Earnings season is upon us once again. That means it's the perfect opportunity to make some fast cash.

Technology has dominated the markets as the best-performing sector so far this year. But it's not the sector I'm looking at for the fall.

And while the talking heads are betting on technology...

There's a much bigger play in the works.

Why You Should Focus on the Financial Sector

Every earnings season brings up the same set of concerns or confirms the same old concerns for publicly traded companies and the investors that own shares of those stocks.

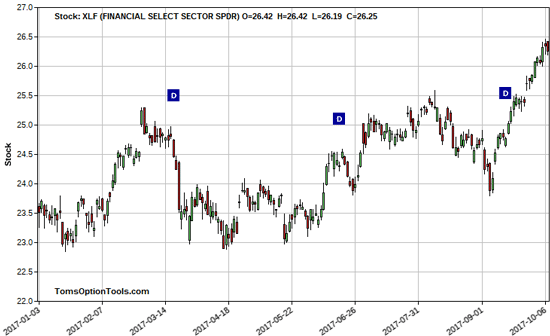

The U.S. financial sector is going to have another strong earnings season this coming quarter. The Financial Select Sector SPDR ETF (NYSE Arca: XLF) chart below shows how well the financial sector has performed this year.

It is at - or just slightly off - its yearly high.

Now, this doesn't mean it is the best-performing sector thus far this year. Over the past quarter, technology has dominated the market, but the financial sector will be one of the biggest leaders this fall.

Now one could speculate that it's due to better than expected earnings. But it's actually due to the fact that we have seen higher interest rates. Couple that with more rate hikes anticipated to come (the next one most likely to happen in December) and it will adjust future earnings for banks and broker dealers.

I've used this pattern to show my readers triple-digit gains in one or two days. Click here to learn more…

People tend to think that equities drop in value when interest rates rise.

But that isn't the case.

Assuming you're a company whose earnings come from interest and interest received on short sales (something you have sold and have cash for), then when interest rates rise, you stand to make more money on cash on deposit. It's not something a lot of people think about when investing in the stock market.

The best stock to watch in the financial sector right now is Morgan Stanley (NYSE: MS).

Here are the three reasons why...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

- It's an investment firm - so it stands to see an increase in earnings as rates go up, as we discussed before.

- I believe it will beat the expected $0.82 a share this quarter. And if nothing else changes other than the strength of the dollar, I can even see it beating estimates by about 4% to 5%.

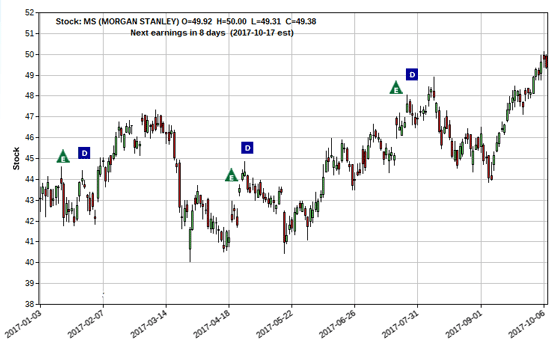

- As a rules-based trader, I focus on patterns. Here's what MS shows over the past nine months:

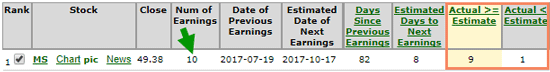

Looking back on the same quarter for the last 10 years, MS has moved higher during this time frame in nine out of the last 10 years by about 5%. That means the perception alone may push the stock higher into earnings, which are scheduled for Oct. 17 before the market opens.

Now, my proprietary tools give me a different view of the markets.

I ran a look at MS's last 10 earnings reports and could see that its actual earnings came in higher than or equal to the estimate nine out of the last 10 times.

During this earnings season, there will be many other companies in a vast array of different sectors that will meet, miss, or beat expectations.

And we'll deal with those as they come.

But my focus is on the financial sector and on Morgan Stanley in particular.

In fact, the last time I recommended MS, my readers had the chance to score 124% in just two days. To see how you can get in position for the next quick-hit triple, keep reading...

Fast-Moving Trades You Can Play Right on Your Cell Phone

I love fast money. That's why I've spent the last four months working on a brand-new invention.

It's a way to get rapid-fire profits in your hands week after week. I'm talking about trades that run four days or less, start to finish.

On Monday, you just wait to hear that familiar ding… make a few keystrokes right on your phone to check it out… decide to make the trade…

And you're in position with the opportunity to collect $1,000, $2,000, even $5,000 in extra cash by Friday.

If you hope to find yourself with a pile of extra cash in your pockets this week (and every week), click here to learn more...

The post This Earnings Season's Hottest Company to Trade appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.