I've seen Wall Street use darn near every little conceivable technological trick in the book to gain a statistical edge over every day investors over the past 35 years.

One of the craziest was a high-frequency trading shop that actually wanted to drill through mountains so they could shave off milliseconds transporting information along a fiber-optic cable between exchanges in Chicago and New Jersey.

So, when BlackRock, a global investment management company with $5.1 trillion under management announced earlier this week that it was replacing human managers with stock-picking machines, only one thought raced through my brain...

...here we go again!

Here's what Wall Street won't tell you.

What Wall Street Hopes You'll Never Know

If you've never heard the term "robo-advisor" you're not alone.

The term denotes some sort of automated system - a "robot" for lack of better terminology - that is programmed to make investment decisions for you.

The notion of a super-fast, super-smart computer sounds great at first glance because they're being billed as a smarter way to make decisions with minimal human intervention based on mathematical rules of algorithms.

Not only will you "save time" says the slick advertising, but the implication is that you'll "get better results, too."

Don't bet on it - there's always a catch.

Or, in this case, three powerful reasons to steer clear.

First, Wall Street's interests always come first.

Wall Street is like a casino in that it makes its money using your money.

The more you trade, the more profitable they become. Diversification, the efficient frontier, target date portfolios, online trading screeners...and now robo-advisors...these are all tools cooked up to separate you from your money.

Years ago - in 1940 - a Wall Street insider and professional trader named Fred Schwed, Jr. touched on this subject when he wrote a book called "Where are the Customers' Yachts?" Ostensibly written as an educational and humorous look at Wall Street hypocrisy in an age gone by, the book neatly captures the lunacy of modern investing 77 years later.

I can only imagine what Schwed would say today about legions of investors who are going broke following the advice of Wall Street's bankers and brokers - many of whom trade directly against their clients. And about robo-advisors that will only accelerate that process under the guise of helping every day investors.

You may think Wall Street is acting in your best interests but that's because they want you to believe that's the case. Wall Street firms have spent billions over the years understanding their customers and they know exactly which buttons to push when it comes to the slick advertising luring you in.

Want to buy the latest unicorn when it IPOs?

Good luck with that...you're last in line, and your "buy" is their exit. Early investors make a killing and it's not uncommon for big bankers, lawyers, and underwriters to force your hand even as they conduct "dog and pony" shows intended to convince you that XYZ is really a great investment. A robo-advisor will not get you around this problem.

Fancy trading the dollar but trying to limit losses?

Better hang on tight. Odds are the broker you're using has a huge book comprised of thousands of customers making similar bets with dozens of currencies. Market makers can use a simple algorithm to game you and never risk a dollar doing so themselves because they maintain a neutral market position that banks the spread, which is what they call the difference between what somebody wants to pay (the bid) and what somebody wants to sell (the ask). A robo-advisor won't know the difference.

Do you really want to hand over investment authority to software programmed by Wall Street to operate within a system Wall Street rigs and uses to trade openly against you?

I think not.

Want to do a little tax-loss harvesting to minimize what you owe Uncle Sam this year?

Hah. There's no way a robo-advisor can be programmed to compensate for benefits unique to your investment situation, risk tolerance, and objectives.

Adding insult to financial injury, some robo-advisors may actually generate higher fees that you would otherwise pay if you manage your own money because they have to have large mandatory cash allocations as a protective buffer against mistakes. The robot, in other words, could actually prevent you from investing efficiently.

Can you spell c-o-n-f-l-i-c-t of interest?!

Second, the programming behind robo-advising isn't just flawed... it's downright dangerous to you and your money.

I'll spare you all the mind-numbing details but there's a growing body of research (in addition to my own) showing that many of the sacred cows Wall Street uses to keep you in the game have been barbequed.

For example, diversification doesn't work when everything goes down at once because significant stock market declines are becoming more tightly correlated over time. Just ask anybody who lived through the dot.bomb crash and again through the Financial Crisis in 2008 how it felt to get halved twice inside a decade??!!

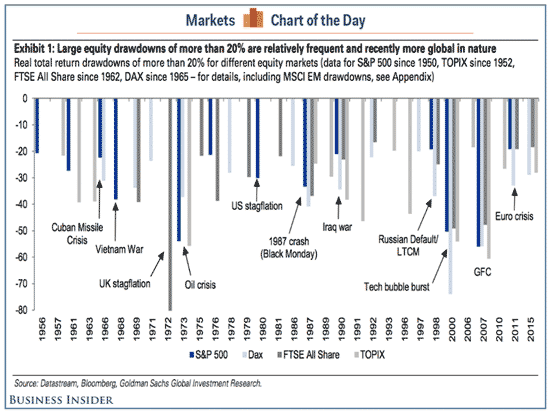

There have been 57 stock market crashes of 20% or more since 1950 in four of the world's major stock market indices: the S&P 500, the UK's FTSE All Share, Japan's TOPIX, and Germany's FAX.

