took of it when we were picking it up from the dealership.

But that aside... the fact is TSLA's market capitalization (or market cap) was $52.7 billion as of Tuesday, while General Motors Co. (NYSE: GM) was sitting at a market cap of $49.6 billion. And according to the latest sales report, TSLA had 25,000 deliveries in the first quarter, beating analysts' expectations.

Market cap is a way of referring to the size of a company. You can calculate a company's market cap by multiplying the number of outstanding shares by it's current price per share. Companies with larger market caps have been primarily deemed as more stable with less risk, and companies with smaller market caps are considered less stable with more risk.

Now some would say that looking at a company's market cap isn't the best way to assess its worth or success, while others would say it reflects the components of the company that are working well. The fact that TSLA has a large market cap as such a young company but hasn't really turned a comparable profit only speaks to the concerns about whether or not this market cap is warranted. But whatever conclusions you draw on your own, there's no denying that the markets are taking this stock higher.

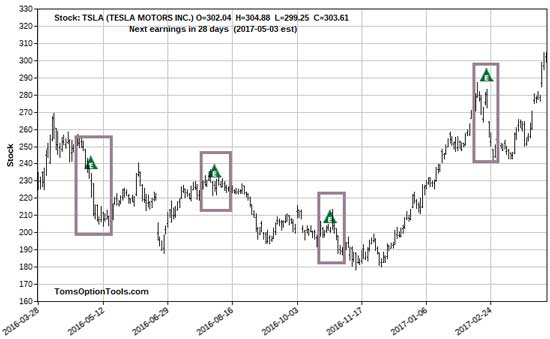

And now, we're about to enter the next round of earnings, with TSLA reporting after the market closes on April 24. So I used my proprietary tools, one of which is called "Earnings Effects," to analyze the history of how the stock performs going into and after earnings.

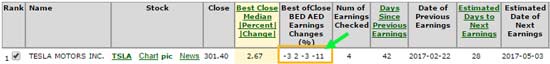

Look at TSLA's percentage price move prior to its last four earnings sessions:

Above, you're looking at the percentage move of the stock four days prior to the last four earnings reports, which reflect a slight percentage down heading into three of the last four.

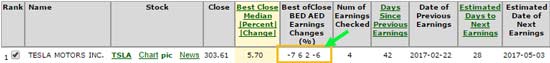

Now here's the Earnings Effects for TSLA one day after earnings come out (over the past four earnings sessions):

TSLA has moved higher 50% of the time and lower 50% of the time, which means there's no one set direction to anticipate the stock's movement. So directional option trade ideas, like long calls or long puts, may not provide consistent profit opportunities, even though the stock is trading around $300 as of the time I'm writing.

So since TSLA could move either up or down after its next earnings report, one way you could trade the stock is to use a straddle, which is an options strategy where you buy a call and buy a put with the same expiration and same strike price (as one transaction on the same order form).

But an even better way to play it is by using LEAPS (long-term equity anticipation securities). A LEAP option would allow you to participate in the company's longer-term growth potential - but at a much lower cost than buying the stock outright.

And here's a good one to consider...

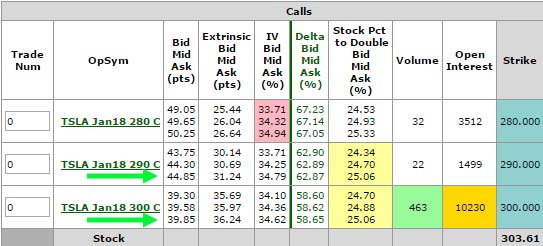

TSLA January 2018 Calls

In this chart, you can see that the cost for one contract of the Jan. 19, 2018, $290 calls is $4,485 ($44.85 x one contract, which is 100 shares). Compare that to buying 100 shares of the stock outright, which would cost you $30,300.

Now if you wanted to sell a shorter-term premium against TSLA LEAPS calls (or covered LEAPS call writing), then you could generate a monthly stream of income. But keep in mind that that comes with the risk of the value of your underlying shares falling significantly, which could cancel out the benefit of the premium you received in the first place.

But if you don't want that risk and don't want to have to frequently manage these additional options variations, then simply buying a LEAPS option is the more conservative route to take.

To your continued success...

Tom Gentile

P.S. Though LEAPS offer a lower-cost, lower-risk way to play a stock over a longer period of time, I've developed the most lucrative strategy for you to capture profits in only four days or less. In fact, my members have already gotten the chance to pocket over 732.6% total gains since January - including a double in just 24 hours. And I've got another special profit opportunity coming soon... To learn more, just click here.

The post How to Play America's Number One Carmaker appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.