The market is getting ready to kick off another roller coaster ride...

If you've kept an eye on the news lately, then you know what I'm talking about. There are a ton of drivers pulling stocks back and forth right now.

Third-quarter earnings reports are being released every day, public impeachment hearings drag on, the trade war is barreling on without a deal - and to top it all off, the holidays are about to hit.

There's something brewing in the market right now, and it's about to explode - and even experienced traders don't know the truth behind it.

Today, I want to share something with you that most traders don't know. It's one of the biggest secrets in the world of options...

And this is how it could drop some serious cash in your pocket...

Options are comprised of two kinds of value: intrinsic and extrinsic (also called real and time value, respectively).

This value goes into how an option is priced - and more importantly, it's an essential part of your own profit-taking strategy.

Now, most traders don't know this, but an option's extrinsic value includes more than just time value...

It also contains something called "implied volatility" (IV).

Extrinsic Value = Time Value + Implied Volatility (IV).

An option's IV can fluctuate wildly - and that translates directly to wild fluctuations in price.

The general rule of thumb is that a 1% change in IV translates to a 1% change in the option's price.

So, if you buy an option and the IV of the option drops 20%, your option will drop 20% as well, even if nothing else changes.

Of course, the opposite is true as well.

Clearly, it's critical to understand IV and, in particular, what the IV of an option is before you buy it.

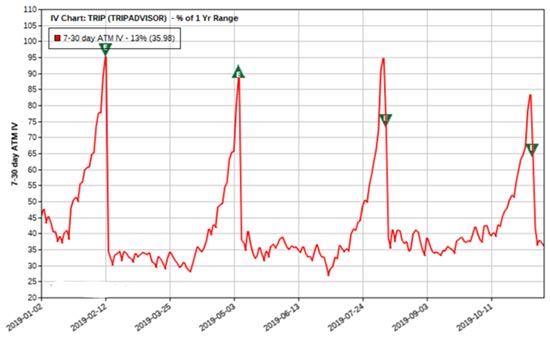

Let's take a look at an example. Below is an IV chart for TripAdvisor Inc. (NASDAQ: TRIP).

The green "E" triangles are earnings announcements. The red line is the amount of IV in TRIP options. As you can see, IV consistently runs up into earnings, meaning that TRIP options become more expensive - something we've talked about before.

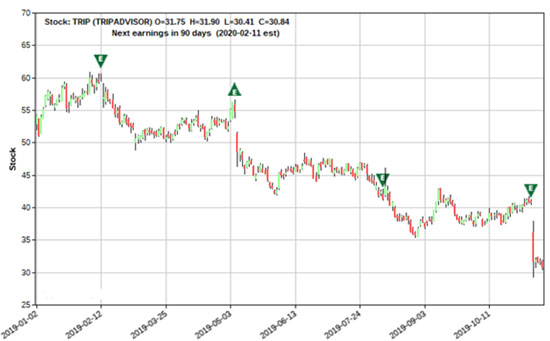

Why?[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]TRIP happens to gap at earnings. Take a look at the corresponding TRIP stock chart:

You can see that over the past four earnings periods, TRIP tends to gap after the announcement. Option traders know this, and as an earnings report approaches, they will pay more for options. As the demand increases, IV increases - and options get more expensive.

Notice also that immediately following earnings, TRIP's IV drop likes a rock... as does option value. Buyers of options right before the announcement will suffer what's called "IV crush." Expensive options become cheap overnight, leading to dramatic losses.

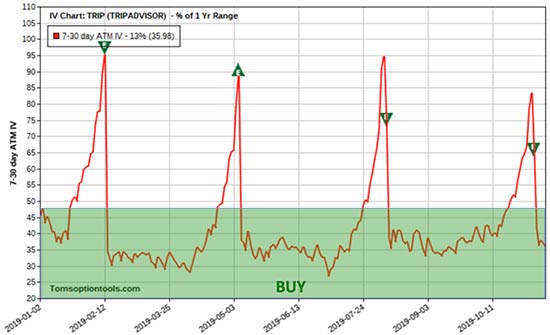

So, here's a simple rule to avoid IV crush:

Buy options when IV is in the lower 25% of its annual range.

These options are considered cheap or fair-valued.

On the TRIP IV chart below, it is advisable to only buy options when the IV is in the green zone.

I have scanners that can both build IV charts and tell me the IV of a specific option. Some brokers will provide IV charts as well, and there are a handful of online services that provide them.

Now, don't think that high IV should necessarily be avoided...

With the right strategy, you can build trades that profit as IV rushes into earnings, for example. But we'll talk about generating profits in high-IV environments another time - keep an eye out.

Understanding IV will not only keep you out of trouble, but can also result in bigger and faster profits for your wallet.

Take Your Options Trading to the Next Level: Tom Gentile's showing subscribers how to make fast profits - real money - in three simple steps. You could be cashing in on some of the biggest stocks on the market. Click here to learn how.

The post Most Traders Don't Know This Lucrative Options Secret appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.