You may have heard of this very simple trading mantra: invest in what you know.

In other words, if you use a company's products, you should consider investing in the company.

Now this may seem logical...

But just because you like a brand doesn't mean you should dump your money into the stock. And the No. 1 rule when it comes to the stock market is to never put all your eggs into one basket - especially during earnings season.

With over 100 companies poised to release their fourth-quarter earnings reports in the next few weeks, there's still plenty of time to profit from these market eruptions.

The key is knowing how to get in two full days ahead of the biggest, most promising, mouth-watering price eruptions that exist... a mind-blowing 733% BIGGER than any "normal" stock move might make.

And now you can learn exactly how to turn these massive eruptions into $30,000 with just a small stake. Click here to find out how to make that first move right now.

Now let's talk about a major earnings announcement coming next week...

Our Options with Tesla - Pun Intended

By now, you know how much I love Tesla...

Aside from just loving the car in general, my Tesla Model S is what got me and my family safely out of Hurricane Irma's path last September.

So I decided to do a little investigative shopping this past weekend...

Elon Musk, Tesla Inc.'s (Nasdaq: TSLA) outspoken CEO, has stated that the company will equip all of its vehicles with an enhanced version of its Autopilot system that will enable fully autonomous driving in the future after further testing and retooling are completed.

Although the technology isn't there yet, I'm excited for the future potential. But as a resident of Florida, I and many who own Teslas here are concerned about whether the state will allow fully autonomous cars on the road.

While I was at the dealership, the wonderful salespeople and representatives couldn't provide me with answers regarding what they're hearing from the state's reps about this matter. But that's OK. I had a different reason for being there, anyway...

As I mentioned, I'm looking for a new car - one to keep at my home in New Zealand. But it's not as though I'll be there every week or even every month.

It's just not healthy for a car with a combustible engine to sit for such lengthy periods of time without use, which is why I need another option...

And that's where Tesla comes in...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The company is a Power Profit Trades and Gentile family favorite. And there's no need to worry about leaving the car sitting for long periods of time. My family and I could get one for New Zealand, leave it plugged in, and it'll be ready whenever we have the opportunity to get back there.

We have plenty of local knowledge about Tesla. And we've talked about how we can profit from options on the company before.

In fact, the last time I had my eye on TSLA, I made a swift recommendation that showed my readers 105.47% in three days. It's based on a simple strategy that can hand you $1,000, $2,000, even $5,000 week after week... Click here to find out how to get in position to score your fast cash with lucrative trade recommendations like these.

So let's look at it from a technical standpoint to see if we can do it again...

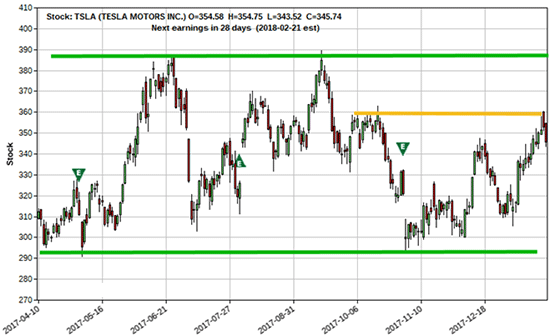

In the above chart, Tesla's stock is trading between support at $295 and resistance around $387. The horizontal green lines represent this range.

Right now, TSLA is testing neither of those price areas.

Within that wider box range, there is a price point that is acting as a double top form of resistance at the price point of $360, indicated by the orange horizontal line, which TSLA recently tested and is trading down from in the last couple of trading days.

I could see it trading lower from that mini-resistance down to support, but with the fundamental component of earnings due to be released Feb. 21, any bearish option trade with an expiration past that should be monitored for profit prior to earnings - meaning I wouldn't hold straight long puts through the earnings announcement.

If there isn't a clear directional view in your opinion to consider a straight directional option trade, one can always consider the straddle trade I have educated you on in recent articles.

If You Like Fast Cash, You Don't Want to Miss This

I love fast money. That's why I've been working on a new invention. It's a way to get rapid-fire profits in your hands week after week.

I'm talking about trades you can make from anywhere, even right on your phone, in four days or less.

The pattern behind these quick paydays appears every single week. And I'm the only one who knows how to find it.

I've used it to show my readers top gains like 100% on RTN in one day, 100% on BIDU in one day, 120.93% on MS in two days, and 124% on ABBV in one day.

If you hope to find yourself with a pile of extra cash in your pockets, click here to learn more...

The post The Single Best Way to Play Tesla Before Earnings appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.