"Not unless hell freezes over."

That's what I would have told you 35 years ago had you asked me to recommend a "pot" stock... even if they were legal back then.

Times change.

Hell has just frozen over and that's exactly what I'm going to do today...

...recommend a "pot" stock.

Several, actually.

Let me explain.

News broke earlier this week that Constellation Brands Inc. (NYSE: STZ) made a $191 million investment for 9.9% of Canadian marijuana company, Canopy Growth Corp. (OTCMKTS: TWMJF).

This isn't just another merger for the history books, which is how the transaction was widely reported in the national news cycle. It's a monster deal that "green lights" the kind of profit potential that we know from past experience comes with massive game-changing investments.

First, this deal single-handedly legitimizes a $53 billion industry and in turn creates profit potential that's at least double that when the smoke clears - pun absolutely intended.

Second, the acquisition changes "pot" stocks from purely speculative undertakings suitable only for your riskiest capital on par with the Iraqi dinar, Zimbabwean dollar, and Bitcoin, to quality investments that can produce windfall profits year after year on par with choices like Altria, Diageo, and yes, Constellation itself.

Third, Constellation has just broken the taboo associated with marijuana, which means that other top-tier competitors aren't far behind; they'll have to get in the game or risk getting left behind - something no self-respecting CEO can risk in today's hotly competitive markets. In fact, I'll be very surprised if we don't see similar moves from Pernod Ricard SA (OCTMKTS: PDRDY), Diageo (NYSE: DEO), and Anheuser-Busch InBev NV (NYSE: BUD) in short order - all of which I'm watching very, very closely at the moment for signs of similar deals.

One of the Most Volatile Sectors in the Markets... Until Now

Pot stocks, canna-vesting, the "Green Rush" - whatever you want to call it - marijuana investing has been all over the headlines recently as states across the country have begun to legalize the green stuff for recreational or medical use.

Not surprisingly, millions of investors jumped on board thinking this was their ticket to financial freedom, only to get badly burned via questionable stock offerings touted by even more questionable individuals.

It was less than three years ago that investors lost a whopping $23 billion buying marijuana penny stocks like Growlife Inc. (OTCMKTS: PHOT), Advanced Cannabis Solutions Inc. (OTCMKTS: CANN), and MediJane Holdings Inc. (OTCMKTS: MJMD). More will follow when the SEC concludes a number of "pump-and-dump" investigations rumored to be in the works.

If only the problems stopped there. Earlier this month, the Toronto Stock Exchange announced it would be delisting stocks for marijuana companies that weren't in compliance with U.S. federal laws. Examples include Aphria Inc. (OTCMKTS: APHQF) and Maple Leaf Green World Inc. (OCTMKTS: MGWFF), both of which are pursuing growth and distribution efforts stateside.

If You Can't Beat 'em, Join 'em... and Profit

Before today, some of the largest opponents to marijuana usage and legalization have been alcohol companies, but Constellation's move changes the game. Where before the alcohol producers saw competition in cannabis, they now see dollar signs.

The way I see things, Constellation's acquisition is the ultimate "sin" stock move. Only, the end game is NOT smoking-related products nor traditional alcoholic beverages as the standalone product lines they've historically represented.

It's cannabis-infused drinks, which means there's a crossover effect.

Alcoholic beverages are a $223.2 billion a year industry in the United States alone, and it makes sense that a major beverage company like Constellation would move in as a narcotic like marijuana goes mainstream, because that means it can potentially reclassify an entire product line when it crosses from one genre to another.

Pot brownies won't hold a candle to what's next!

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Cannabis has obviously come a long way since Jeff Spicoli, the constantly stoned surfer played by Sean Penn, rolled out of his smoke-filled VW van in 1982's hit movie, "Fast Times at Ridgemont High."

