There's no way to eliminate risk 100% when it comes to investing.

I can't do it. You can't do it. (And if anyone tries to tell you otherwise, take your money and run.)

There's just no such thing.

That said, there is one way you can make any investment risk-free under the right set of circumstances - by using one of my favorite Total Wealth Tactics: the free trade.

The concept of a risk-free investment is not new. The allure of risking nothing and gaining everything has been around for centuries.

Case in point...

...the Tulip Bulb Crisis of 1634-1637

...the South Sea Bubble of 1711

...the Florida Real Estate Crash of 1926

...Bernie Madoff's Ponzi scheme

So, why is it that you hear the term in widespread use today?

Because Wall Street only associates risk with loss.

That's why you're told U.S. Treasuries and other government paper are risk-free investment choices, even though they know full well that there are risks inherent in every investment. It's a game of semantics.

It's also a game, incidentally, that Wall Street's big traders desperately want you to play because it forces you to implicitly buy off on the most profitable strategy of all (for them) - diversification.

No doubt you've heard that term before - just probably not like I'm about to explain it to you.

"Diversification" Is a Marketing Tactic

Diversification is the idea that if you spread your risk around in different asset classes and investments - like stocks, bonds, cash, real estate, and the like - you'll be better off. The thinking is that not everything can possibly go down at once.

It's also a concept that's been around for a while. In fact, the theory was first noted in the book of Ecclesiastes written around 935 B.C. It's also mentioned in the Talmud. Even Shakespeare picked up on it in "The Merchant of Venice" hundreds of years ago.

But it's absolutely wrong.

Ask anybody who got their portfolio halved twice in the last 15 years - first during the dot-bomb implosion from 2000-2003 and then the ongoing financial crisis that kicked off in 2008 with a vengeance. "Everything" went down at once... both times.

And it's not just me who thinks so, either.

Warren Buffett notably quipped that diversification "makes very little sense for those who know what they are doing."

The legendary Jim Rogers famously observed that "diversification is something brokers came up with, so they don't get sued." To which he added in a 2016 Business Insider interview on the subject, "if you want to get rich, you have to concentrate and think differently."

I agree very strongly.

Wall Street doesn't want you to put all your eggs in one basket because - they'll tell you - it's riskier. To which I reply, "for you" because spreading your money around means they earn higher commissions, they have a greater number of opportunities to pick your pockets, and they can prey on your worst fears.

I believe you've got to think about risk differently in today's highly computerized and interlinked global markets, especially when it comes to your winners.

Again, Mr. Rogers and I agree. He notes - and I'm paraphrasing - that you want to put all your eggs in one basket... just make sure it's the right basket and watch it carefully.

My logic isn't sophisticated.

Put simply, nobody ever went broke taking profits, but plenty of people have gone broke taking losses. So it not only makes sense to concentrate your assets using appropriate risk management, but also to harvest your winners when the markets are strong. That way you'll have opportunity at hand rather than be forced to run for the hills when the markets are weak.

It doesn't matter whether you've got a lot of money or just a little, the principles driving our discussion today are exactly the same:

You want to capture profits every chance you get; and,

You want to take risk off the table at every opportunity.

Preferably, both at the same time.

Here's a Real-Life Example of How This Works

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

I recommended Raytheon Co. (NYSE: RTN) to my Money Map Report subscribers in August 2011 because it was closely tied into one of the single most powerful Unstoppable Trends we follow: War, Terrorism and Ugliness. It was trading at $46.05 a share then.

By November 2013, the company's stock had risen to $85.19, and dividend payouts had reduced the cost basis to $42.51, so subscribers who followed along as directed were sitting on returns of at least 100%. ($42.51 x 2 = $85.01) In keeping with what I've just explained, I recommended selling half the position to capture profits and redeploy the proceeds into subsequent recommendations. I also suggested that they let the remaining shares run.

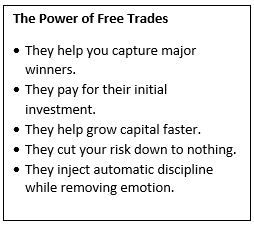

I call this a "free trade," because you not only get back your original investment, but you maintain all the upside you can handle, essentially "for free." Even better, because you've now "paid" for your investment, you can stay in the game with not an additional dollar at risk... even if the stock you've just harvested has a sudden reversal in fortune and goes from hero to zero.

By capturing profits when we had the chance, subscribers ensured that their focus was on winning and on new opportunity, exactly as a savvy investor should. Not losing their asteroids, as is the case for most investors when the markets take a hit.

As part of that move - selling half their RTN shares - subscribers were left with a remaining position in Raytheon that could literally go to zero and they wouldn't lose money. Obviously, that's a very unlikely outcome for such a major player. (And I'll show you how the trade turned out in just a moment...)

So while it's not literally risk-free, I would argue that it's as close as you can get to the term's true meaning.

What I like about this most is that a free trade works: a) in all kinds of market conditions, b) on any investment, and c) can be set up well in advance. That means you don't have to be planted by your computer nor be an aggressive day-trader to make it work.

What I like about this most is that a free trade works: a) in all kinds of market conditions, b) on any investment, and c) can be set up well in advance. That means you don't have to be planted by your computer nor be an aggressive day-trader to make it work.

No other technique I know of comes close in terms of simplicity or effectiveness.

Plus, you know exactly what price is required to harvest your gains - and remove your risk - in advance. In fact, you can set up your order to sell half of your investment for at least a 100% gain the moment you buy a stock you're interested in. Or any investment for that matter.

Contrary to what a lot of people think, the "free trade" is not about reducing potential at all when it's properly executed. That's because you can then take the money you've pulled out of a free trade and immediately lateral it into another opportunity while letting the rest ride.

So How Did the Raytheon "Free Trade" Work Out?

The stock closed yesterday at $166.13. Meanwhile, after collecting more dividends, subscribers' cost basis is now down to $39.85 per share. Anybody who's followed along has had the opportunity to capture at least 100% while the remaining shares continue to appreciate. Returns are now north of 316.80% and climbing.

Meanwhile, they've also had the opportunity to put the profits they captured from the "free trade" into subsequent recommendations that have allowed them to repeat the process yet again and, in the process, build their capital even faster.

Imagine how fast your money can grow if you do this once, twice, three times, or more - all from a single Total Wealth Tactic used at the right time.

The markets want to hand you money every day... all you have to do is make sure you're ready to grab it.

Editor's Note: "Must-have" companies backed by Unstoppable Trends are a cornerstone of Keith's wealth-building strategy. But there's another type of investment he wants Money Morning Members to know about. It's one of his favorites, a kind of "desert island fund" he'd buy if he had to park his money in one place, "retire" from civilization for 20 years, and come back to a pile of money. Click here to learn more…

The post Make Any Investment Risk-Free in One Move appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.