During the 60s, 70s, and 80s, those market drawdowns were relatively independent, which is the basis for much of the modelling used today. However, since then, those very same events have become much more tightly correlated, which is a $5 way of saying "they happen almost simultaneously."

You may as well be asking for your portfolio to get creamed if you're using Wall Street's traditional diversification models as protection against today's market downturns.

To be blunt, diversification just won't work when everything goes down at once which is why you've got to have another way to protect and grow your money (which I'll touch on in a second).

Do you really want a computer in the driver's seat when the stuff hits the fan if the decision making algorithm used to program it is based on outdated, flawed research?

Not me.

Third, Wall Street sets the rules.

There's a term you need to know... asymmetric information.

Put directly, this means Wall Street knows everything before you do. They also know what every investor on every exchange is doing. They know what you want to buy, when, and how much you are willing to pay.

That's why Wall Street hates the notion of transparency so much and does everything it can to resist changes that would take away their ability to see all the cards. At least the casinos to which they're so often compared are regulated - but that's a story for another time.

Robo-advisors are programmed in Wall Street's image using rules set in Wall Street's interest. Use one and you've made it easier for them and less profitable for you.

Can you imagine what happens if you want to get your money out one day and the firm's robot won't let you have it because the latest buying routine it's using conflicts with sending junior to college?

It's the stuff of nightmares.

What to Do Instead

The bottom line is that Wall Street will never change.

Period.

The temptation to exploit unsophisticated investors is simply too great and too profitable.

Whenever I talk about this stuff, audiences around the world inevitably get edgy at this point in my presentation. Many people don't believe you can win when Wall Street holds all the cards.

That's not true.

Sir John Templeton did.

The legendary Jim Rogers does.

Warren Buffett does.

So do millions of investors just like you who are members of the Total Wealth and Money Map Press Family.

How?

By taking away Wall Street's advantage.

There any number of ways to do this depending on your investing skill, tolerance and objectives. You can make it as complicated as you want...or as simple.

Simple, to my way of thinking, is always better.

That's why I created the 50-40-10 Model I advocate, and which I've written a lot about recently. I don't want to sound like a broken record so I'm not going to repeat that discussion now lest I bore you to tears. (But I encourage you to check out this link at your convenience)

What you need to know for purposes of today's discussion is that the 50-40-10 is built around something called "risk parity." It divides risk across a range of investments rather than conventional Wall Street-style diversification which focuses on the specific dollars allocated to component investments i.e. 60% equities, 40% bonds.

Basically that's a fancy way of saying that changing market conditions pose different risks to different asset classes at various parts of the economic cycle, and the 50-40-10 is a framework for dealing with it. In other words, it's flexible.

Robo-advising, by comparison, only targets optimal risk and return. That means it's fixed within preconceived notions that may actually add risk at times when you don't need it.

Everything in the 50-40-10 is built around a rock-solid investment I call my "desert island fund" - as in, if I had to go away to a desert island and leave one investment to my unborn grandchildren... the Vanguard Wellington (VWELX).

This fund has been around since 1929, and is one of the longest-running, most balanced funds in existence today. Management has literally lived through most of the market conditions other fund managers only read about in the history books.

Not only has the Wellington proven to be exceptionally stable, but there are plenty of double-digit returns over the years, which means you get the best the markets have to offer while simultaneously defending your wealth against the worst.

The fund's biggest holdings include some extremely strong performers, such as Wells Fargo & Co. (NYSE:WFC), up 120% over the last five years, and JPMorgan Chase & Co. (NYSE:JPM) and Comcast Corp. (NasdaqGS:CMCSA), up 163% and 197% in the last five years.

You may hear that the fund is "closed" but don't let that stop you. You can still invest in the VWELX in two ways: through any broker or financial advisor who had a pre-existing relationship with Vanguard prior to February 28, 2013 when it was "closed" to new advisors as a means of controlling the amount of money flowing in, and as an individual investor when you open an account directly with Vanguard.

I realize that this is a lot to take in, so here's another link to a valuable tactic that will boost the 50-40-10 portfolio that you may find helpful.

I'll be back later this week with a look at Amazon.com Inc. (NasdaqGS:AMZN) - and how this e-commerce giant is rendering even some of the most iconic retailers obsolete. Of course, I have a profit play in mind for you as well.

Until next time,

Keith

The post Three Reasons to Ignore Robo-Advisors... and The Best Strategy to Beat Them appeared first on Total Wealth.

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.