There's a reason people always say, "bulls climb up the stairs and the bears fall out the window."

This old adage is true - stocks tend to fall more quickly than they rise. And bigger bears - meaning more expensive stocks - fall even faster and harder.

The past three weeks, I've shown you three of my favorite trading strategies to help you turn the biggest profits in any market- calls, puts, and call spreads...

But when these big bears start to fall, none of those strategies are going to cut it - you could end up losing thousands of dollars, and fast.

So here's the only trading strategy you can use to walk away from these massive drops unscathed...

Prevent a Four-Digit Loss by Using Spreads

There are thousands of stocks in the market, and while some will only cost you a few cents, others can run you as high as $2,000 per share.

Because these stocks are so expensive, they present some serious opportunities when they start to move - and that direction doesn't always have to be up.

$1 Cash Course: Tom Gentile is offering a rare opportunity to learn how to amass a constant stream of extra cash – year after year. And he’s going to teach you how to do it entirely on your own. Learn more…

When an expensive stock starts to drop, you have the ability to take home some serious cash. There's only one roadblock - they can be too expensive, even if you're just trying to buy a put.

And that's exactly why we use long put spreads, also called bear put spreads.

Now, they work almost the same as a long call spread - except we want the stock to go down, not up.

Here's what I mean...

Take a look at this chart on market behemoth Amazon.com Inc. (NASDAQ: AMZN).

On October 8, 2018, AMZN closed well below $1,900 support level on above average volume. And it came up on my scans as a 10/30 Moving Average (MA) bearish cross - at $1,864, this fat bear looked poised for a fall...

Risk Less Capital by Pairing Two Different Puts

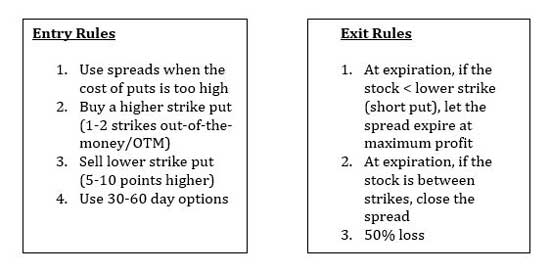

When I anticipate a short term drop in the stock like this, I like to trade options with 30 days to expiration - that way, we can lock in some fast cash.

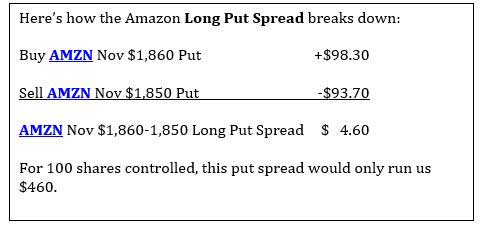

So, I looked at AMZN's November options - particularly, the November $1,850 put. You can reduce the cost of this put by selling another put with the same November expiration - but a lower strike price.

For example, if you sell an AMZN Nov $1,850 put for $93.70, you reduce the cost of the trade by $9,370!

This put spread gives you the opportunity to rent 100 shares of stock. Now, that's worth $186,400 - but you're only paying $460.

And the cost of the spread is the maximum risk - so worst case, if the stock rises instead of falling, the most you'd lose is what you paid.

That right there is a perfect illustration of how options can minimize risk, protecting your wallet in the process.

The Rights and Obligations Behind a Long Put Spread

Now, it's important to remember the rights and obligations of a long put spread...

Buying put options gives you the RIGHT TO SELL the stock at the strike price. So, you can sell the underlying stock. But you don't have to.

Selling put options, or shorting the stock, gives you the OBLIGATION TO BUY the stock at the strike price. This means if someone else exercises their right to sell, then you have to buy it.

Now, you don't need to worry about the obligation to buy. That's exactly why you're buying another put with a different strike price.

The short Nov $1,850 put is covered by your long Nov $1,860 put. In other words, the obligation is covered by the rights.

Minimized Risk Caps Your Maximum Profit

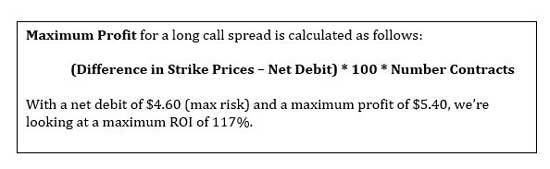

If AMZN rises above $1,850, the worst case is that you'll have to buy AMZN at that price. This sounds like a lot of money - but we coupled this transaction with the right to sell AMZN at $1,860, giving the spread a worth of just $10. Just subtract your net debit from your total spread worth, and you're looking at a maximum profit of $5.40 per share.

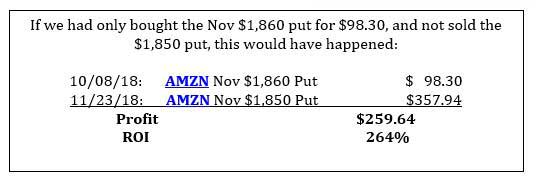

It's important to note that by selling the lower strike put, we're giving up our upside and capping the profits that would be available if we only bought the long put. So, we are technically sacrificing unlimited reward of a straight put - but we're doing it for a good reason:

Lower risk.

How a Long Put Spread Leads to Profits

On expiration of our long put spread, AMZN had dropped to $1,500 - well below both of our long put spread strike prices.

With the stock well below both of our put strike prices at expiration, both legs' rights and obligations were carried out - netting a maximum profit of $540 or 117% ROI - not a bad profit for a single spread!

Now, even if this is a higher profit than what we got from our spread, remember - we would have needed $9,830 to play. All the stock had to do was go the wrong way, and we would have lost the entire investment.

With the spread, we were still able to rake in a high profit, while greatly reducing our risk along the way.

The Most Important Rules of Long Put Spreads

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Not all of your long put spreads will end up at maximum profit like our example did though. As the second and third rules describe, you will have to close your spreads out from time-to-time.

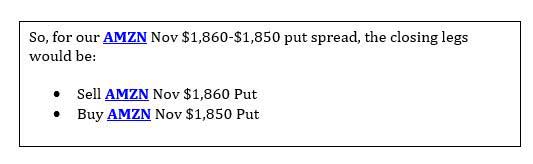

To close a spread, simply sell the put you originally bought and buy the put you originally sold.

And that's a wrap on my special options training series!

We've explored the worlds of calls, puts, long call spreads, and long put spreads - along with rules for trading them.

Now you know exactly how these strategies work. And next, I'm going to show you exactly how to start collecting anywhere from $1,190, $1,313, and even $2,830 in consistent income with my seven-day crash course. (See all the details right here).

This course covers all the essential trading ideas you need to know to potentially make thousands in extra income every week.

But these classes are not for everyone...

I put these together for ONLY those who are ready to move beyond living paycheck to paycheck. For those who want the opportunity to make substantial changes in their lives. And for those who are serious about taking control of their financial futures.

Click here to learn how to access my latest one right now.

The post Prevent Your Next Portfolio Crash with This High-Flyer Insurance Policy appeared first on Power Profit Trades.

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.