Quick! What do the following have in common?

... Gordon Ramsay

... Kim Kardashian

... Major League Baseball

They're all third-party personalities and licensed brands for one of the hottest turnaround plays I can find in one of the hottest sectors going - mobile gaming.

Best of all, shares are still under $5.

Ordinarily, this wouldn't interest me for a New York minute. My family and I would rather be out living life than watching it or playing games about others living theirs. However, that's not true for millions.

And that's, of course, your entry.

Global game markets are expected to grow to $128.5 billion by 2020, according to market research firm Newzoo. What's more, mobile games are expected to grow from 32% of that market share to 40% or roughly $72.3 billion.

No doubt you know exactly what I'm talking about if you're of a certain "vintage" like I am because the transformation is taking place in front of our very eyes.

This, for example, was going to the museum when you and I grew up:

Source: Public Domain, PxHere CCO

This, however, is what it looks like going to museums nowadays:

Source: David Hughes

This was enjoying the "experience" back in the day:

Source:© Unsplash

This is what enjoying - err - "sharing" the experience means today:

Source: CNN.com

Smartphones are taking over our lives, and that means there are some huge profits up for grabs.

Especially when it comes to gaming.

People don't just stand around and talk anymore.

They "game."

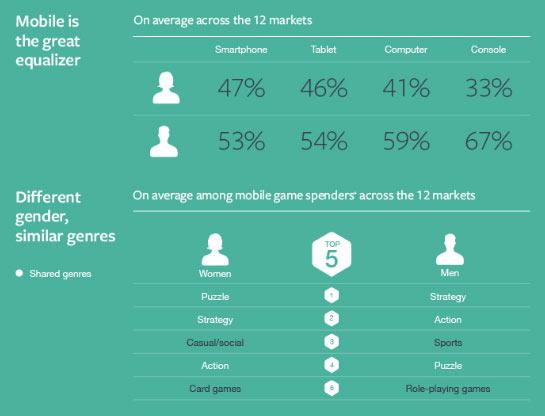

Surprisingly, men and women are roughly equal in terms of use. Mobile gaming, to borrow a Facebook Inc. (Nasdaq: FB) term, is the great equalizer.

What the two genders play differs, but not by much, as you can see in this slide excerpted from Team Zuckerberg's a.k.a. Facebook's research.

Source: Socialmediatoday.com, Facebook Research

At the same time, development costs are dropping like a rock as online coding libraries, artificial intelligence, and mobile markets grow. Especially when we're talking about "franchise games" involving specific personalities and well-known brands.

It's not uncommon for a celebrity to rake in millions for third-party licensing arrangements. Kim Kardashian bragged on Twitter Inc. (NYSE: TWTR), for example, that her game, "Kim Kardashian: Hollywood" generated $80 million in royalties that went, not surprisingly, right into her pocket.

It's less common, however, for gaming companies to engage in collaborative deals with major studios producing their own content.

Especially creative content.

The Best Turnaround Play to Get In On Now

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

That brings me to Glu Mobile Inc. (Nasdaq: GLUU).

Until very recently, GLU was a slow-motion train wreck driven by single-hit, celebrity-focused games that often fell to earth after a brief burst to "hot" status. Examples include the company's failed attempts with Katy Perry and Britney Spears that just didn't cut it with paying customers that stand in sharp contrast to celebrity chef Gordon Ramsay's four-letter filled variant.

Shares tumbled from a high of $7.60 in July 2015, all the way to a low of $1.73 in November 2016.

Then, at the click of a key - pun intended - management changed their thinking and the company's course. The stock is, once again, tracking higher, and the company's user base appears to be on the rise again.

Urgent Video: Keith just posted this 5-minute video message from his home office. In it, he's doubling down on the $9.75 wager he made last November... and he insists the numbers are massively in his favor. Watch now!

In this case, growth is being driven by a relatively new - but proven - CEO named Nick Earl who came on board in 2016. If that name is familiar, it's because he ran Worldwide Studios at Kabam and had been a Senior Vice President at Electronic Arts Inc. (Nasdaq: EA), a company that I've recommended in the past.

Earl's pivoted the company towards what he calls a "creativity first" strategy. And, in doing so, he's made heavy investments in upgrades to evergreen gaming platforms like WWE and MLB TSB 18, while also developing newly built partnerships with Disney Consumer Products (Walt Disney Co. [NYSE: DIS]) that will include the next best thing to an annuity... Disney and Pixar characters.

Shares are trading at $4.28 as I write this, but could easily hit $10.87 by the end of next year if things go according to a simple equation:

- High estimate for 2019 is $0.29 per share.

- PE ratio of 37.49, which is equivalent to Electronic Arts.

- PE ratio of 37.49 x $0.29 per share = $10.87 by the end of 2019.

If you're interested in following along for faster and potentially bigger profits, don't just buy the stock. Consider the GLUU Jan. 18, 2019 $7.00 Calls (GLUU190118C00007000) as an alternative or as a compliment.

Don't dally, though.

There have been five major institutional shareholders buying at least 1 million shares over the past quarter and only one selling, which tells me that the big money is warming up to the situation I've laid out for you today. Until very recently, it was the other way around, with more selling than buying.

Revenue shot up sharply from 2016 to 2017, representing a 43% increase year over year.

It's also worth noting that the company wants to end 2018 with at least $80 million in cash and no debt, which suggests positive cash flow of around $20 million a year.

As always, keep your risk management front and center if you decide to get on board.

Most investors don't get in trouble because they lose every now and then; they get in trouble because they lose too much.

The 2% Rule we've talked about many times applies, meaning you keep total capital at risk in this trade (or any other speculative trade) to 2% of investable assets.

That way you're still on track for what could be a quick double and then some, but without the risk of blowing up your portfolio if the markets reverse or the company fails to gain traction.

People ask me frequently if a trailing stop would work in a situation like this one, but at under $5 a share, the better way to play is to limit risk before you buy, because that price point doesn't leave a lot of maneuvering room.

Remember, always focus on the upside!

Your Rare Second Chance at a Piece of $9.75 Million

Keith Fitz-Gerald is doubling down on the $9.75 million wager he made last November.

Back then, only a handful of people could take him up on the bet.

But now they're getting the chance to pocket accelerating average gains of 286%, 425%, and 571% per week (including partial closeouts).

Don't miss your rare second chance to join them - this 5-minute video explains it all.

The post The Best Turnaround Play I Can Find Is Still Under $5 (For Now) appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.