Many investors are convinced that the bull market is over, and there's nothing worth buying at the moment. Worse, they're selling out and heading for the sidelines using even the slightest market drop as justification for their actions.

I can't think of a worse mistake.

There are all kinds of ways to hedge volatility these days. No investor need fear a bear market – let alone suffer the ravages of getting financially mauled.

You can run flat or down markets to your advantage if you are properly prepared, have the right perspective, and have a firm grasp on the right Total Wealth Tactics.

So far we've talked about specific Total Wealth Tactics like LowBall Orders, which you can use to buy the stock you want at exactly the price you're prepared to pay – ideally at a huge discount. We've also covered Position Sizing as a means of limiting risk before you place a trade, Trailing Stops to protect your capital once you're "in," and Free Trades to help you maximize profits when it's time to sell.

Today, I want to introduce a new wrinkle.

I want to show you how to buy more stock without spending more money...

It's a simple, easy-to-use tactic that's ideally suited for today's markets, and best of all, one that could lead to profits of 2,426% or more. As always, I've got a few examples and stocks that can help you put what you learn today into action immediately.

How to Turn Three Decades of Losses into 2,426% Profits

Millions of investors lurch from investment to investment in a desperate search for the one stock that will turbo-charge their returns. And, in doing so, they ruin their portfolios.

Stock selection, as it turns out, is only part of the mix.

If you want to earn the big bucks, you've got make sure your money is working as consistently and efficiently as possible. What I mean by that is you want to be making money with everything you own every day.

If you're moving from stock to stock, you may as well be playing roulette. The principle of Gambler's Ruin will ultimately bleed your wealth dry.

Don’t Miss: This secret stock-picking method is so good, if you started with a small stake, a string of these picks could have earned you $1.2 million. Find out how it’s done…

When I say consistently and efficiently, I am talking about putting something into a place that will keep your money moving through thick and thin, that will keep you tapped into upside, and will ensure that you're constantly buying low and selling high.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The first step in this process is identifying undervalued stocks.

We talk about that a lot because that's the first step on the path to profits. You find something that's beaten down yet still has a fortress-like balance sheet, strong sales, and growing revenues, and you buy it because it's tapped into an Unstoppable Trend.

The second is to keep your money moving by reinvesting it. That way you can capture the powerful upside bias inherent in today's financial markets even in flat or down markets.

I know that sounds like a tall order, but actually it's a lot easier to do than most investors think.

Let me prove it to you.

Imagine buying 100 shares of ABC at $100 per share for a $10,000 initial investment. And that ABC has a dividend yield of 2.31%, which is the average yield offered by companies on the S&P 500 at the moment.

A year down the road you would have earned slightly more than $231 back in dividends (it's slightly more than 2.31% because of the miniscule short-term effect of compounding quarterly rather than all at once, yearly). I know that doesn't sound very inspiring yet, but hang with me for a minute.

But in Year 2, you've got approximately $10,231 invested, and at 2.31% yield that translates to $10,467. Year 3, $10,709. Year 4 brings $10,956 in capital working for you. By Year 5, dividend reinvestment would have allowed you to purchase $11,209 in company stock, a figure roughly equivalent to 11.2% appreciation.

In the interest of simplicity, I've made two key assumptions:

- The stock stays completely flat, meaning that it doesn't get more expensive and result in your dividend payouts being able to buy fewer shares.

- The company never raises its dividend.

Now, you and I both know that's not going to happen – the best companies (like those we follow here at Total Wealth) raise their dividends constantly, and the markets fluctuate, which means that your money is going to get more valuable over time... again, even if prices go down before they go up.

And that brings me to Lockheed Martin Corp. (NYSE: LMT).

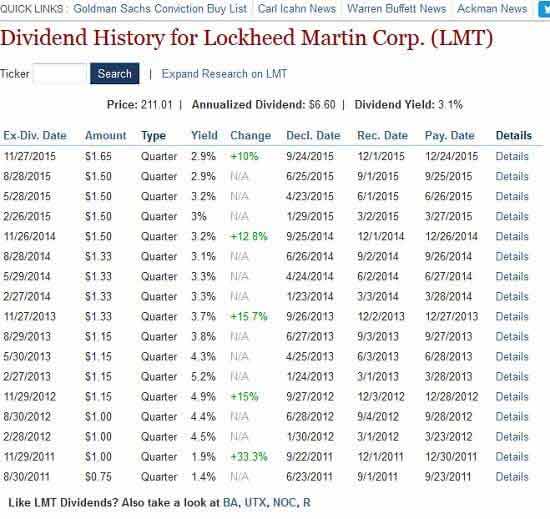

The company is tapped into one of the biggest Unstoppable Trends of all: War, Terrorism and Ugliness. What's more, its current 3.11% yield is higher than our example, and management has a history of dramatically increasing payouts.

