The Dow Jones Industrial Average is trading at historic highs for the first time since it broke 21,000 in March. The Nasdaq has also broken to new highs, thanks in part to positive earnings reports for many of its larger-weighted stocks.

Despite these highs right now, history tells us that between now and the end of October, we'll see declining or flat markets.

But one particular sector offers two advantages that make it an optimal addition to your portfolio right now.

And it's virtually "market-proof..."

Why Utility Stocks Are a Good Bet This Month

One thing I've witnessed in my nearly 30 years of trading is that the utilities sector sees an influx of capital during a downtrending or flat market environment. This happens largely because investors sell their equities in anticipation of lower prices and move some of their capital to the stocks that have a history of paying strong dividends. And utility stocks can offer just that.

Utility stocks primarily invest in the gas, water, and electric companies that supply water and power to cities and municipalities. People primarily invest in these funds for income and, secondarily, growth. But they don't tend to park their money in these stocks until May (when they typically depreciate in price). Keep in mind that stocks historically return lower gains between now and the end of October and return higher gains between November and April. So when utility stocks are at low share prices, you typically see some nice dividends, which makes them even more enticing to investors.

This sector is largely deemed market-proof because it's considered to be a defensive investment. The reason being that people need gas, water, and electricity no matter how good or bad the economy is. And obviously, none of those are things that people can simply decide to stop paying for.

But here's the thing...

Don't expect these stocks to move high very quickly. By nature, they take longer to move higher in price compared to a speculative stock that offers higher growth potential. That's why growth is really a secondary investment objective.

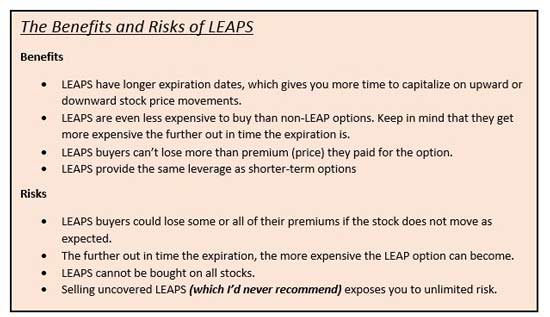

So when it comes to trading ideas, I wouldn't consider trading weekly options on these guys. Options with at least six months until expiration are a much better idea. Long-term anticipation securities (LEAPS) are even better because they're more conservative, with expirations that are much further out in time - making them a safer option to consider.

Now, you should always speak with your broker or financial professional to determine which utility stocks would be most suitable for your portfolio. But you can do a quick and easy search on the whole sector on any financial website.

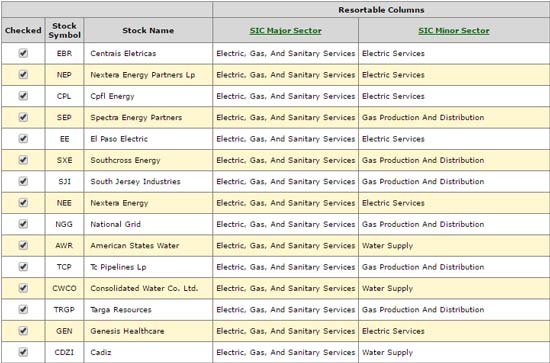

I used my proprietary tools to run a scan on the electric, gas, and sanitary services sector. Then, I ranked them according to dividend payout. And these are the top 15 from that list:

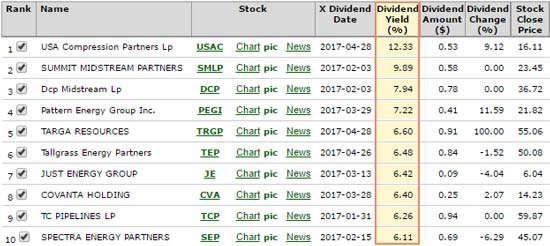

I added these 15 stocks to a watch list and ran another scan on the sector to rank the ones with the highest dividends, which is below. Keep in mind that this list looks different than the one above because it ranks these stocks in descending order (from highest to lowest):

And as you can see, the winner is clearly USA Compression Partners LP (NYSE: USAC). Below is a chart of its price movement since Election Day, which shows USAC trading in a low support range. It also already posted a dividend payout, and you'll want to keep in mind that stocks tend to trade down by the equivalent of the dividend payout. So you'll also want to factor in a potential increase in price due to a buying catalyst over its low price...

Again, this is a trade consideration - not a recommendation - so be sure to speak with your broker before adding to your portfolio.

Don't Miss: This investing strategy has delivered 217 double- and triple-digit peak-gain winners since 2011. And you can get access for just pennies a day. Learn more…

The post The Most "Market Proof" Sector to Trade in May appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.