I've spent 36 years in global markets as a consultant, analyst, and trader, and if there's one thing I've learned, it's that the biggest profits frequently stem from the most unthinkable situations.

Like peace in North Korea.

Most investors simply cannot process what's happened, and as usual, the mainstream media isn't helping. In fact, news related to the historic summit between President Donald Trump and Chairman Kim Jong Un has all but vanished from the world's front pages.

But not from my attention.

I call this the "Rule of the Back Page" - because that's where stories like this one get buried before becoming front-page news again.

Savvy investors like the legendary Jim Rogers, Warren Buffett, and the late Sir John Templeton know this all too well. That's why they're frequently "on the hunt" at times when almost no one else thinks to dig up opportunity.

Present company excepted, of course.

We've made a habit out of being ahead of the markets, often with fabulous results.

For example, I told you to buy the Japanese yen back in 2016, and anyone who followed along had the opportunity to more than double the same recommendation, issued by none other than George Soros six months later.

We've also been following China's emergence onto the world stage and, here too, you've had the opportunity to capture massive profits from companies like Ping An Insurance Group Company of China Ltd. (OTC: PNGAY) and Alibaba Group Holding Ltd. (NYSE: BABA), when I have recommended them for your consideration.

And, of course, we latched onto the FAANG stocks long before that became a Wall Street meme with terrific results, including a slew of profitable recommendations in "high" and "low" tech. The common thread, of course, being Unstoppable Trends backed by trillions of dollars and "must-have" companies making products and services the world can't live without.

I'm not telling you this to brag - that's not my style.

What I want you to understand is that getting ahead of major global events can be a source of huge, life-changing wealth if you play your cards correctly.

Here's the Scoop

Love him or hate him, President Trump has done the impossible and, in doing so, has opened up an entirely new and potentially exceptionally profitable frontier for your money.

Critics, of course, say the historic summit that happened a few days ago is a bust.

... "The U.S.-North Korea agreement is extremely vague." - Vox.com

... "where we left negotiations more than 10 years ago and not a major step forward." - Anthony Ruggerio, senior fellow, Foundation for the Defense of Democracies

... "Trump could cancel the deal before he gets home." - Mohammad Bagher Nobakht, Iranian National News Agency

That's entirely normal.

Critics, you see, usually have a lot to lose - not the least of which is their place at the table. That's why they are such vocal proponents of the status quo.

It's such an entrenched position that social scientists who have studied this carefully actually have a term for it - "status quo bias."

Interestingly, status quo bias is not just the desire to see things remain the same. Rather, it's attributed to a combination of loss aversion and endowment, both of which are closely related to prospect theory (a related economic line of thought in which people choose between probabilities of known outcomes and risk).

I won't bore you with the details, but here's the crux of the matter.

Start the Countdown: In just five days, you could have a fat check for $23,441 in your mailbox. The best part is, it's just one short phone call away. Over 80% of eligible seniors may be entitled to this cash. Are you one of them?

Dr. Daniel Kahneman, a Nobel Prize--winning expert on the psychology of judgment, decision making, and behavioral economics, says understanding cognitive bias is critical because of the way it shapes our judgment and decisions.

I agree.

That's why so many people cannot wrap their minds around what's happening. It doesn't matter whether you're talking about international politics or something as simple as changing the lanes on your local roads. Most folks remain grounded in the past.

The situation with North Korea reminds me of East Germany in 1989.

The Berlin Wall divided East and West Germany the way the DMZ divides North and South Korea. Then, as now, the country's culture was sharply divided between those who had it all and those who lived under the harsh thumb of communist ideology.

Back then, the military-industrial complex gobbled up valuable resources - at the expense of the German people - while intellectual capital languished. Today, it's much the same thing in North Korea.

Opponents even went so far as to assassinate those who represented change.

Case in point, I vividly remember having to call my boss, Larry Davanzo, to tell him a crucial meeting was off because the man he was supposed to meet with, Deutsche Bank CEO Alfred Herrhausen, was killed on his way to work that morning. At the time, Herrhausen was one of the most vocal and powerfully connected proponents of European economic integration and figuring out how to reduce third-world debt as global trade developed.

Unfortunately, I'm betting the same thing will happen in the weeks ahead as North Korea adjusts to the prospect of change. They, too, will fail.

North Korea is simply too "valuable."

They won't come all at once, but that's not a disadvantage. Massive changes like this one typically develop in distinct phases, each of which offers spectacular profit potential.

I see three: each with a corresponding timeline, choices, and profit potential:

- Stage 1: Investments will be companies doing business "because of North Korea." That's going to involve larger, well-capitalized trading partners capable of quickly focusing on North Korea's most pressing needs via their own highly established business networks.