Click to Enlarge Source: www.streetinsider.com

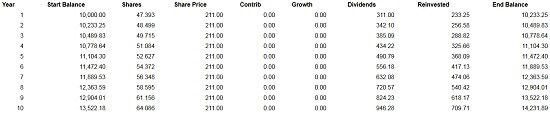

So let's re-run the numbers.

Assuming the dividend increases by 10% annually and the stock remains flat, you'll have $14,231 in 10 years. That's a 42.31% return. It's not glamorous, but keep in mind that you would have earned $946 in dividends by year 10, which works out to an impressive 9.46% yield... just because you kept your money moving consistently and efficiently.

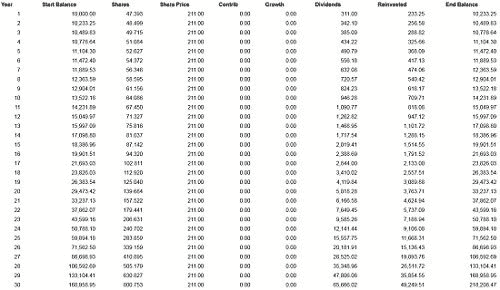

In 30 years, you'd be sitting on $218,208 and a 118.2% return. Most impressively, though, you'd be earning an eye-popping $65,666 in dividends just for that year ($49,249 after a 25% capital gains tax) that amounts to a 392% yield on your initial $10,000 investment!

Whenever I'm doing a presentation on this topic, it's usually right about now that the hands start going up: "But what about a declining market?"

Surely a stock that goes down by 5% each year for 30 years is a losing proposition regardless of the dividend, right?

Billions Are Now in Play: Millions of Americans could collect “Federal Rent Checks” – to learn how to claim your portion of an $11.1 billion money pool using this backdoor investment, click here now...

Wrong.

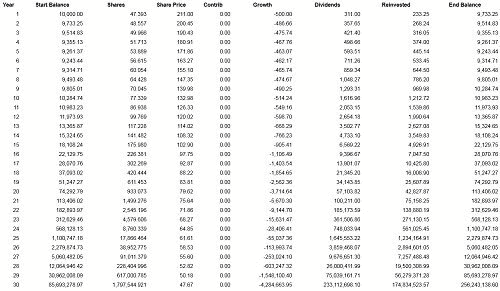

Believe it or not, when the price declines by 5% each year but the dividend payouts rise, you actually end up with more money than you'd have if the stock hadn't lost any value!

If there's a bell ringing in the back of your head, this is why I constantly talk about managing upside.

Selling out may feel good, but doing so takes you out of the game. Being able to purchase more income-generating shares, year after year, at cheaper prices clearly outweighs the downside of 5% losses on principle each year.

Missing out on upside is always the far more expensive proposition over time.

Keep in mind that we're talking about 2,462% returns in a 30-year bear market.

To be clear, I'm not forecasting a 30-year bear market at the moment. What I want you to understand is that bear markets always represent opportunity if you know what to look for...

...high-quality companies tapped into our Unstoppable Trends, making "must-have" products and services that translate into rising revenues, rising earnings, and – ta da! – rising dividends.

The financial crisis of 2007–2009 didn't stop high-quality companies like Altria Group Inc. (NYSE: MO) from raising its dividend payout by 17% during that time frame. It didn't stop Raytheon Co. (NYSE: RTN) from boosting its payouts 21%. And it didn't stop Lockheed Martin, which we used in our 30-year example, from hiking its payouts a stellar 80%.

The next crisis won't either.

All three companies are great choices under the circumstances.

Never Buy a Losing Stock Again

Money Morning Special Situation Strategist Tim Melvin knows a thing or two about going against the herd.

You won't find him buying into massively popular stocks like Apple or Netflix.

Tim's bread and butter are the diamonds in the rough – the stocks that don't get 24/7 cable news coverage or sit on the tip of every investor’s tongue.

But finding the gems the mobs overlook is exactly how he's earned an undefeated track record.

You read that right.

Tim has issued 119 trade recommendations with zero realized losses.

He's closed out 32 winning trades in a row, and 85 of his 87 open positions are in the green.

Find out how to never buy a losing stock again by clicking right here…

The post This is The Single Worst Mistake You Can Make in Today's Markets appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.