If you think back to last November, you'll remember that everyone was throwing in their towels on Netflix Inc. (Nasdaq: NFLX) amidst a sudden whirlwind of bad news - like the serious Kevin Spacey allegations and Disney pulling all of its content in order to start its own streaming business.

It was a bad news business for this streaming giant.

But fast forward six months, and the tables seem to be turning...

Recently, Netflix announced it is spending $8 billion on developing and acquiring original content. And on top of this, it plans to raise $1.5 million in debt.

That's a step in the right direction - something any investor likes to see.

So, I've got three ways you can play this upswing - and the third one will blow your mind.

Three Strategies to Cash In on Netflix Stock

Recently, Netflix released its earnings report.

And while many were concerned the streaming giant wouldn't live up to the numbers predicted, it turned out to be wasted worry.

Netflix actually came out on top in every category - beating expectations for earnings per share (EPS), revenue, and - you guessed it - subscriber growth.

The company came in at 7.4 million subscribers for the first quarter - beating the "expected" 6.5 million by nearly 1 million.

On top of this, Netflix noted it experienced its fastest year-over-year growth in company history.

LIVE ON CAMERA: Watch Tom officially become $1,050 richer in 15 seconds! His secret to becoming a multimillionaire is so easy that anybody can do it. Click here for details…

And despite the volatile markets and political rhetoric that has put the market in an up-and-down cycle - Netflix stock is currently up nearly 60% for 2018 - an impressive number compared to the market as a whole.

Now when you see a stock performing like NFLX, you may want to jump right in. But before you do, here are three different strategies that could give you the biggest profit while protecting you from any unexpected bumps along the way.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

"Flip" the Stock - Don't Buy It

As I noted earlier, Netflix stock is up nearly 60% in 2018, and it's showing no signs of slowing down. I'm also seeing no signs of a sell-off in the near future.

We've discussed several different strategies to combat earnings reports, and we've discussed how at times the best thing to do is close your trade before the announcement.

On the other hand, we've talked about straddles - and how sometimes holding on through earnings can bring you the largest rewards.

But seeing as how Netflix had such a positive earnings report and has the capability to go much higher, I want to talk to you about what the best move might be for you and your bottom dollar.

If you look at the chart above, you will see what NFLX was trading at close of market Thursday, April 19, 2018.

The green triangle with the letter "E" indicates the trading on the day of earnings.

The stock traded down that day, but since releasing its earnings reports, NFLX has since jumped up and has continued to climb.

I've also circled the price level to which the stock could retrace before I see it regaining its footing and climbing again.

With this being said, let's take a look at our strategies.

1. Go for a long call option.

Long call options offer us the safety net of less risk - and more time for the stock to grow. That's why I typically recommend these in my services.

As of now, there are no options with July expirations, and the first month available is September.

I still think a long call is a great option - but you may want to weigh your thoughts on what earnings could do.

2. Buy LEAPS

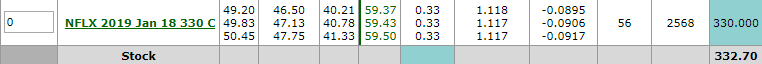

If the idea of earnings spooks you like it does many, another option for this trade would be to buy LEAPs. LEAPs are long-term options - and as of now, I'm eyeing LEAPs in January 2019.

Now, the price of the LEAP above (Jan. 18, 2018 $330 call) is $50.45. That means to open one contract would cost you $5,045...

Now, this may seem like pretty penny, but compared to buying 100 shares of the stock outright for $33,720, it doesn't seem so bad.

That's why I always recommend that you trade options, as they can offer less risk and more gain.

3. Thanks to my groundbreaking discovery, I'm able to pinpoint trade recommendations on the hottest, fastest-growing names in the world.

I'm talking about being able to trade companies pioneering the technologies that are shaping tomorrow's future today - expensive "FANG" stocks... and not just Netflix, but Facebook, Google, and Amazon, too.

These are soaring companies that some folks are paying upwards of $50,000 for 1,000 shares of stock.

But with just one extra click of your mouse, the strategy I use can help you grab huge cash by leveraging the hottest stocks on the planet... for pennies on the dollar.

If you haven't seen this shocking footage of my discovery, you need to move quick...

Because I just released the latest trade recommendation with the set-up for 200% gains from this unique play on Amazon.com Inc.

And this opportunity is sure to close out quickly....

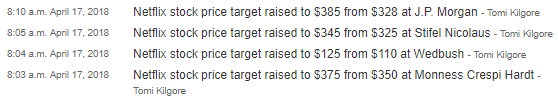

With this said - Netflix continues to receive several upgrades, and target prices and all signs are pointing toward the company continuing to climb higher.

But before you add this streaming giant to your portfolio - as always, talk to your broker and find out if this position is right for you.

And if you decide this is the best move for you - continue to stick to your strategy and trust your plan.

The post Three Ways to Play Netflix - Right Now appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.