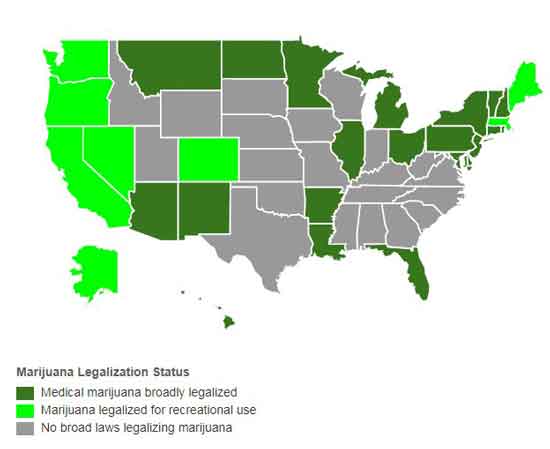

There are 29 states in the United States that have legalized medical marijuana as of press time, along with the District of Columbia. Of those 29, eight have also approved marijuana for recreational use. Canada's on board for medical use nationwide with recreational approval expected no later than mid-2018.

Most recent numbers show that nearly 55 million adults regularly smoke, toke, or vape marijuana in the United States alone.

Soon they're going to be able to drink it, too.

What you need to know is that Constellation's move hints at an entirely new industry being created in plain sight - something you see but once or twice in your investing lifetime if you're lucky. And that's why I think you've got a ginormous opportunity on your hands.

I believe Constellation's move is a powerful signal that the beverage company intends to develop, produce, and market a line of cannabis-infused drinks that are tested (initially, at least) in Canada. And, importantly, that other major players will follow.

This isn't a stretch when you think about it, particularly if you've ever had a Bud Light Lime, spiked seltzer, or tried fruit-flavored martinis, infused sakes, and the like. The flavored alcoholic beverage market is the one of the largest in the broader adult beverage sector, second only to beer.

BDS Analytics, a cannabis market data research company, reports that 45% of cannabis consumers have already tried "pot" infused concoctions. This is still a lot lower than the 85% who have reportedly tried cannabis-infused baked goods (like brownies), but still serves as an important corollary to the potential ahead.

The situation reminds me a lot of absinthe, an alcoholic drink made from grande wormwood that was illegal here until very recently because of its mind-altering effects.

Like marijuana, absinthe was the toast of the town - literally - in the late 1800s, and a favorite of creative types including Vincent van Gogh, Paul Gauguin, and even Ernest Hemingway... until it was banned for supposedly causing a wide range of social problems.

Reintroduced in 1988 under a law spanning the entire EU, absinthe is once again legal for personal consumption. It's also been reintroduced in the United States for personal consumption and possession but not sold in bars, which ought to sound very familiar given today's conversation.

Anyway, now on to the fun stuff - how you can profit.

I see three ways to play the emerging opportunity we're talking about today.

1) Buy shares of Constellation Brands Inc. (NYSE: STZ). The stock is trading at $218 a share with a forward PE of 25.19 that will probably prove conservative once earnings come in line with the expected revenue I think cannabis-infused drinks will generate. You could also lateral into a choice like distilled beverage company Pernod Ricard (OTCMKTS: PDRDF), which hasn't yet announced its intentions to make a similar move. (If you believe like I do, it'll be making a similar announcement shortly).

2) Buy Canopy Growth Corp. (OCTMKTS: TWMJF). It's an obvious choice. Problem is, it's also now a fully valued one, which means you're probably going to be "in line" with expectations going forward. The play here is the pilot development of cannabis-infused drinks in Canada and the lead that gives the company when it comes to international expansion.

3) Then there's the Horizons Medical Marijuana Life Sciences ETF (TSX: HMMJ), which trades on the Toronto Stock Exchange. Right now, the ETF includes a wide range of pot stocks, but what attracts me is the willingness to add ancillary plays that are important to the industry, like Scotts Miracle-Gro Co. (NYSE: SMG), for example.

Pot stocks are riding a huge wave of wealth - more than $6.7 billion. And these three opportunities are just the tip of the iceberg.

My colleague, Michael Robinson, has put together an 89-page "pot investment" plan that gives step-by-step instructions you can follow to learn how to get started. If you move now, you'll have the chance to make a fortune in the weed industry with just a tiny stake. Get all the details here.

In closing, I want you to stay tuned.

Today's column is the first of many conversations to come given the enormous profit potential the Constellation deal unlocks.

The post The ONE Signal I've Been Waiting for on "Pot" Stocks appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.