The "Trump Trade" may be on life support, which obviously has a lot of investors worried at the moment.

Not surprisingly, the question I'm getting asked more than any other is twofold:

Has the bull market run its course, and is there a correction right around the corner?

The implication, of course, is whether or not you should be selling everything you own, buying a banjo and a couple hundred gallons of water, and hunkering down 500 miles from the nearest military installation.

In a word - no.

As we've talked about many times, there is no reason in the world why a properly prepared investor has to suffer the ravages of a bear market, let alone a major market correction.

In fact, both of those scenarios can be turned into tremendously profitable opportunities. But only if you understand what we're going to talk about today.

Here's What You Need to Know

Take a cue from Warren Buffett, who made headlines 48 hours ago when he lost a bid for Texas-based electric transmission company Oncor to Sempra Energy.

The real story is not that he lost, but rather that he is chasing the best companies and Unstoppable Trends just like we are. In this case, he wants the reliability and innovation associated with smart electrical grids that produce steady, growing income for decades to come.

Millions of investors take a different approach, lurching from investment to investment in a desperate search for the one stock that will turbo-charge their returns. In up markets they confuse that with genius, and in bad markets they confuse that with something dastardly.

Either way, they ruin their portfolios.

Times like the present call for exceptionally prudent stock selection - meaning you still want to invest, but only in the things we talk about all the time - Unstoppable Trend, must-have companies with rock-solid balance sheets, experienced management, and global product portfolios.

That way, you are both growing your fortune and defending your portfolio at the same time.

More importantly, you're making sure that your money is working as consistently and efficiently as possible no matter what the markets hand you.

If you're moving from stock to stock, you may as well be playing roulette. The principle of "gamblers ruin" will ultimately bleed your wealth dry.

When I say consistently and efficiently, I'm talking about putting something in place that will keep your money moving through thick and thin, that will keep you tapped into upside, and will ensure that you're constantly buying low and selling high.

The first step in this process is identifying undervalued stocks.

We talk about that a lot because that's the first step on the path to profits. You find something that's beaten down, yet still has a fortress-like balance sheet, strong sales, and growing revenue, and you buy it because it's tapped into an Unstoppable Trend.

The second is to keep your money moving by reinvesting it. That way you can capture the powerful upside bias inherent in today's financial markets... even in flat or down markets.

It's a lot easier to do than most investors think - and, chances are, what was driving Buffett's thinking with regard to Oncor.

Let Me Prove It to You

Imagine buying 100 shares of ABC at $100 a share for $10,000 initial investment. And that ABC has a dividend yield of 2.05%, which is the average yield offered by companies on the S&P 500 today.

Now, imagine you resolved to re-invest those dividends, quarter after quarter.

A year down the road you would have earned slightly more than $205 back in dividends (it's slightly more than 2.05% because of the miniscule short-term effect of compounding quarterly rather than all at once, yearly). I know that doesn't sound very inspiring, but hang with me for a minute.

Coming into year two, you've got approximately $10,205 invested, and at a 2.05% yield that translates to $10,414. Year three, $10,627. Year four brings $10,845 in capital working for you. By year five, dividend reinvestment would have allowed you to purchase $11,067 in company stock, totaling more than 11% in appreciation.

In the interest of simplicity, I've made two key assumptions...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The stock stays completely flat, meaning that it doesn't get more expensive and result in your dividend payouts being able to buy fewer shares. And the company never raises its dividend.

Now, you and I both know that's not going to happen. The best companies (like those we follow at Total Wealth) raise their dividends constantly and the markets fluctuate, which means that your money is going to get more valuable over time... again, even if prices go down before they go up.

And that brings me to Lockheed Martin Corp. (NYSE: LMT).

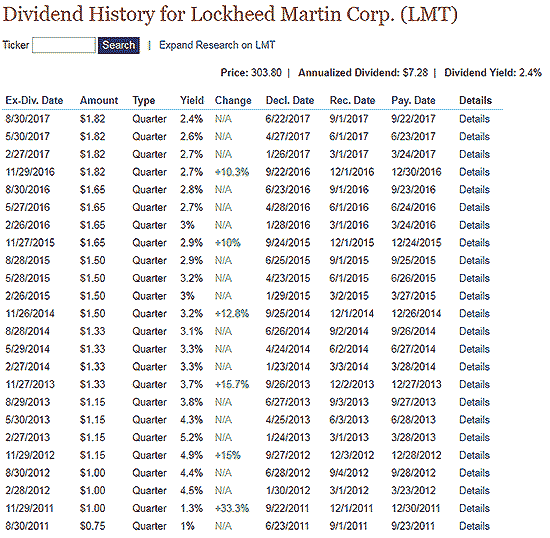

The company is tapped into one of the biggest Unstoppable Trends of all: war, terrorism, and ugliness. What's more, its current 2.41% yield is almost 20% higher than our example, and management has a history of dramatically increasing payouts.

The company was at the center of a formula we ran not too long ago. It was 2015, with shares of LMT hovering around $211, when the company's yield was just over 3%, and it's a back test that warrants a revisit.

