You may have been seeing a lot about "share buybacks" in the news lately - especially after Apple Inc. (Nasdaq: AAPL) announced a new $100 billion stock repurchasing program.

Now, I know that "buybacks" may not sound like the most exciting thing in the news right now - but the truth is, they're extremely important for the overall market.

In fact, they're even more important when the major indices are in the red - like we saw on Tuesday when the Dow plummeted nearly 200 points.

But that's where a buyback comes in...

Not only could it be the catalyst for the start of a new rally higher, it could open the door to new, lucrative trading opportunities - like this one...

Three Reasons Why Share Buybacks Are Good for Your Bottom Dollar

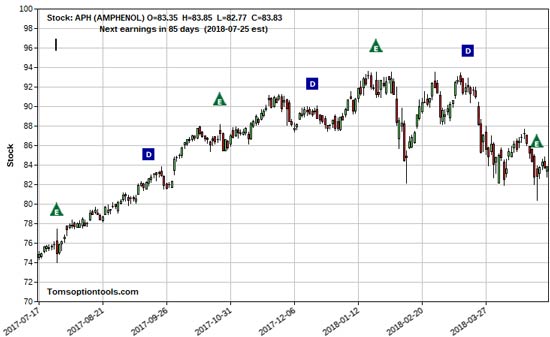

The Amephenol Corp. (NYSE: APH) is an electronic and fiber optic manufacturing company in Connecticut. Late last month, on April 25, the company released their earnings and beat all expectations, including earnings per share and reported revenue.

But more importantly, they recently announced their plan to execute a $2 billion share buyback program that will be equal to 7.9% of their stock.

Now, buybacks are always a sign of good things to come. You see, they tell investors that the company has confidence in its growth prospects - and it also shows confidence in the operations, sales, and revenue-producing potential over a longer haul. And this make the company much more appealing to investors, because you know the stock has the capability to continue climbing in price.

Top Five: These tiny Canadian pot stocks are set to skyrocket. Click here...

Here are the top three reasons why share buybacks are good for the stock market - and your pockets:

- They prove to investors that a company is confident and expecting growth in the near future.

- They are a way to also pay off investors and reduce the overall cost of capital for the company.

- They show that a company believes its shares are undervalued so they can pick them up at this suppressed price and then issue them back at a higher value when the price increases.

How to Bank 200% on Amephenol's Share Buyback

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Now, APH does not have Long-Term Equity Anticipation options (LEAPs, for short) - and the farthest out option expiration is October 2018.

But here's a trade idea for you to consider...

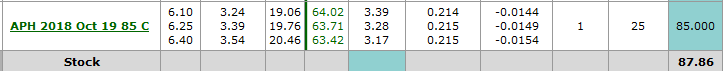

Oct. 19, 2018 $85 Call

Now, the current price is $6.40 - which means your total cost would be $640 (remember, one contract controls the rights to 100 shares). That's why I always say - flip stocks - don't buy them outright. To give you an idea, buying 100 shares of APH, at the time of writing, would cost you $8,828 - or 1,279.37% more than buying one single options contract.

Pretty big difference...

The ideal setup for this trade would be to close half of your position when your trade doubles in value and close the remaining half for another double. That's a 200% profit on one trade - not too shabby.

Of course, this is a trade consideration only - so you'll want to speak with your broker to determine the most suitable profit plan for your needs.

And speaking of profit plans...

This Easy-to-Follow Blueprint Could Make You $15,000 Richer

For most of my life, I was an average Joe scraping to get by. I was tired of busting my butt, and I didn't want to be stuck at a job I didn't like until I was 80.

So I taught myself how to trade. I had a knack for it, and I became richer than I ever thought possible.

Then I invented my patent-pending Money Calendar. I didn't want to keep it to myself - because I knew it could change people's lives.

Now, for the first time, I'm revealing all the trading secrets and strategies I've used to become a multimillionaire... so you can amass a fast fortune for yourself.

Step by step, click by click, I'll guide you through setting up your account - and show you how to set up a series of take-it-to-the-bank payouts of $605... $822... $1,190... $2,830 every single week.

I'll give you an easy-to-follow blueprint for achieving complete financial freedom. No guesswork - all you have to do is decide to follow along!

And the best part is... it'll only take you 10 minutes per day! Click here now to start this once-in-a-lifetime journey...

The post Score a Quick and Easy 200% Profit on this Latest Buyback appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.