As we know, the U.S.-China trade war is creating high tensions – especially in the market.

And commodities, especially, have taken a serious hit...

But there's one commodity in particular that's taken a real beating – and you use it every single day...

It's not gold.

It's not silver.

It's not oil.

And it's the only way to profit amidst the trade war...

The Commotion in Commodities Is Where Your Next Profit Lies

The United States has officially slapped 10% tariffs on $200 billion worth of Chinese imports. And China didn't wait long to follow suit by placing 5% to 10% tariffs on $60 billion worth of American goods. Not surprisingly, tensions are high, and most expect them to continue to escalate.

Now, this means a few things for both countries' economies – including higher prices for consumers, certainly. It also could impact demand for raw materials used to manufacture products, which in turn will impact producers in both countries.

And thanks to this constant gunfight, volatility in the commodities market has been rampant, driving prices down in many areas – including soybeans, pork, cotton, and metals.

Weekly Windfalls: This exciting way to make money has the potential to deliver fast-cash paydays Monday to Friday every week – kicking out $1,000, $1,500, and even $2,000 in four days or less. Learn how to get in on this…

But the opportunity lies in a part of the market that has been ignored for years...

Copper.

So why copper?

Here's the deal: Copper is an industrial metal used in the manufacturing of many products, including electrical generators, motors, electrical wiring, radios, and TVs. So, it goes without saying that it's a vital component for products in high demand.

Now, the price of copper, along with other metals like silver and gold, took a hit in June as the trade war was heating up. And while many investors took this as a sign to run the other way, that was the exact opposite of what they should've been doing.

Despite the small hit in June, the copper price has been on a steady rise since it bottomed in January 2016. But it hasn't been driven by demand, instead by the lack of supply...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

With demand for this critical industrial metal consistent, even in the face of a trade war, copper is poised for a bullish run from here.

And in fact, the commodity is already on the rise.

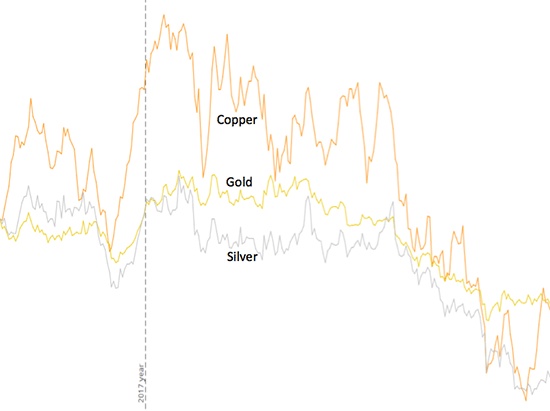

Check out the following chart that overlays ETFs for Copper (NYSE: COPX), Gold (NYSE: GLD), and Silver (NYSE: SLV).

This chart above shows relative price movements of these three popular metals. You can see that into early 2018, COPX outperformed both GLD and SLV, illustrating the lack of copper supply.

Now, all three took a hit in the summer as the trade war took shape. But most recently, as you can see, COPX has bounced up sharply and is poised for more upward movement.

And there's no better time than the present to get in on this lucrative commodity...

Now, you could simply trade copper futures. But there's another way to take your profits: Copper Exchange-Traded Funds (ETFs). These instruments track copper and trade like stocks.

Here are some popular Copper ETFs:

- Copper Miners ETF (NYSE: COPX)

- US Copper Index ETF (NYSE: CPER)

- iPath Bloomberg Copper Subindex Total Return (NYSE: JJC)

Now, any of these ETFs could easily hand you a profit, but as always, I advise doing your own research and talking to your broker about which opportunity will serve your portfolio best.

While copper is the leading precious metal for profits right now, I'll continue to keep my eye on gold and silver because – no surprise here – I track patterns on all three of these commodities. In fact, the next lucrative pattern on gold is gearing up pretty soon. Stay tuned for more details...

After 11 Years of Searching, He’s Finally Arrived

We’ve searched high and low for 11 years to find the very best talent our industry has to offer.

But no one compares to our newest recruit.

He’s the only undefeated strategist we know of today, and he’s sharing his strategy for the first time ever.

With 32 wins in a row, you have to see this.

The post This "Gun Slinging" Commodity is the Key to Your Next Profit appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.