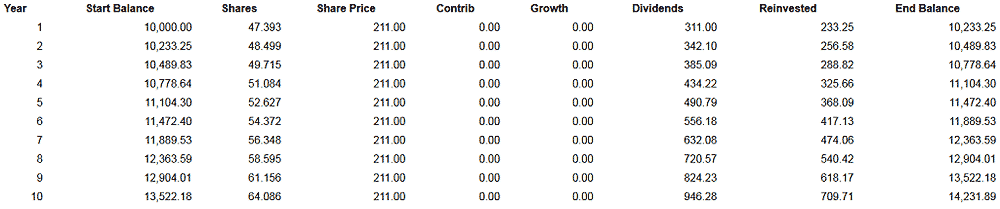

So let's rerun the numbers:

Assuming the dividend increases by 10% annually and the stock remains flat, you'll have $14,231 in 10 years. That's a 42.31% return. It's not glamorous, but keep in mind that you would have earned $946 in dividends by year 10, which works out to an impressive 9.46% yield... just because you kept your money moving consistently and efficiently.

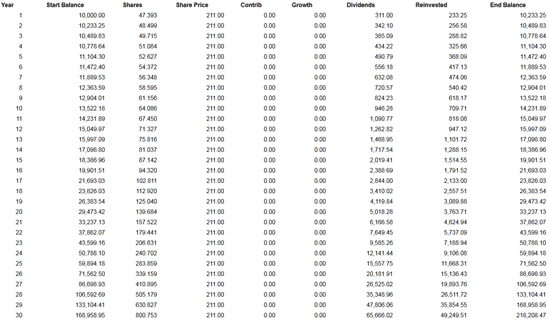

In 30 years, you'd be sitting on $218,208 and a 118.2% return. Most impressively, though, you'd be earning an eye-popping $65,666 in dividends just for that year ($49,249 after a 25% capital gains tax) that amounts to a 392% return on your initial $10,000 investment!

Whenever I'm doing a presentation on this topic, it's usually right about now that the hands start going up... but what about a declining market?

Surely a stock that goes down by 5% each year for 30 years is a losing proposition regardless of the dividend, right?

Wrong.

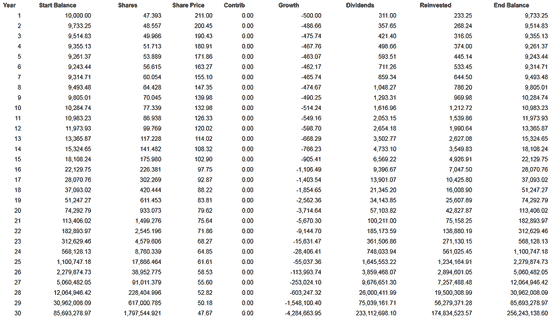

Believe it or not, when the price declines by 5% each year but the dividend payouts rise, you actually end up with more money than you'd have if the stock hadn't lost any value!

In this scenario, a $10,000 initial investment transforms into a $252,600 holding - or a 2,426% gain.

If there's a bell ringing in the back of your head, this is why I constantly talk about managing upside and why doing so is such an important part of the Total Wealth approach.

Selling out may feel good, but doing so takes you out of the game. Being able to purchase more income-generating shares, year after year, at cheaper prices clearly outweighs the downside of 5% losses on principal each year.

You see, missing out on upside is always the far more expensive proposition over time.

Keep in mind that we're talking about 2,462% returns in a 30-year bear market.

To be clear, I'm not forecasting a 30-year bear market at the moment. What I want you to understand is that bear markets always represent opportunity if you know what to look for...

...high quality companies tapped into our Unstoppable Trends making must-have products and services that translate into rising revenue, rising earnings, and - ta da - rising dividends.

The financial crisis of 2007-09 didn't stop high-quality companies like Altria Group Inc. (NYSE: MO) from raising its dividend payout by 17% during that time frame. It didn't stop Raytheon Co. (NYSE: RTN) from boosting its payouts 21%.

And it didn't stop Lockheed Martin, which we used in our 30-year example, from hiking its payouts a stellar 80%.

The next crisis won't either.

All three companies are great choices under the circumstances.

In closing, people tell me all the time that they "don't have 30 years to wait."

Fine. But think about this...

If you bought $10,000 worth of Amazon.com Inc. (Nasdaq: AMZN) shares on Jan. 3, 2007, despite the recession that occurred from December of that year until roughly June of 2009, your stock would be currently valued at $246,328.

That's over 25 times your initial investment.

If you purchased Apple Inc. (Nasdaq: AAPL) on the same day in January 2007 and purchased $10,000 worth of shares, those shares would currently be worth $148,428.87.

All you have left to do is decide whether you want to be in to win or stuck on the sidelines.

Don't Miss: Times like the present are loaded with pure, unadulterated profit potential. My strategy can help you capture it. Readers following my recommendations have had the opportunity to score 30 triple-digit gains this year, and 46 triple-digit winners in the last 12 months. This strategy can lead you to profit opportunities no matter what's dominating the news cycle – and I have 16 years of historical data to prove it. Click here to learn more...

The post The "Trump Trade" Is on Life Support... Here's What to Do appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.