Amazon.com Inc. (Nasdaq: AMZN) has been in the news a lot lately - for both good and bad reasons. Take Wednesday, for example, when the media heads were raving about AMZN's deal with Kohl's to start selling smart home products like the Echo. Fast forward a day and these same pundits were questioning the company over the latest accusations of ignoring tax fraud in the United Kingdom.

This can cause some pretty mixed messaging about whether the stock is worth adding to or keeping in your portfolio.

And that's exactly what I want to talk to you about today...

You don't need to wait for the talking heads in the media to tell you what you should do next - you can make money no matter what type of press AMZN gets.

And these are the two best strategies to do just that...

There are two big catalysts right now that could cause a pop or drop in AMZN: a boost in its overall revenue from its deal with Kohl's and its upcoming earnings report on Oct. 26.

Now we can't know for sure what will happen - but we can use technicals to pinpoint the best strategies to use no matter where the stock goes...

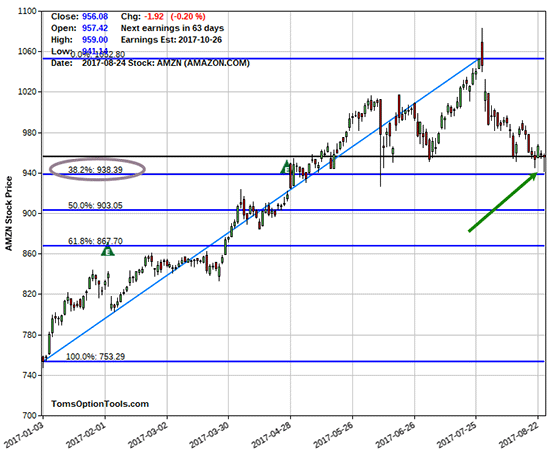

What you're looking at above is what's called a "Fibonacci view" of the stock. I placed the Fibonacci Retracement Tool from my proprietary software on the year-to-date chart on AMZN to see if it's currently trading at or up off of a Fibonacci support line. A key Fibonacci retracement level (where the underlying stock could find support), is at the 38.2% retracement. I drew a purple oval on the chart at the 38.2% level, which is at a price point of $938.39.

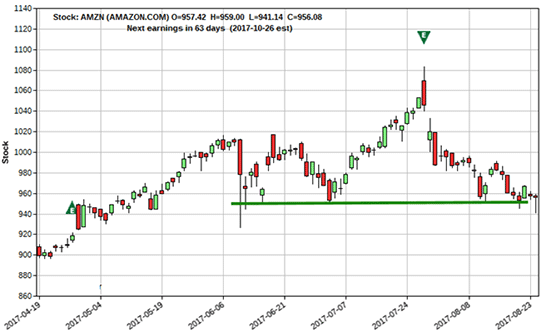

When you look at the last bar to the right of the chart (the last trading day), you'll see AMZN coming very close to touching that price on an intraday basis and then trading up off its lows to close around $956.08. I zoomed in on the chart to give you a better view of the last trading day and to also highlight this price area as the current support level for the stock...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Now there are two easy ways you can play the stock from here...

- You can buy long calls with 30- to 60-day expirations (or even Long-Term Anticipation Securities, or LEAPS) if you believe this is strong enough support for AMZN. This could indicate more strength to come, which is why you'd want to use a bullish strategy to make some money. You could also consider a call debit spread with a 30-day expiration and at a price where the option you're selling is one in which you believe the stock will be trading higher than at expiration.

- You can buy puts if you see AMZN breaking below support. This could indicate further weakness to come, so you'd want to use a bearish strategy to pocket profits.

The Gains Are Both Big and Fast: Just take a look at how quickly readers can bank their profits. Total gains of 277% in five trading days, 269% in six trading days, 221% in two days, and 297% in 24 hours. That's good enough to turn $500 in each trade into $11,855 cash a few days at a time. It's the fastest legal way to make money we've ever seen. When anything makes this much money, there's a limit to the number of readers who can see all the details. See how it all happens right here…

The post Two Easy Ways to Pocket Triple-Digit Gains on Amazon's New Deal appeared first on Power Profit Trades.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.