- Stage 2: Investments will be related to mining and the necessary infrastructure needed to bring goods to market. North Korea's geographic position gives it unique access to China and Russia alike. Estimates suggest there may be $1 trillion to 3 trillion alone in mineral reserves, a figure I am inclined to think is low given what little we know about the country and how secretive it's been historically.

And, trade around the South China Sea has also gotten much dicier in recent news: China is now testing their prized H-6K bombers in the region. This seems like a situation right out of history's playbook recalling Russian aggression back in the Soviet times. Fortunately, besides the play I'll get to in just a minute, this opens up an incredible investment opportunity for America's stalwart defense contractors - but only if you jump in now. Just click here to learn more.

- Stage 3: Investments will be the technology driving an increase in "catch up" consumerism. There are 25 million North Koreans who will demand everything from toilets to mobile phones as their standard of living improves.

Again, the time to start lining up your money for maximum profit potential is now, when seemingly everyone else is looking the other direction... or simply not looking at all.

Starting with Chinese large caps as a Stage 1 choice.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Millions to Be Paid Out: Three audits by the U.S. Inspector General have uncovered startling accounting errors by the Social Security Administration - 82% of eligible seniors may be entitled to a share of this cash. Details here.

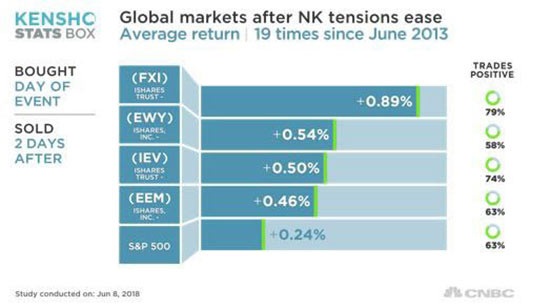

CNBC analysis, using Kensho - a hedge fund analytic tool - suggests that Chinese large caps, reflected by the iShares China Large Cap ETF (NYSEArca: FXI), rallied 79% of the time since June 2013 on positive North Korean perception, while the S&P 500 rose 63% of the time.

This is obviously an extremely short-term view, but this is also the longer-term hold here given that the peace accords still have a bunch of details to be worked out.

FXI's holdings include top-drawer companies like China Construction Bank Corp. (OTC: CICHY), Tencent Holdings Ltd. (OTC: TCEHY), and Ping An Insurance Group Company of China Ltd. (OTC: PNGAY), plus another 47 of the largest Chinese stocks.

Most investors are surprised to learn that Chinese stocks have been at the head of the class when it comes to performance, turning in a healthy 54% in 2017 versus only 28.31% from other emerging markets - based on the $88.5 billion asset-holding Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO) - and more than double the 19.42% the S&P 500 turned in that year.

This year, FXI has been somewhat level, but that doesn't particularly bother me. North Korea isn't going anywhere any time soon, and that means China's going to have a vested interest in seeing that country transition.

In fact, that process has been under way for some time.

Chinese President Xi Jinping continues to open China while simultaneously pivoting away from the old "industrial" model to the new "technological" model based on consumer spending, healthcare, and less credit-intense sectors.

North Korea plays into this scenario perfectly when you consider that 49.3% of FXI's holdings are related to financial services, with another 11.8% and 11.2% allocated to technology and telecom services, respectively. All of this will play a crucial role in the "modernization" just the way similar West German companies did.

FXI is part of the BlackRock Fund Advisors family, which is something else I like quite a bit because BlackRock Inc. (NYSE: BLK) has a very deep and, I believe, accurate, understanding of China's investment potential.

FXI's expenses are a low 0.74%, and the ETF sports a high 2.14% yield that is a welcome bonus for income-starved investors. What's more, FXI's price has appreciated 38.36% in the past two years as of press time.

In closing, this is a story that we're going to be following for the foreseeable future.

The investment potential really is "that big."

If you're uncertain, I understand.

Change is never easy but it can be exceptionally profitable for those who understand the need to invest when the story is still buried on "page 12."

Up Next: Most Investors Believe This Great Lie (Don't Be One of Them)

There's an old market adage that tells us "you can't time the market."

And most individual investors believe it - believe it in their hearts.

They believe there are only two kinds of markets - a bull market where stocks go up, and a bear market where stocks go down.

You make money in a bull market, the thinking goes, and you lose money in a bear market.

According to this line of reasoning, "timing the market" means you're either "in" stocks - or are out and on the sidelines. And if you get that "timing" wrong - you're going to get hosed.

Well, here's the thing: This bit of "wisdom" is one of the biggest lies the professional investing crowd has foisted off on Main Street investors.

And it could cost you millions.

Instead, there's a simple way for you to outsmart Wall Street at its own game - and capitalize on the ability to be nimble and fast-acting. If you follow this method, you could soon find yourself running circles around the mega-investment banks.

The post How to Play North Korea for Big Profits (Most Investors Will Miss) appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.