The most dependable and consistent way to generate huge profits is to latch on to the world's best companies when they're "going up."

And if they're not?

You do the exact same thing... in reverse.

I know what you're thinking – that can't be possible.

Well, it is.

What's more, you're missing out on half the market's financial potential if you're not profiting from stocks moving in both directions – up AND down.

Let me explain.

The world's best companies – those we profile all the time – have the world's best profit potential. Over time, that translates from higher revenues to higher profits and, in turn, to higher share prices.

Buy "right" and you'll laugh all the way to the bank.

But there's a hard truth to this as well...

Finding big profits is more difficult than ever before because the amount of information investors have to deal with today is staggering. There are Internet chat rooms, constantly updated headlines, curated content, advertisements... details.

You can't help but feel like you're missing out on something key.

Only you're not.

The secret is getting back to what works.

For example, I run a very exclusive sister service called High Velocity Profits that's singularly focused on finding huge profit potential. It uses just two very simple bits of information every investor needs to know:

- A company's fundamentals, and

- Velocity – a $5 word for momentum.

That way, you know what to buy or sell and when to make your move for maximum profits. It's given readers an incredible 72 winning plays this year alone.

Some 20 of which – roughly 28% of the total – have been from downside moves like the one I'm going to share with you today – meaning when a stock drops. Just click here to learn more about the High Velocity Profits approach and join in today.

Again, most people don't think this is possible in a market that's hitting new highs.

But that's the irony.

[pa_button slug="keith-fitz-gerald"]Get Keith Fitz-Gerald's latest recommendations and research sent straight to your inbox the moment they're released.[/pa_button]

What's more, profits from downward price drops often come faster than big gains to the upside.

Especially when a company's in transition.

Or failing - like this one...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Harley-Davidson Inc. (NYSE: HOG) is an American icon, and people can't imagine Harley going the "way of the dodo." We are, after all, talking about one of the world's most powerful brands and something so valuable that legions of the faithful ink it on unmentionable parts of their bodies!

That's okay.

People said the same thing about Eastman Kodak Co. (NYSE: KODK), General Electric Co. (NYSE: GE), and Sears Holdings Corp. (Nasdaq: SHLD) – all of which are fighting for their lives and all which have lost their investors billions of dollars. Tattoos aside.

Billions Are Now in Play: Millions of Americans could collect “Federal Rent Checks” – to learn how to claim your portion of an $11.1 billion money pool using this backdoor investment, click here now...

The fact that people feel so strongly about Harley makes your opportunity that much bigger and potentially that much more profitable!

Harley...

-

- sales have dropped 8.7% year to date here in the U.S., and Q2 worldwide retail sales were down 3.6% per their Q2 earnings presentation.

- only offers one bike under $10,000, which means that the young, urban, and increasingly female riders who are motorcycling's future can't afford to buy one. Most are $12,000 to $25,000 a copy. Or more!

- profit margins will drop from 12.5% last year to around 9% next year if management cannot reverse the trend.

- is losing ground to Polaris, which makes a far superior and freshly engineered product line that includes ATVs and other products (so there's diversification Harley doesn't have).

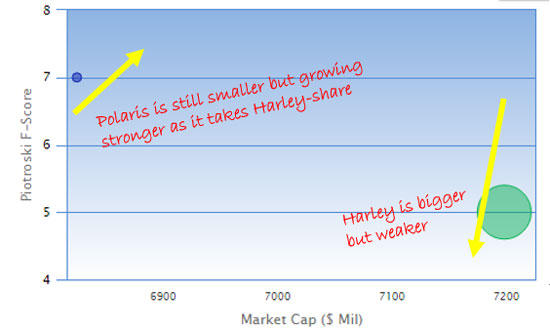

Harley-Davidson's Piotroski Score is a 5... and dropping.

That's a measure you've heard me talk about before because it's such an accurate measure of a company's underlying financial strength and profit potential. Or, in this case, lack thereof.

In this case, Harley's numbers are going in exactly the opposite direction from its smaller-but-stronger archrival, Polaris Industries Inc. (NYSE: PII).

The present trajectory suggests two things.

Harley is rapidly losing its mojo, and the speed of its decline is such that the company may have a Piotroski Score of only 1 or 2 within the next 12 months. Loads of research – in addition to my own – shows that's a range consistent with companies at imminent risk of financial failure.

There are three ways to play this for big profits:

- Sell Harley stock you own (if you own it) and buy Polaris instead. You always want to ride the strongest horse you can, especially when there are challenging market conditions ahead for the weaker player.

- Or, do both – the selling and the buying – at once in single transaction called a "Pairs Trade." I've written about this "Total Wealth Tactic" extensively in the past, so I won't repeat that here in the interest of time. However, I do encourage you to click here to read this article describing a pairs trade I recommended on VW when "dieselgate" broke.

- Buy long-term LEAPS put options that will appreciate in value as Harley struggles and the company's stock falls over time. I suggest the HOG Feb. 15 2019 $42.50 Puts (HOG190215P00042500) because they're comparatively cheap at the moment and because they don't expire until Feb. 15, 2019... so there's plenty of time for the trade to shape up.

To be fair, you could also "short" Harley, but I wouldn't recommend that in this instance because there are plenty of insiders who will fight tooth and nail against you as Harley comes unglued. I simply don't think that's worth the unlimited risk shorting entails in a rising market unless you've got the rock-solid discipline and risk management skills needed to pull it off.

More advanced readers could also consider vertical bear spreads or even diagonals to harness the rising volatility that will accompany this trade as it builds.

I'll cover those another time or in Dallas in a few weeks at the MoneyShow when we see each other next! Just click here to register for your spot if you haven't already!

As always, Harley is a speculative trade, so treat it accordingly by limiting risk to money you can afford to be without if it doesn't go as expected.

The fall of an American icon is never easy.

But there's no doubt it can be profitable for savvy investors following along.

Keith Is on Fire – 129 Double- and Triple-Digit Winners!

Members of Keith Fitz-Gerald’s High Velocity Profits have had the opportunity to get in on 129 MAJOR winners since last year (including partial closeouts) – some gains coming in as little as a few hours.

All of those winners could have turned a small stake into over $700,000!

Those wins are already in the bank, but you can still have the chance to get in on Keith's next winners by clicking here right now.

The post How to Profit from Another Falling American Icon appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.