There's no question about who won 2017. It was cryptocurrencies. But, more specifically, it was Bitcoin, which has absolutely exploded.

In 2017, Bitcoin, the one that started it all, went from less than $1,000 a coin to above $19,000 on the Coinbase exchange. Since then, it has pulled back some, but it's still well above $16,000.

That high represents a better than 1,900% increase in price.

So other than my mother-in-law and niece and garbage man asking if they should get in, I decided to find out if there's a trend in Bitcoin that wasn't there before now that people who aren't typically traders or investors are interested.

What I found was especially interesting because it reminded me of another kind of currency rush...

I have to admit that the recent moves in cryptocurrencies have made me a little nervous. I'm not worried about my own investment, as I was able to get into Bitcoin at next to nothing.

I'm worried about my family, friends, and even strangers who are asking me about it. My concern stems from what I'm seeing in the two charts below.

Everyone has seen the first chart, but the other one very few have seen...

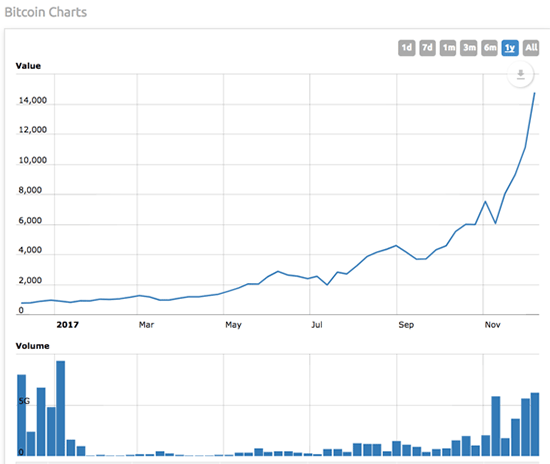

Notice the volume at the beginning of the year and the volume at the end. The big interest at the beginning of the year came as it crossed above $1,000. The more recent interest was due to its exponentially growing valuation and all the positive news it had been receiving - from its growing ubiquity and number of partners to offerings from the CME (Chicago Mercantile Exchange) and CBOT (Chicago Board of Trade) to trade Bitcoin futures.

If this isn't legitimizing Bitcoin as a currency, a mainstream one at that, then I don't know what is.

Most technical traders would admit that the combination of rising volume and rising prices makes for a bullish pattern. Although this isn't a regulated security, it's possible that the rules could be thrown out here.

So, aside from telling my Uber driver what I do for a living and having him ask me if he should get into cryptocurrencies, is there a trend in Bitcoin that wasn't there before now that people who aren't your typical traders or investors are interested?

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

There's one way of finding out, and that's with my favorite website: Google, which, incidentally, just handed us our 68th double of the year.

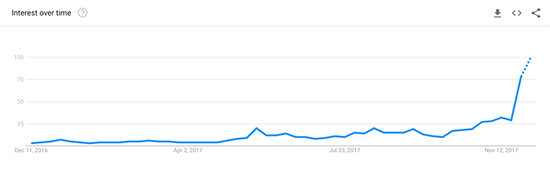

The chart above comes from Google Trends on Bitcoin. What we see here is the interest over the year. Interest started trending in September with a huge pop in November. This interest trend tells us that the Internet has really spread the word about Bitcoin.

As I mentioned earlier, my investment was next to nothing. My cost of entry was a computer and some education on mining back in 2013, so I literally own my Bitcoins at zero.

I mined Bitcoins out of the garage of my house with my son keeping tabs on the computer. We were part of a mining pool, meaning I pooled resources with others and as we found tokens, we shared in the rewards. From there, I deposited my coins in Coinbase.

I have long since gotten rid of the Bitcoin mining computer. My wife had a problem with the garage being 90 degrees all year long with all the heat coming off the processors. For a while afterward, she would let everyone know her displeasure with my Bitcoin mining project.

Fast forward to now, and she doesn't mind it as much with the current prices of Bitcoin.

Mining for almost no cost means I currently have nothing at stake. If you were to set up a mining machine, it would cost much less than shelling out almost $20,000 for a coin.

That way, you would have no greed or fear in this area. You could hang onto it for as long as you wanted - through any ups and downs. Bitcoin could become a multitrillion-dollar cap, or it could be deemed illegal by world governments. Either way, you wouldn't lose any capital.

The blockchain technology behind cryptocurrencies like Bitcoin is here to stay, so as companies that play a role on this technology become public, I will be looking at these as future trades or investments.

As far as Bitcoin goes specifically, my gut feeling is that, based upon the positive feedback and the addition of futures, this currency is also here to stay.

Regarding the rest of the pack, I have looked at Ethereum and Litecoin. I've even checked out SparkleCOIN. Even though the price points are much easier to stomach, they all seem riskier than Bitcoin.

Remember, just because it's cheaper doesn't make it less risky. Bitcoin is the foundational token; therefore, it will always have some kind of branding value. The others, especially SparkleCOIN, which is the newest coin with hype, have much more risk due to being much newer.

Sparkle is offering what is called an ICO (initial coin offering). That means between now and Dec. 21, anyone can purchase SparkleCOIN for $35 a token before it goes "public."

If this were truly a regulated instrument, it might be great to get into something that hasn't started being mined yet. But the fact that there will be thousands of these different "coins" coming out soon makes me wonder just how long some of these will last. And there's always something newer on the horizon...

Whatever your decision in this area, I have always been told that in the height of the gold rush, the only ones who actually made money were the sellers of pickaxes and shovels. In a sense, all gold was fool's gold.

But the ones who supplied the tools for people chasing metaphorical "gold tails" were the real ones who found a fortune.

That's why I believe that the "pick and shovel" of Bitcoin and other cryptocurrencies will be the blockchain technology. It's the technology or tool that allows the currency to exist. It allows others to chase a new "gold tail."

Blockchain and cryptocurrencies might be here to stay, but there's always something new, and that's what I'm looking toward. And by the end of 2018, it could be even bigger than cryptocurrency is now.

But more on that next year...

If You Like Fast Cash, You Don't Want to Miss This

I love fast money. That's why I've been working on a new invention. It's a way to get rapid-fire profits in your hands week after week.

I'm talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I'm the only one who knows how to find it.

I've used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

The post The Pick-and-Shovel Play in Cryptocurrencies appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.