Editor's Note: Tom first shared these easy strategies with us at the end of September 2016, ahead of the last interest rate increase. With another hike in the bag, we think it’s a good idea to take a fresh look. So here's Tom…

The Fed just announced it's raising interest rates by one quarter-point for the second time this year, bringing rates above 1% for the first time since 2008 – which could hurt your portfolio.

So there are two things you should do to make some real money – and protect what you have, too.

The first helps you lock in steady income every month.

The second offers you unlimited profit potential – with limited risk.

So this is the perfect time to brush up on a technique I first told you about ahead of the last rate hike. It's been making us money ever since, and this time around it could be even better…

A New Way to Use a Very Familiar Trade

The covered call is a great way to make some extra income for a turbulent time when others are likely losing their shirts.

You use the strategy when you already own the stock. You're selling a call option and collecting a premium, but remember: That premium comes with an obligation to sell the stock at a specific price on or before the expiration date.

That means you sell-to-open a call option against the shares you own. Remember, one contract equals 100 shares, so you would need to own at least 100 shares in order to sell (or write) one option contract.

You make money by selling the call option, but you're also giving the markets the right to buy (or call away) your stock at the option's strike price any time up to - and including - expiration. That's an important consideration, so I'd recommend selling options only on shares you're willing to part with.

This is a great strategy for when the Fed raises rates and sends markets tumbling; you'll get to keep the premium from the options you sold and, more than likely, your stocks, too.

Let's look at scenario using Microsoft Corp. (Nasdaq: MSFT).

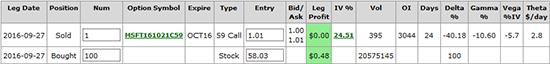

In this example, you already own at least 100 shares of MSFT and sold-to-open the Oct. 21, 2016, MSFT $59 call. This is what's meant by "writing a covered call." This means the market has the right to buy the 100 shares of MSFT from you at any time up to - and including - Oct. 21.

So if the Fed raises rates and Microsoft plunges along with the markets, you get to keep the $1.01 ($101) from the sale of the MSFT $59 call. And if MSFT is under that $59 strike price at the close of the trade's expiration, then you also get to keep the stock.

Now in the unlikely event that the Fed does not raise rates as expected, and the markets surge, you do face the risk of having your stock getting "called away," or bought from you. All in all, that's not a bad outcome - you'd get rid of 100 shares, but you'll also get to keep that $101 premium you made from selling the Microsoft contracts.

The best part is, you can write covered calls over and over again each month, moving the call's expiration date out a month at a time. It's like getting an extra paycheck.

This is a useful strategy anytime, especially when the Fed decides to pull the rug out from under the markets.

But this next strategy is my absolute favorite way to cope with rising rates. It can be even more powerful, because there's no theoretical limit to the money you can pull in, and your downside is very tightly managed.

It's easy to use, too.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

How to Use Married Puts When Rates Rise

A married put strategy is where you buy a stock and an at-the-money put (the strike price is the same as the stock's market price) or an out-the-money put (the put's strike price is lower than the stock's market price) to protect yourself against the risk of the markets falling. So you're buying the right to "put to the markets" (sell) at least 100 shares of the stock you own at the strike price of the put option you bought.

When using this strategy, you don't have any contractual obligations to sell the stock at any price. You have spent money to protect or insure your shares by buying-to-open the put option.

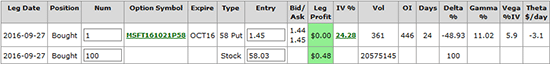

Here's how a married put would work with those same Microsoft shares I mentioned.

In this scenario, you own the stock for $58.03 and bought the put option at $1.45.

So if the markets run higher, you've only lost that premium. Now you could also sell-to-close the put you bought in order to claw back a little bit of that premium. But either way, the total cost of your trade is $59.48. So gains made over that amount are yours to keep.

Now here comes that rate hike, and the markets drop.

You still own the stock you bought, which now has the potential to increase in value - even high enough to offset any capital losses from the shares' drop in price.

What's more, you can keep your upside open.

Here's what I mean.

If the market's plunge has dinged a quality company, like Microsoft or Apple Inc. (Nasdaq: AAPL), the married put gives you a juicy opportunity.

You can use the profits from the put to beef up your position in the stock at a tidy discount. In essence, you're cost-averaging down the price of a great stock while cashing in on a plunging market.

If that's the aftermath of a rate hike, bring it on!

Tom is showing his Money Calendar Alert readers how to potentially make five years' worth of profits on gold before this autumn. It has to do with an extremely lucrative pattern he's discovered. Click here to learn more...

Follow Tom on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.